Question: please explain QUESTION 1 Q1-Q7 are based on the following information Acquiring Company is considering the acquisition of Target Company in a stock for stock

please explain

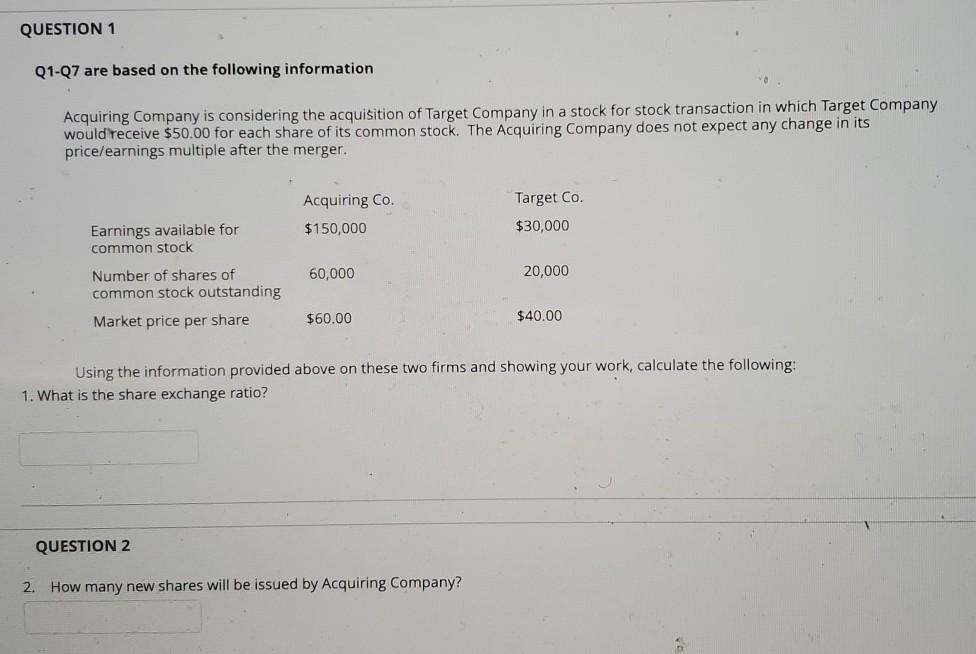

QUESTION 1 Q1-Q7 are based on the following information Acquiring Company is considering the acquisition of Target Company in a stock for stock transaction in which Target Company would receive $50.00 for each share of its common stock. The Acquiring Company does not expect any change in its price/earnings multiple after the merger. + Acquiring Co. $150,000 Target Co. $30,000 Earnings available for common stock 60,000 20,000 Number of shares of common stock outstanding Market price per share $60.00 $40.00 Using the information provided above on these two firms and showing your work, calculate the following: 1. What is the share exchange ratio? QUESTION 2 2. How many new shares will be issued by Acquiring Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts