Question: Please explain the red in more depth. 2 The following question has to do with relationships between option prices. 2 a (6 points) In the

Please explain the red in more depth.

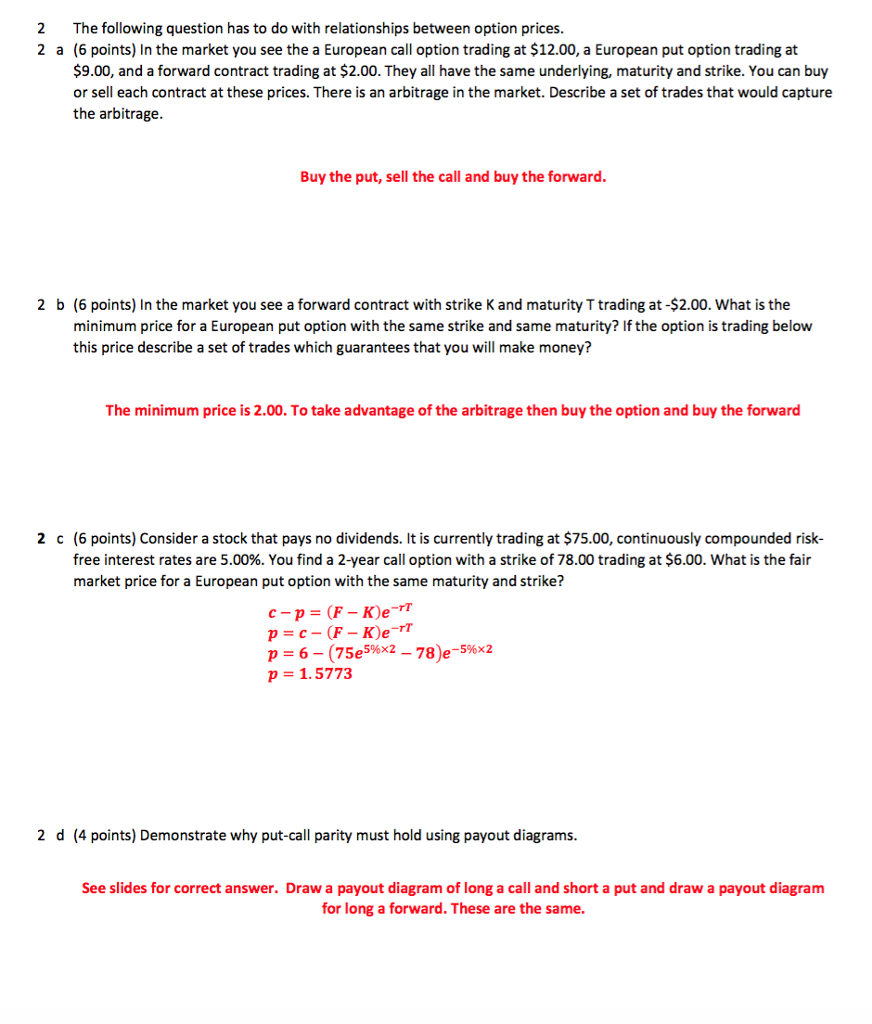

2 The following question has to do with relationships between option prices. 2 a (6 points) In the market you see the a European call option trading at $12.00, a European put option trading at $9.00, and a forward contract trading at $2.00. They all have the same underlying, maturity and strike. You can buy or sell each contract at these prices. There is an arbitrage in the market. Describe a set of trades that would capture the arbitrage Buy the put, sell the call and buy the forward 2 b (6 points) In the market you see a forward contract with strike K and maturity T trading at-$2.00. What is the minimum price for a European put option with the same strike and same maturity? If the option is trading below this price describe a set of trades which guarantees that you will make money? The minimum price is 2.00. To take advantage of the arbitrage then buy the option and buy the forward 2 c (6 points) Consider a stock that pays no dividends. It is currently trading at $75.00, continuously compounded risk- free interest rates are 5.00%. You find a 2-year call option with a strike of 78.00 trading at $6.00, what is the fair market price for a European put option with the same maturity and strike? p-6-(75e5%x2-78)2-5%x2 p-1.5773 2 d (4 points) Demonstrate why put-call parity must hold using payout diagrams See slides for correct answer. Draw a payout diagram of long a call and short a put and draw a payout diagram for long a forward. These are the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts