Question: please explain this in excel with formulas given An investor considers the purchase of 2-year annual zero-coupon Bond I to be e issued 2 year

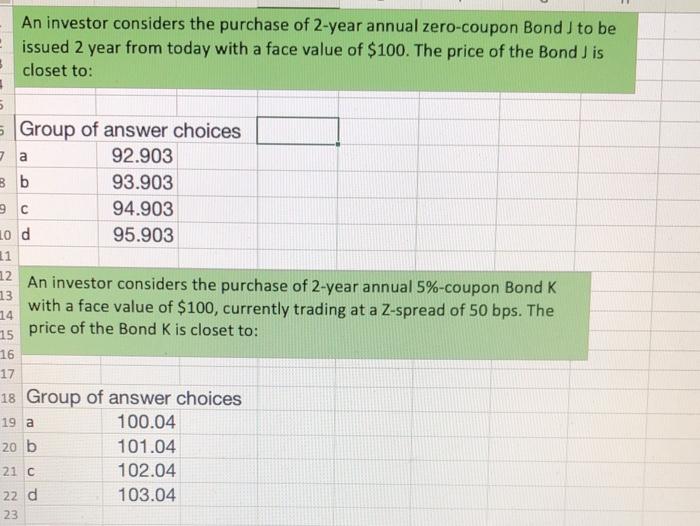

An investor considers the purchase of 2-year annual zero-coupon Bond I to be e issued 2 year from today with a face value of $100. The price of the Bond I is closet to: 5 Group of answer choices 92.903 Bb 93.903 2c 94.903 lod 95.903 11 12 An investor considers the purchase of 2-year annual 5%-coupon Bond K 13 with a face value of $100, currently trading at a Z-spread of 50 bps. The 15 price of the Bond K is closet to: 16 17 18 Group of answer choices 19 a 100.04 20 b 101.04 102.04 103.04 14 21 C 22 d 23 An investor considers the purchase of 2-year annual zero-coupon Bond I to be e issued 2 year from today with a face value of $100. The price of the Bond I is closet to: 5 Group of answer choices 92.903 Bb 93.903 2c 94.903 lod 95.903 11 12 An investor considers the purchase of 2-year annual 5%-coupon Bond K 13 with a face value of $100, currently trading at a Z-spread of 50 bps. The 15 price of the Bond K is closet to: 16 17 18 Group of answer choices 19 a 100.04 20 b 101.04 102.04 103.04 14 21 C 22 d 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts