Question: Please explain the steps... I am particularly having trouble with calculating the variance and standard deviation of the assets and the portfolio as a whole.

Please explain the steps... I am particularly having trouble with calculating the variance and standard deviation of the assets and the portfolio as a whole.

Please explain the steps... I am particularly having trouble with calculating the variance and standard deviation of the assets and the portfolio as a whole.

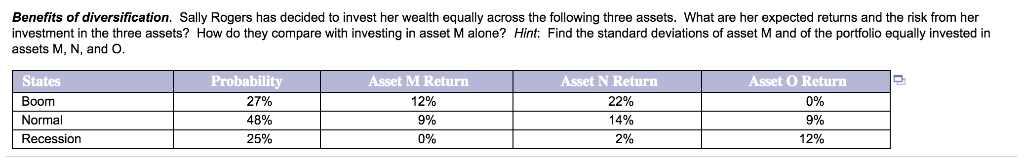

Benefits of diversification. Sally Rogers has decided to invest her wealth equally across the following three assets. What are her expected returns and the risk from her investment in the three assets? How do they compare with investing assets M, N, and O asset M alone? Hint: Find the standard deviations of asset M and of the portfolio equally invested in States Probability Asset M Return Asset O Return Asset N Return 27% 0% Boom 12% 22% Normal 48% 9% 14% 9% 12% 25% 0% 2% Recession

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts