Question: What is the answer to C? its not 20% Here is a simplified balance sheet for Locust Farming: Current assets Long-term assets Locust Farming Balance

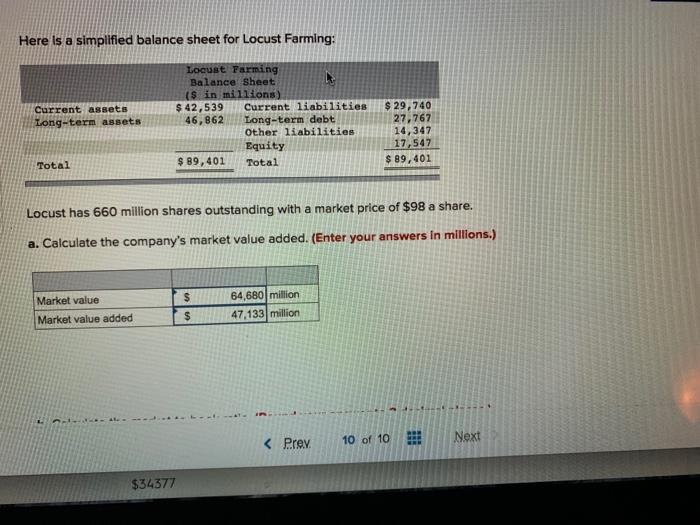

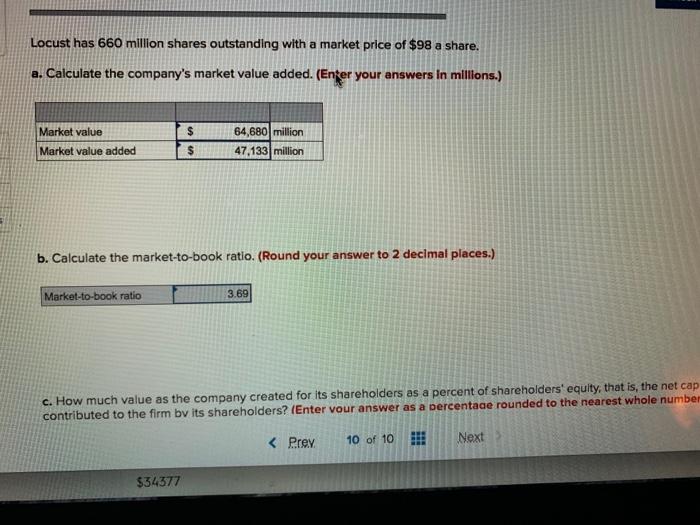

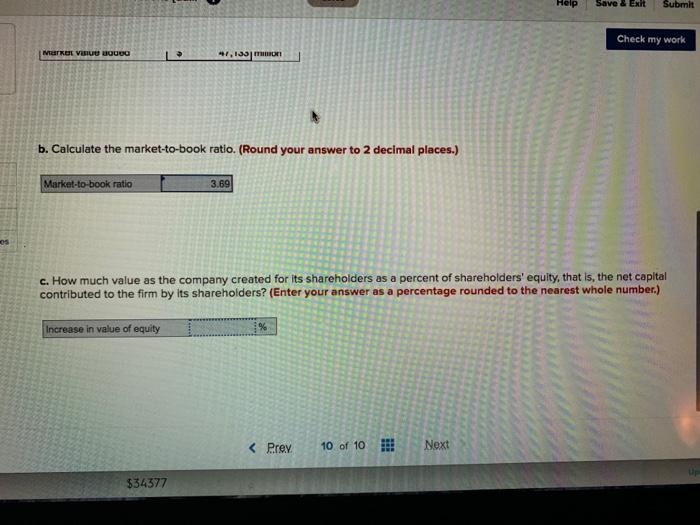

Here is a simplified balance sheet for Locust Farming: Current assets Long-term assets Locust Farming Balance Sheet ($ in millions) $ 42,539 Current liabilities 46,862 Long-term debt Other liabilities Equity $ 89,401 Total $ 29,740 27,767 14,347 17,547 $ 89,401 Total Locust has 660 million shares outstanding with a market price of $98 a share. a. Calculate the company's market value added. (Enter your answers in millions.) $ Market value Market value added 64,680 million 47,133 million $ - 4- ------- 47,133 b. Calculate the market-to-book ratio. (Round your answer to 2 decimal places.) Market-to-book ratio 3.69 c. How much value as the company created for its shareholders as a percent of shareholders' equity, that is, the net capital contributed to the firm by its shareholders? (Enter your answer as a percentage rounded to the nearest whole number.) Increase in value of equity %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts