Question: Please explain the solution clearly for me!! Thank you:) Portfolio Theory and CAPM: The stock market comprises two stocks, A and B, and a risk-free

Please explain the solution clearly for me!! Thank you:)

Please explain the solution clearly for me!! Thank you:)

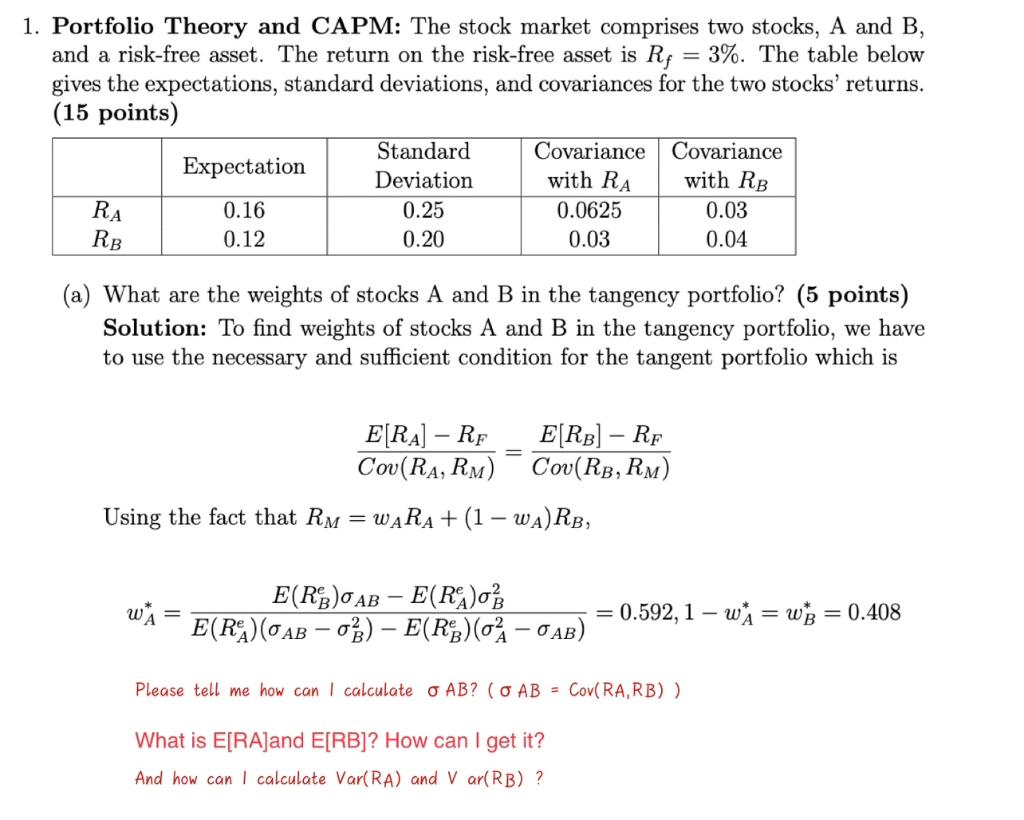

Portfolio Theory and CAPM: The stock market comprises two stocks, A and B, and a risk-free asset. The return on the risk-free asset is Rf=3%. The table below gives the expectations, standard deviations, and covariances for the two stocks' returns. (15 points) (a) What are the weights of stocks A and B in the tangency portfolio? (5 points) Solution: To find weights of stocks A and B in the tangency portfolio, we have to use the necessary and sufficient condition for the tangent portfolio which is Cov(RA,RM)E[RA]RF=Cov(RB,RM)E[RB]RF Using the fact that RM=wARA+(1wA)RB, wA=E(RAe)(ABB2)E(RBe)(A2AB)E(RBe)ABE(RAe)B2=0.592,1wA=wB=0.408 Please tell me how can I calculate AB ? (AB=Cov(RA,RB)) What is E[RA] and E[RB] ? How can I get it? And how can I calculate Var(RA) and Var(RB) ? Portfolio Theory and CAPM: The stock market comprises two stocks, A and B, and a risk-free asset. The return on the risk-free asset is Rf=3%. The table below gives the expectations, standard deviations, and covariances for the two stocks' returns. (15 points) (a) What are the weights of stocks A and B in the tangency portfolio? (5 points) Solution: To find weights of stocks A and B in the tangency portfolio, we have to use the necessary and sufficient condition for the tangent portfolio which is Cov(RA,RM)E[RA]RF=Cov(RB,RM)E[RB]RF Using the fact that RM=wARA+(1wA)RB, wA=E(RAe)(ABB2)E(RBe)(A2AB)E(RBe)ABE(RAe)B2=0.592,1wA=wB=0.408 Please tell me how can I calculate AB ? (AB=Cov(RA,RB)) What is E[RA] and E[RB] ? How can I get it? And how can I calculate Var(RA) and Var(RB)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts