Question: Please explain the answer. Thank you. Learning Objective 2 1. Dec. 31 Int. Rev. CR $15,00 P10-18A Accounting for debt investments Suppose Solomon Brothers purchases

Please explain the answer. Thank you.

Please explain the answer. Thank you.

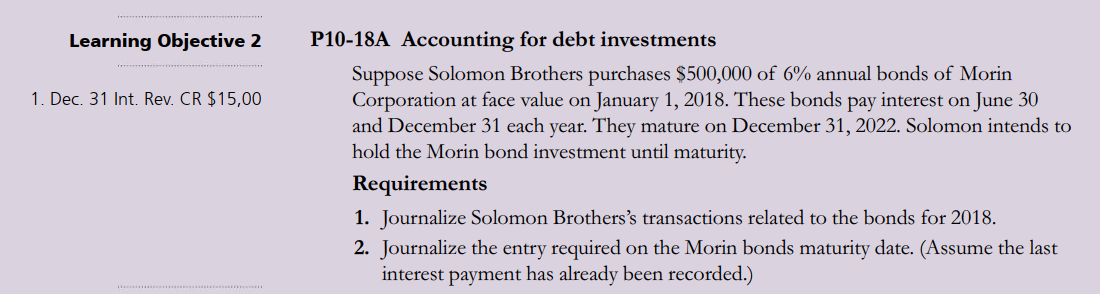

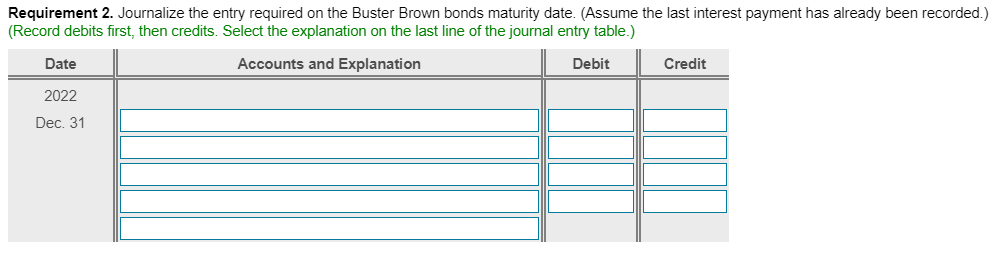

Learning Objective 2 1. Dec. 31 Int. Rev. CR $15,00 P10-18A Accounting for debt investments Suppose Solomon Brothers purchases $500,000 of 6% annual bonds of Morin Corporation at face value on January 1, 2018. These bonds pay interest on June 30 and December 31 each year. They mature on December 31, 2022. Solomon intends to hold the Morin bond investment until maturity. Requirements 1. Journalize Solomon Brothers's transactions related to the bonds for 2018. 2. Journalize the entry required on the Morin bonds maturity date. (Assume the last interest payment has already been recorded.) Requirement 2. Journalize the entry required on the Buster Brown bonds maturity date. (Assume the last interest payment has already been recorded.) (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit 2022 Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts