Question: please explain step by step. how you do it? Calculate the Gross Debt Service (GDS) and the Total Debt Service (TDS) ratios for the following

please explain step by step. how you do it?

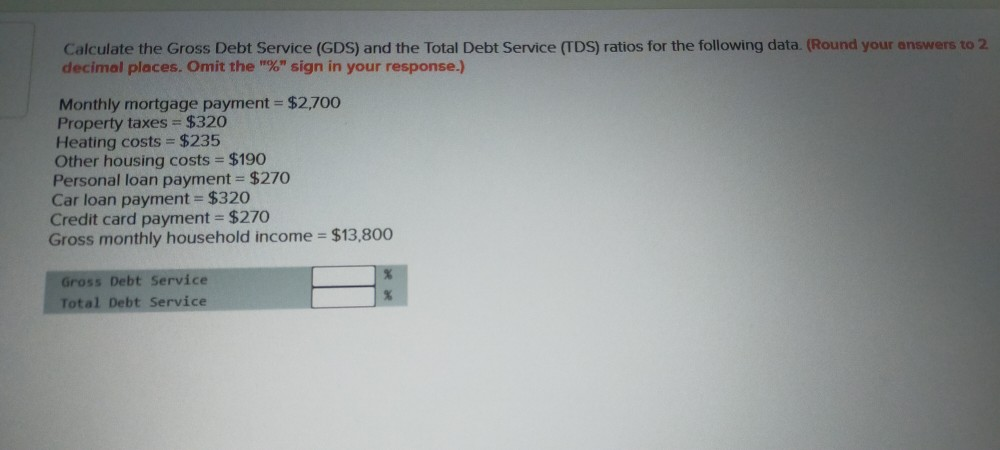

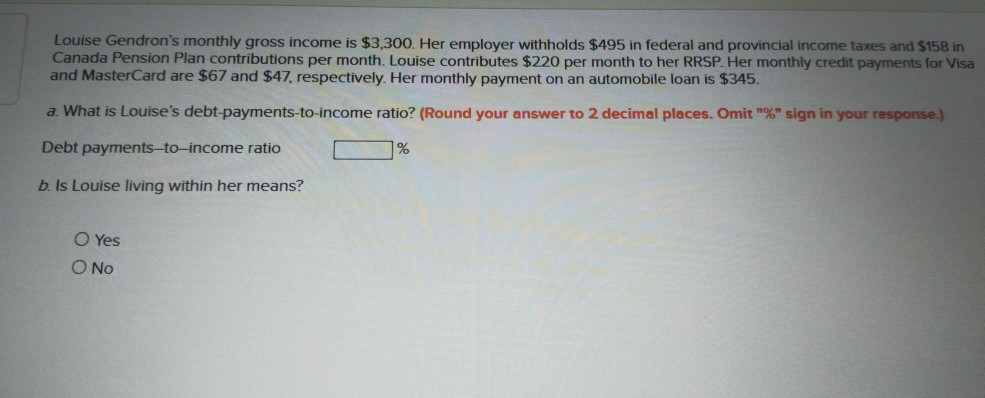

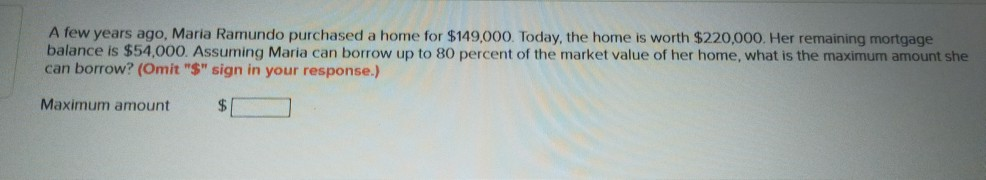

Calculate the Gross Debt Service (GDS) and the Total Debt Service (TDS) ratios for the following data. (Round your answers to 2 decimal places. Omit the "%" sign in your response.) Monthly mortgage payment = $2,700 Property taxes = $320 Heating costs = $235 Other housing costs = $190 Personal loan payment = $270 Car loan payment = $320 Credit card payment = $270 Gross monthly household income = $13,800 % Gross Debt Service Total Debt Service Louise Gendron's monthly gross income is $3,300. Her employer withholds $495 in federal and provincial income taxes and $158 in Canada Pension Plan contributions per month. Louise contributes $220 per month to her RRSP. Her monthly credit payments for Visa and MasterCard are $67 and $47, respectively. Her monthly payment on an automobile loan is $345. a. What is Louise's debt-payments-to-income ratio? (Round your answer to 2 decimal places. Omit "%" sign in your response.) Debt payments-to-income ratio % b. Is Louise living within her means? O Yes O No A few years ago, Maria Ramundo purchased a home for $149,000. Today, the home is worth $220,000. Her remaining mortgage balance is $54,000. Assuming Maria can borrow up to 80 percent of the market value of her home, what is the maximum amount she can borrow? (Omit "$" sign in your response.) Maximum amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts