Question: Please explain step by step on how to get that answer Question 1 O out of 0.5 points SLOAN-GREY Corporation (calendar year end) has 2020

Please explain step by step on how to get that answer

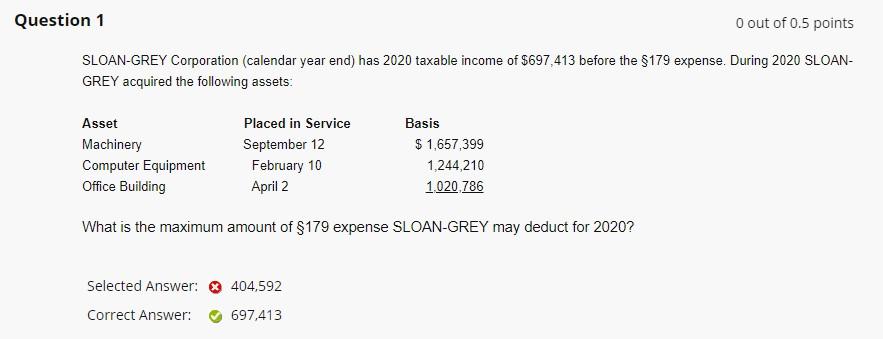

Question 1 O out of 0.5 points SLOAN-GREY Corporation (calendar year end) has 2020 taxable income of $697,413 before the $179 expense. During 2020 SLOAN- GREY acquired the following assets Asset Machinery Computer Equipment Office Building Placed in Service September 12 February 10 April 2 Basis $1,657,399 1,244,210 1.020.786 What is the maximum amount of $179 expense SLOAN-GREY may deduct for 2020? Selected Answer: 404,592 Correct Answer: 697,413

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts