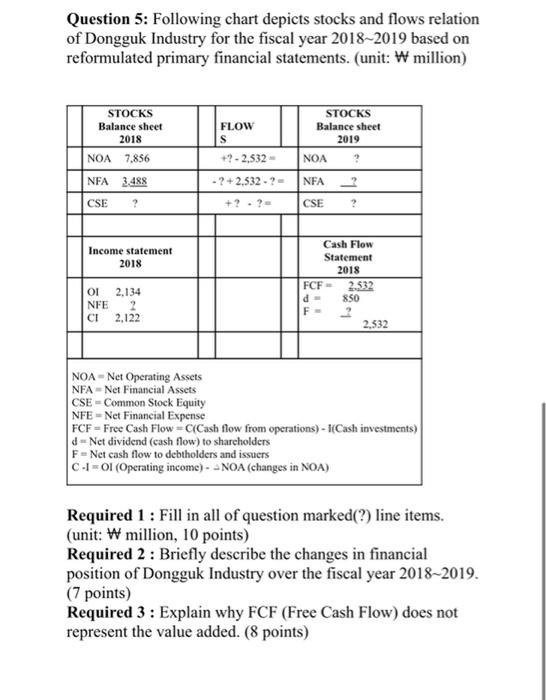

Question: please explain the answer Question 5: Following chart depicts stocks and flows relation of Dongguk Industry for the fiscal year 2018-2019 based on reformulated primary

Question 5: Following chart depicts stocks and flows relation of Dongguk Industry for the fiscal year 2018-2019 based on reformulated primary financial statements. (unit: W million) STOCKS Balance sheet 2018 FLOW S STOCKS Balance sheet 2019 NOA 7.856 +? - 2,532 NOA ? - ?+2,532 - ? - NFA 3.488 CSE NFA ? CSE ? Income statement 2018 Cash Flow Statement 2018 FCF- 850 F 2 2332 OI 2.134 NFE 2 CI 2,122 2,532 NOA-Net Operating Assets NFA - Net Financial Assets CSE - Common Stock Equity NFE - Net Financial Expense FCF - Free Cash Flow - Cash flow from operations) - I(Cash investments) d-Net dividend (cash flow) to shareholders F = Net cash flow to debtholders and issuers C-I = 01 (Operating income) - - NOA (changes in NOA) Required 1 : Fill in all of question marked(?) line items. (unit: W million, 10 points) Required 2 : Briefly describe the changes in financial position of Dongguk Industry over the fiscal year 2018-2019. (7 points) Required 3 : Explain why FCF (Free Cash Flow) does not represent the value added. (8 points) Question 5: Following chart depicts stocks and flows relation of Dongguk Industry for the fiscal year 2018-2019 based on reformulated primary financial statements. (unit: W million) STOCKS Balance sheet 2018 FLOW S STOCKS Balance sheet 2019 NOA 7.856 +? - 2,532 NOA ? - ?+2,532 - ? - NFA 3.488 CSE NFA ? CSE ? Income statement 2018 Cash Flow Statement 2018 FCF- 850 F 2 2332 OI 2.134 NFE 2 CI 2,122 2,532 NOA-Net Operating Assets NFA - Net Financial Assets CSE - Common Stock Equity NFE - Net Financial Expense FCF - Free Cash Flow - Cash flow from operations) - I(Cash investments) d-Net dividend (cash flow) to shareholders F = Net cash flow to debtholders and issuers C-I = 01 (Operating income) - - NOA (changes in NOA) Required 1 : Fill in all of question marked(?) line items. (unit: W million, 10 points) Required 2 : Briefly describe the changes in financial position of Dongguk Industry over the fiscal year 2018-2019. (7 points) Required 3 : Explain why FCF (Free Cash Flow) does not represent the value added. (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts