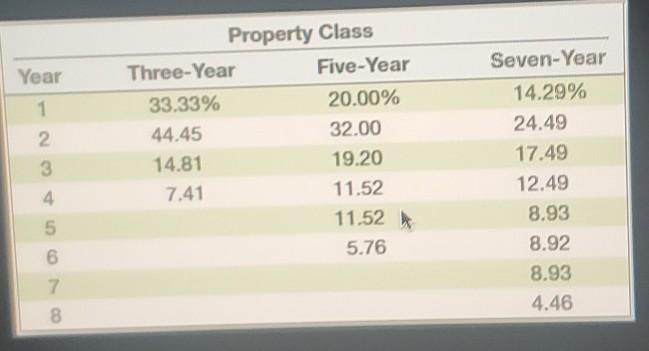

Question: please explain In excel Year 1 Property Class Three-Year Five-Year 33.33% 20.00% 44.45 32.00 14.81 19.20 7.41 11.52 2 3 4 5 6 Seven-Year 14.29%

please explain In excel

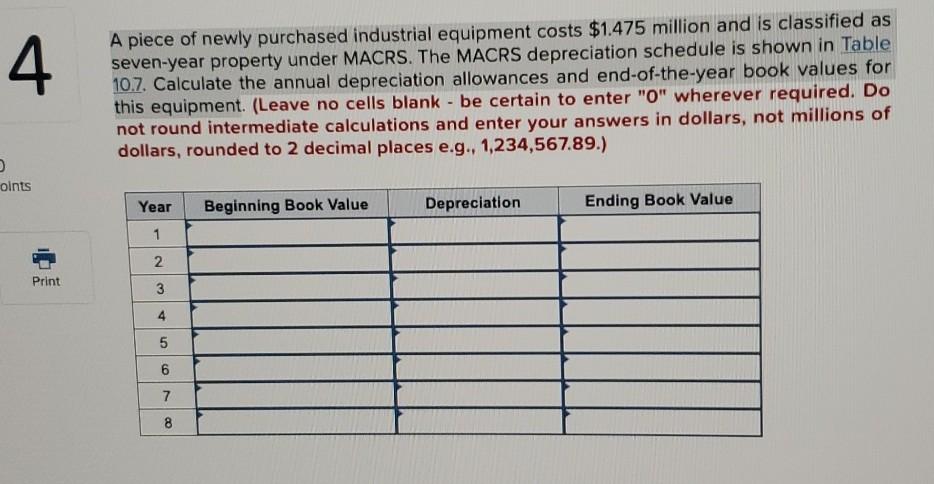

Year 1 Property Class Three-Year Five-Year 33.33% 20.00% 44.45 32.00 14.81 19.20 7.41 11.52 2 3 4 5 6 Seven-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 11.52 5.76 7 8 4 A piece of newly purchased industrial equipment costs $1.475 million and is classified as seven-year property under MACRS. The MACRS depreciation schedule is shown in Table 10.7. Calculate the annual depreciation allowances and end-of-the-year book values for this equipment. (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places e.g., 1,234,567.89.) oints Year Beginning Book Value Depreciation Ending Book Value 1 2. Print 3 4 5 6 7 OD 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts