Question: please explain part a underroot value calculation , how they get 0.05 when i do on calcular it totally different S, (GBP AUD 0.3525 which

please explain part a underroot value calculation , how they get 0.05 when i do on calcular it totally different

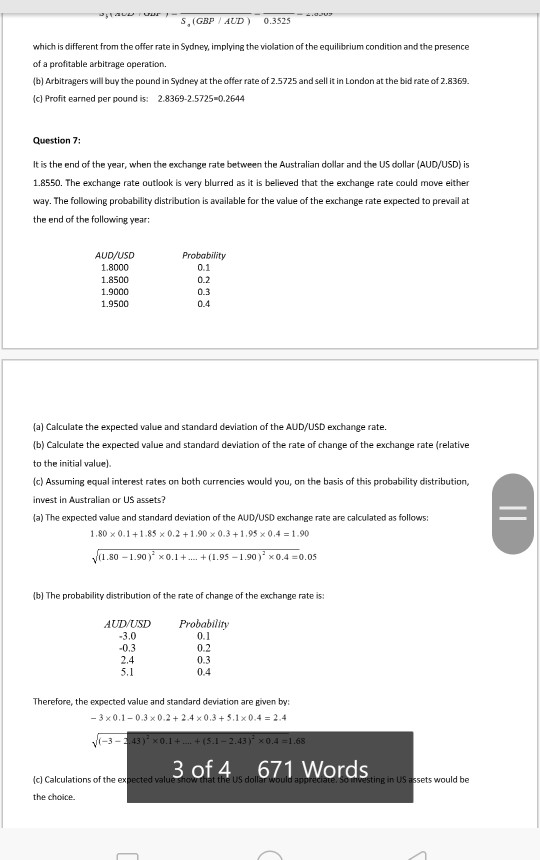

S, (GBP AUD 0.3525 which is different from the offer rate in Sydney, implying the violation of the equilibrium condition and the presence of a profitable arbitrage operation. b) Arbitragers will buy the pound in Sydney at the offer rate of 2.5725 and sell it in London at the bid rate of 2.8369. c) Profit earned per pound is: 2.8369-2.5725 0.2644 Question 7: It is the end of the year, when the exchange rate between the Australian dollar and the US dollar (AUD/USD) is 1.8550. The exchange rate outlook is very blurred as it is believed that the exchange rate could move either way. The following probability distribution is available for the value of the exchange rate expected to prevail at the end of the following year: AUD/USD 1.8000 1.8500 1.9000 1.9500 Probabiiity 0.1 0.2 0.3 0.4 a) Calculate the expected value and standard deviation of the AUD/USD exchange rate. (b) Calculate the expected value and standard deviation of the rate of change of the exchange rate (relative to the initial value). )Assuing equal interest rates on both currencies would you, on the basis of this probability distribution, invest in Australian or US assets? a) The expected value and standard deviation of the AUD/USD exchange rate are calculated as follows 180 x 0.1+1.83 x 0.2 +1.90 x 0.3+1,93 x 0.4 1.90 1.30-1.90)" 0.1 + +(L95-1.90)" 0.4 = 0.05 b) The probability distribution of the rate of change of the exchange rate is: AUD USD Probability 3.0 0.3 2.4 0.2 0.3 0.4 Therefore, the expected value and standard deviation are given by: -3 x0.1 0.3 x 0.2+2.4 x0.3+5.1x0.4 2.4 3 of 4 671 Words c) Calculations of the ex in US a sets would be the choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts