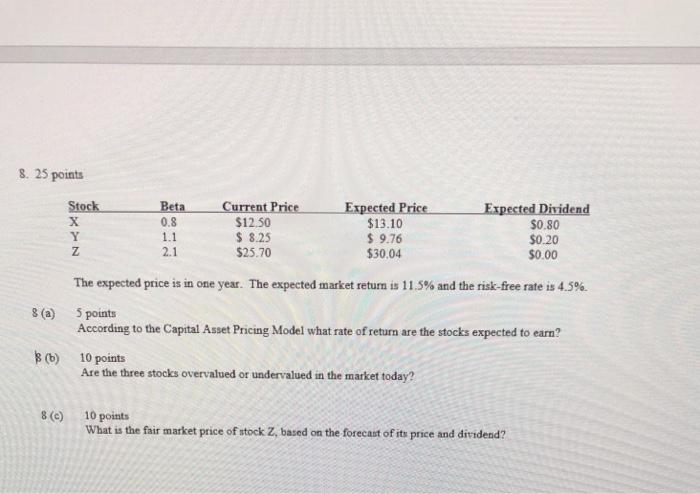

Question: please explain solution 8. 25 points Stock Y Z Beta 0.8 1.1 2.1 Current Price $12.50 $ 8.25 $25.70 Expected Price $13.10 $ 9.76 $30.04

please explain solution

8. 25 points Stock Y Z Beta 0.8 1.1 2.1 Current Price $12.50 $ 8.25 $25.70 Expected Price $13.10 $ 9.76 $30.04 Expected Dividend $0.80 $0.20 $0.00 8(a) The expected price is in one year. The expected market return is 11.5% and the risk-free rate is 4.5% 5 points According to the Capital Asset Pricing Model what rate of return are the stocks expected to earn? 10 points Are the three stocks overvalued or undervalued in the market today? $ (b) 80) 10 points What is the fair market price of stock Z, based on the forecast of its price and dividend

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock