Question: please explain in excel with formulas (Forward Valuation) C) On June 1, the 4-month interest rates in Switzerland and the United States were, respectively, 2%

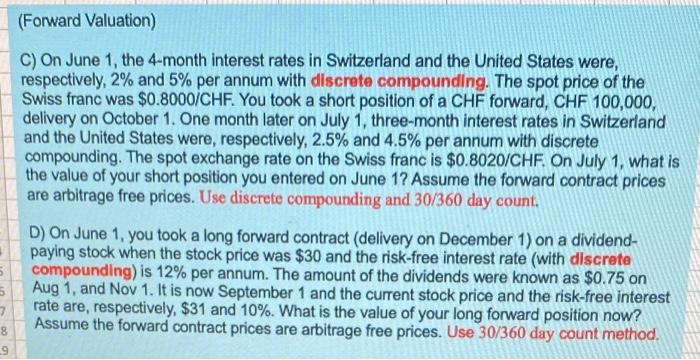

(Forward Valuation) C) On June 1, the 4-month interest rates in Switzerland and the United States were, respectively, 2% and 5% per annum with discrete compounding. The spot price of the Swiss franc was $0.8000/CHF. You took a short position of a CHF forward, CHF 100,000, delivery on October 1. One month later on July 1, three-month interest rates in Switzerland and the United States were, respectively, 2.5% and 4.5% per annum with discrete compounding. The spot exchange rate on the Swiss franc is $0.8020/CHF On July 1, what is the value of your short position you entered on June 1? Assume the forward contract prices are arbitrage free prices. Use discrete compounding and 30/360 day count. D) On June 1, you took a long forward contract (delivery on December 1) on a dividend- paying stock when the stock price was $30 and the risk-free interest rate (with discrete compounding) is 12% per annum. The amount of the dividends were known as $0.75 on Aug 1, and Nov 1. It is now September 1 and the current stock price and the risk-free interest rate are, respectively, $31 and 10%. What is the value of your long forward position now? Assume the forward contract prices are arbitrage free prices. Use 30/360 day count method. 5 5 7 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts