Question: please explain part (c) answer in details Here is a simplified balance sheet for Locust Farming: Current assets Long-term assets Locust Farming Balance Sheet ($

please explain part (c) answer in details

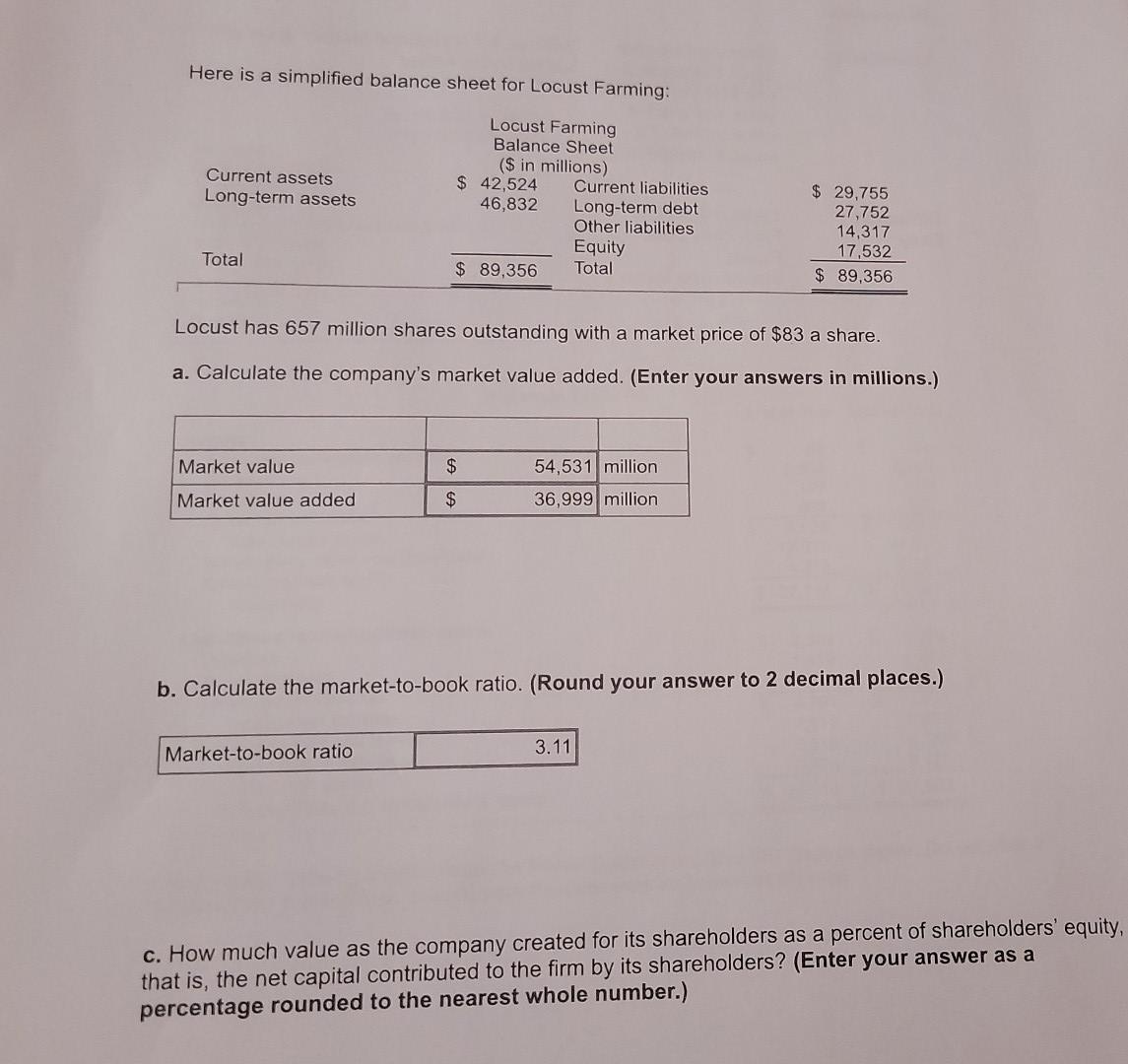

Here is a simplified balance sheet for Locust Farming: Current assets Long-term assets Locust Farming Balance Sheet ($ in millions) $ 42,524 Current liabilities 46,832 Long-term debt Other liabilities Equity $ 89,356 Total $ 29,755 27,752 14,317 17,532 $ 89,356 Total Locust has 657 million shares outstanding with a market price of $83 a share. a. Calculate the company's market value added. (Enter your answers in millions.) Market value $ 54,531 million 36,999 million Market value added $ b. Calculate the market-to-book ratio. (Round your answer to 2 decimal places.) Market-to-book ratio 3.11 c. How much value as the company created for its shareholders as a percent of shareholders' equity, that is, the net capital contributed to the firm by its shareholders? (Enter your answer as a percentage rounded to the nearest whole number.) % Increase in value of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts