Question: Please explain the red. 6This question has to do with the risk on options. 6 a (4 points) You are long a call option and

Please explain the red.

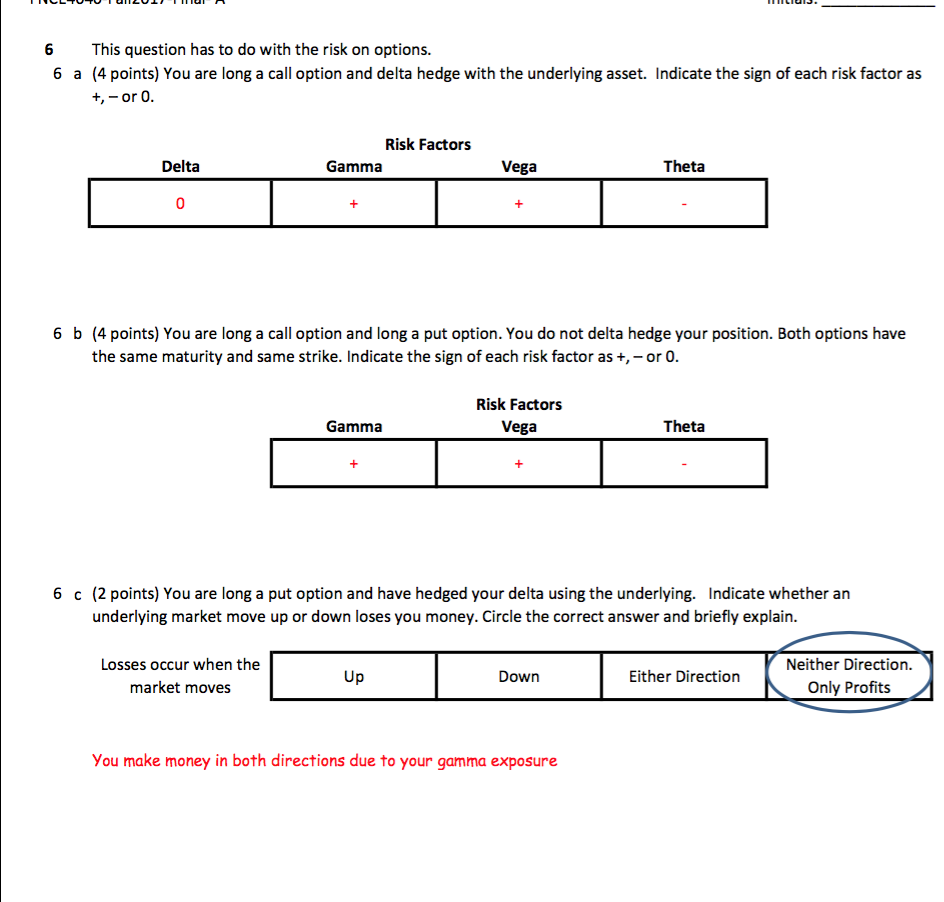

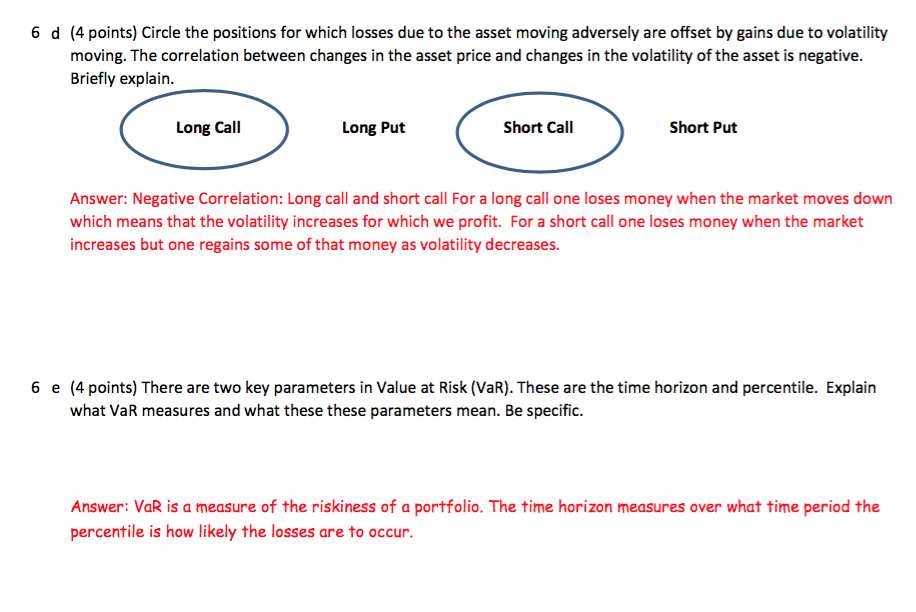

6This question has to do with the risk on options. 6 a (4 points) You are long a call option and delta hedge with the underlying asset. Indicate the sign of each risk factor as +,-or 0 Risk Factors Delta Gamma Vega Theta 0 6 b (4 points) You are long a call option and long a put option. You do not delta hedge your position. Both options have the same maturity and same strike. Indicate the sign of each risk factor as +,-or 0 Risk Factors Gamma Vega Theta 6 c (2 points) You are long a put option and have hedged your delta using the underlying. Indicate whether an underlying market move up or down loses you money. Circle the correct answer and briefly explain Losses occur when the market moves Neither Direction. Up Down Either Direction Only Profits You make money in both directions due to your gamma exposure 6 d (4 points) Circle the positions for which losses due to the asset moving adversely are offset by gains due to volatility moving. The correlation between changes in the asset price and changes in the volatility of the asset is negative Briefly explain Long Call Long Put Short Call Short Put Answer: Negative Correlation: Long call and short call For a long call one loses money when the market moves down which means that the volatility increases for which we profit. For a short call one loses money when the market increases but one regains some of that money as volatility decreases 6 e (4 points) There are two key parameters in Value at Risk (VaR). These are the time horizon and percentile. Explain what VaR measures and what these these parameters mean. Be specific. Answer: VaR is a measure of the riskiness of a portfolio. The time horizon measures over what time period the percentile is how likely the losses are to occur

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts