Question: Please explain the model and provide the excel spreadsheet step by step Allocating Investments An investor oriented to energy industries has decided to buy stock

Please explain the model and provide the excel spreadsheet step by step

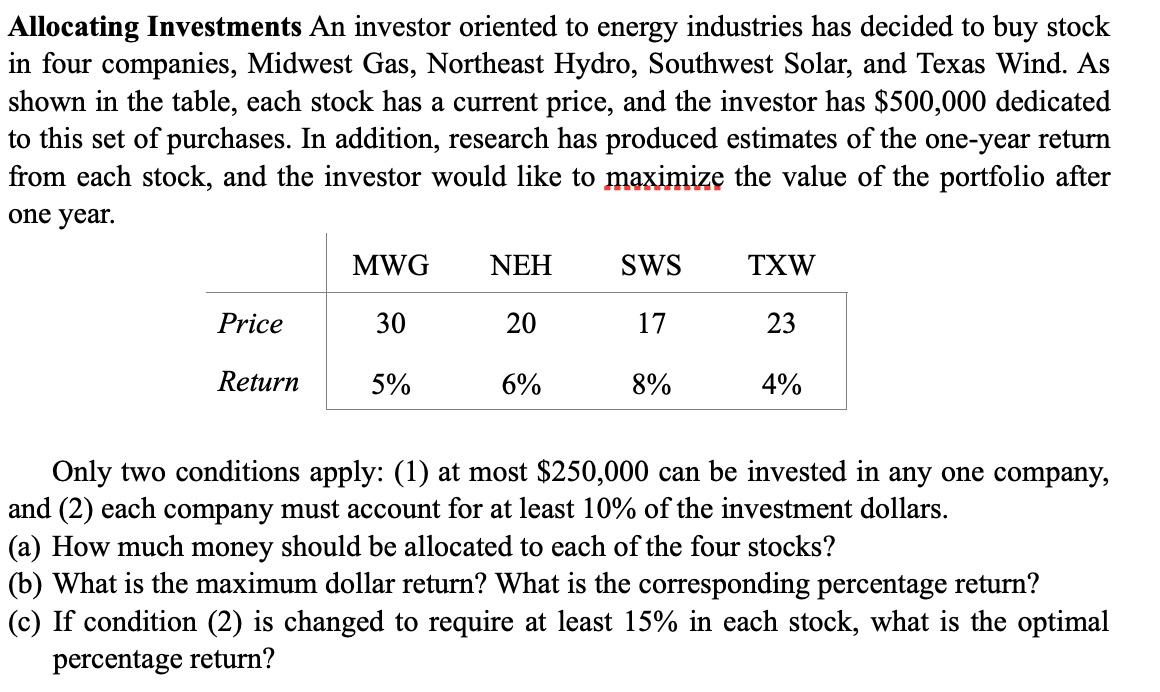

Allocating Investments An investor oriented to energy industries has decided to buy stock in four companies, Midwest Gas, Northeast Hydro, Southwest Solar, and Texas Wind. As shown in the table, each stock has a current price, and the investor has $500,000 dedicated to this set of purchases. In addition, research has produced estimates of the one-year return from each stock, and the investor would like to maximize the value of the portfolio after one year. Only two conditions apply: (1) at most $250,000 can be invested in any one company, and (2) each company must account for at least 10% of the investment dollars. (a) How much money should be allocated to each of the four stocks? (b) What is the maximum dollar return? What is the corresponding percentage return? (c) If condition (2) is changed to require at least 15% in each stock, what is the optimal percentage return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts