Question: Please explain the answer. The Mishka's project requires initial investments of $100 and its NPV is less than zero. If the project has conventional cash

Please explain the answer.

Please explain the answer.

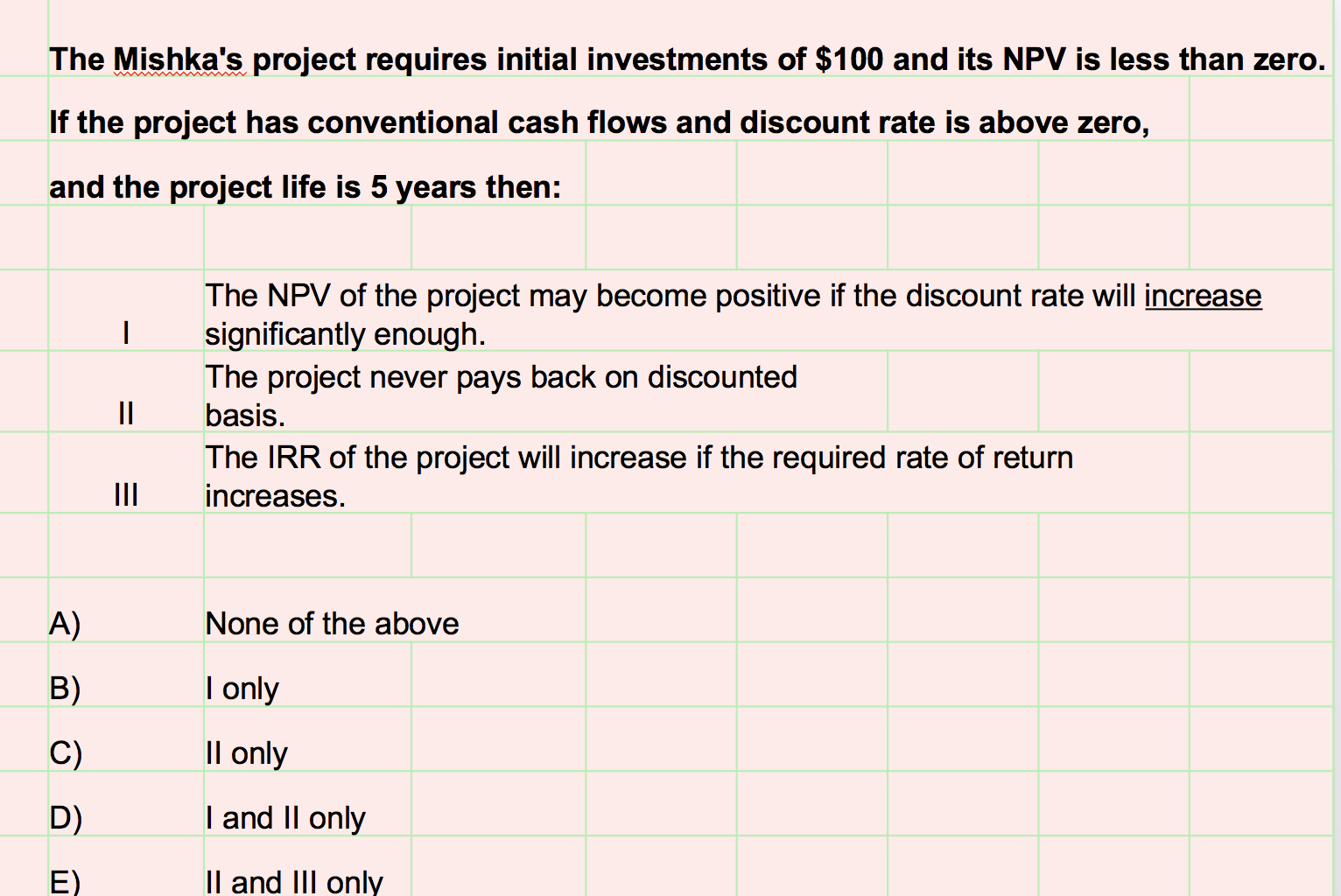

The Mishka's project requires initial investments of $100 and its NPV is less than zero. If the project has conventional cash flows and discount rate is above zero, and the project life is 5 years then: The NPV of the project may become positive if the discount rate will increase significantly enough. The project never pays back on discounted basis. The IRR of the project will increase if the required rate of return increases. None of the above e I only o Il only o I and II only o II and III only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts