Question: Please explain the steps and equations used. #40 The risk-free rate is 3.74% and the market risk premium is 7.19%. A stock with a of

Please explain the steps and equations used.

Please explain the steps and equations used.

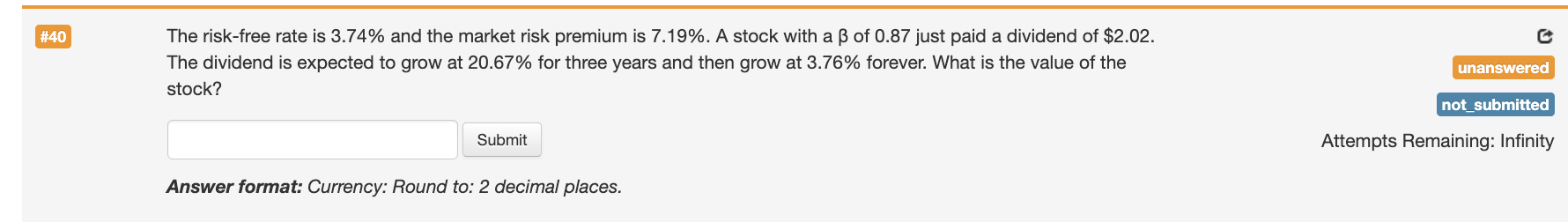

#40 The risk-free rate is 3.74% and the market risk premium is 7.19%. A stock with a of 0.87 just paid a dividend of $2.02. The dividend is expected to grow at 20.67% for three years and then grow at 3.76% forever. What is the value of the stock? unanswered not_submitted Submit Attempts Remaining: Infinity Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock