Question: Please explain line by line the work process on how to get to this final statement of cash flow. SYNERGY COMPANY Comparative Balance Sheets (

Please explain line by line the work process on how to get to this final statement of cash flow.

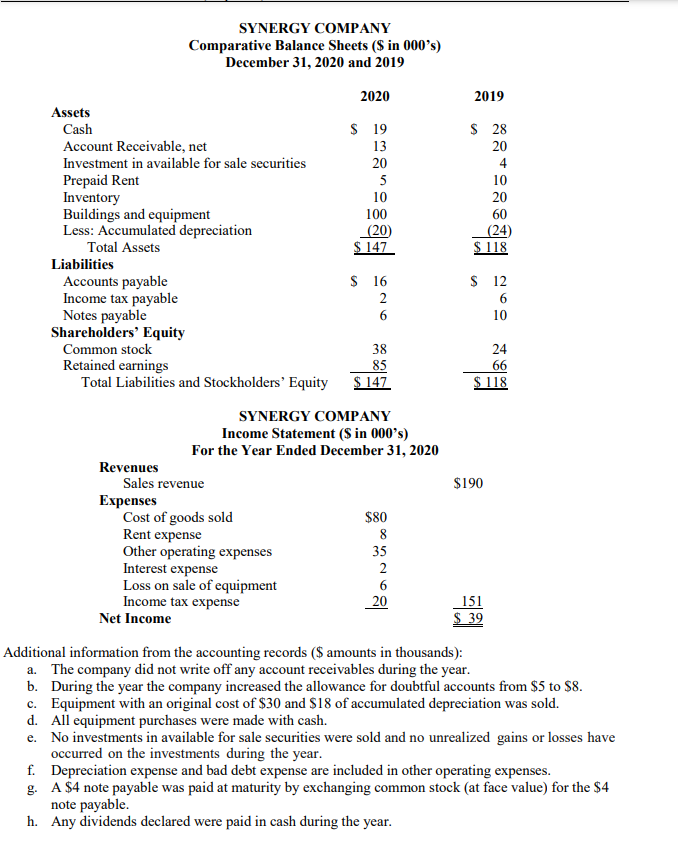

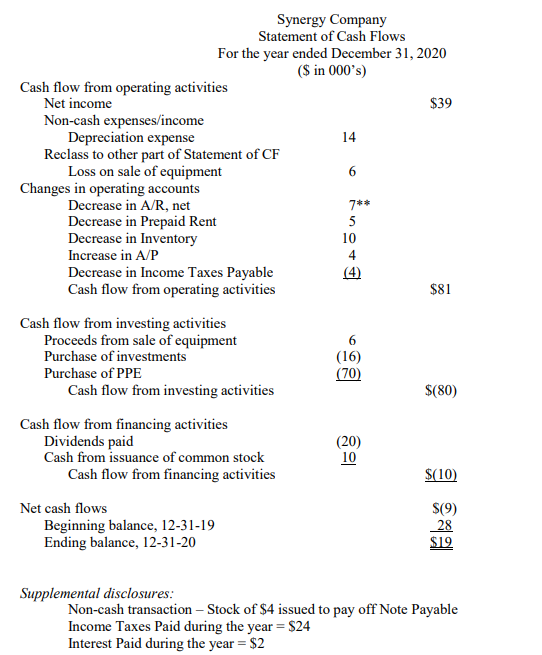

SYNERGY COMPANY Comparative Balance Sheets ( $ in 000 's) December 31, 2020 and 2019 SYNERGY COMPANY Income Statement ( $ in 000's) For the Year Ended December 31, 2020 Additional information from the accounting records ( $ amounts in thousands): a. The company did not write off any account receivables during the year. b. During the year the company increased the allowance for doubtful accounts from $5 to $8. c. Equipment with an original cost of $30 and $18 of accumulated depreciation was sold. d. All equipment purchases were made with cash. e. No investments in available for sale securities were sold and no unrealized gains or losses have occurred on the investments during the year. f. Depreciation expense and bad debt expense are included in other operating expenses. g. A $4 note payable was paid at maturity by exchanging common stock (at face value) for the $4 note payable. h. Any dividends declared were paid in cash during the year. Income laxes Paid during the year =$24 Interest Paid during the year =$2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts