Question: Please explain this question step by step, including the formula used and all the explanations, theories, thanks A portfolio is constructed from 4 shares as

Please explain this question step by step, including the formula used and all the explanations, theories, thanks

Please explain this question step by step, including the formula used and all the explanations, theories, thanks

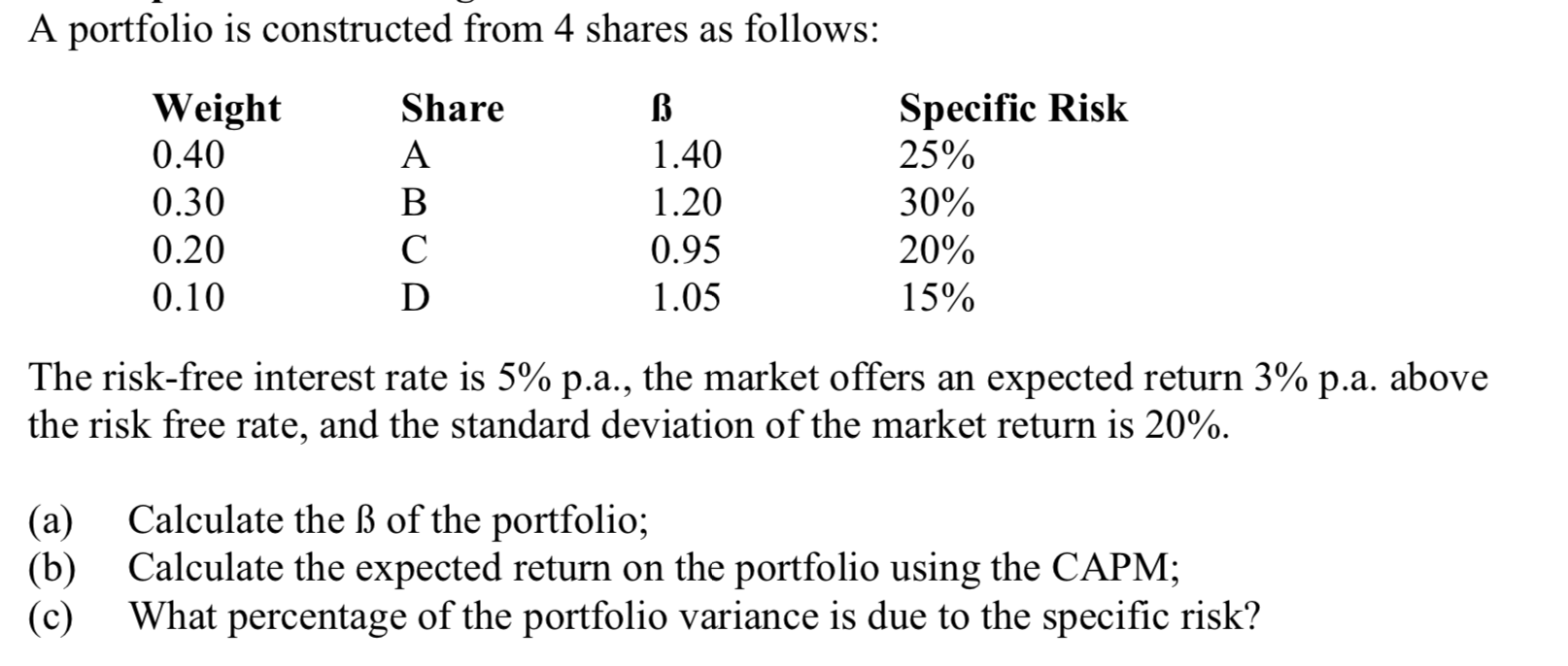

A portfolio is constructed from 4 shares as follows: Weight 0.40 0.30 0.20 0.10 Share A B C D B 1.40 1.20 0.95 1.05 Specific Risk 25% 30% 20% 15% The risk-free interest rate is 5% p.a., the market offers an expected return 3% p.a. above the risk free rate, and the standard deviation of the market return is 20%. (a) (b) (C) Calculate the B of the portfolio; Calculate the expected return on the portfolio using the CAPM; What percentage of the portfolio variance is due to the specific risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts