Question: Hi there, Please answer all the questions; please don't skip any subparts. May you explain all the formulas needed and the theories behind them first.

Hi there,

Please answer all the questions; please don't skip any subparts. May you explain all the formulas needed and the theories behind them first. Feel free to make any reference links that may potentially help me to study. If you don't know any part or subpart, may you not take the question. Please provide an excellent formatted answer, and I strongly prefer typing rather than handwritten. If you provide a bad answer in any form that is badly formatted, or wrong, etc., I am afraid I will need to downvote you and possibly flag it. The answer needs to be. very logical, easy to understand , clear and cover all the necessary theories. I believe you are able to perform good job.Thank you.

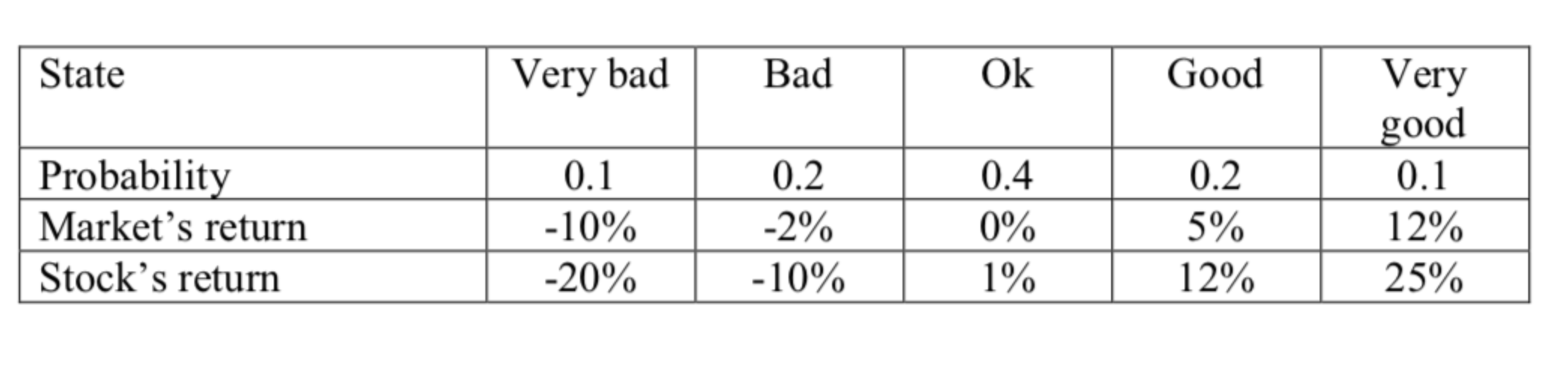

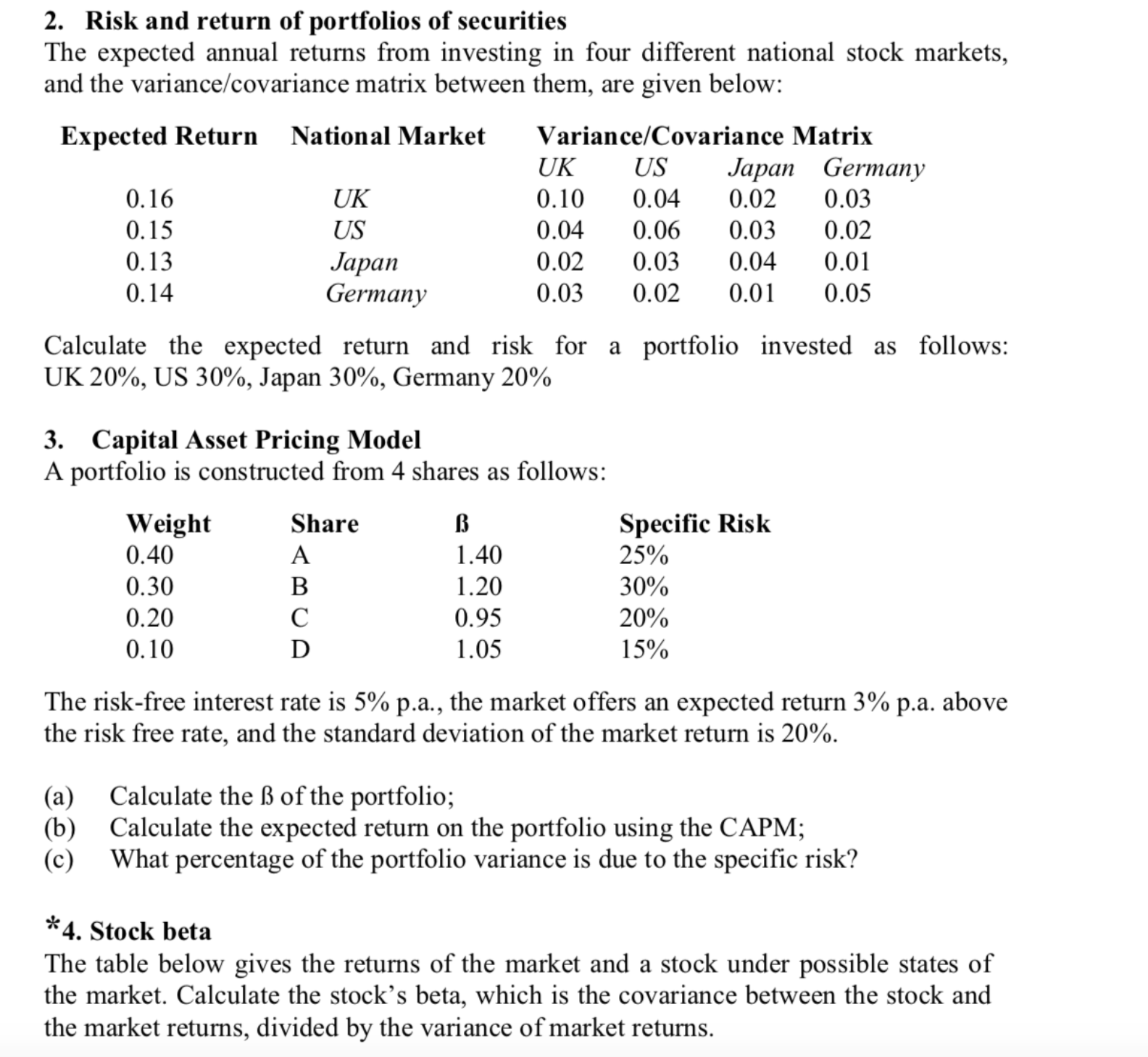

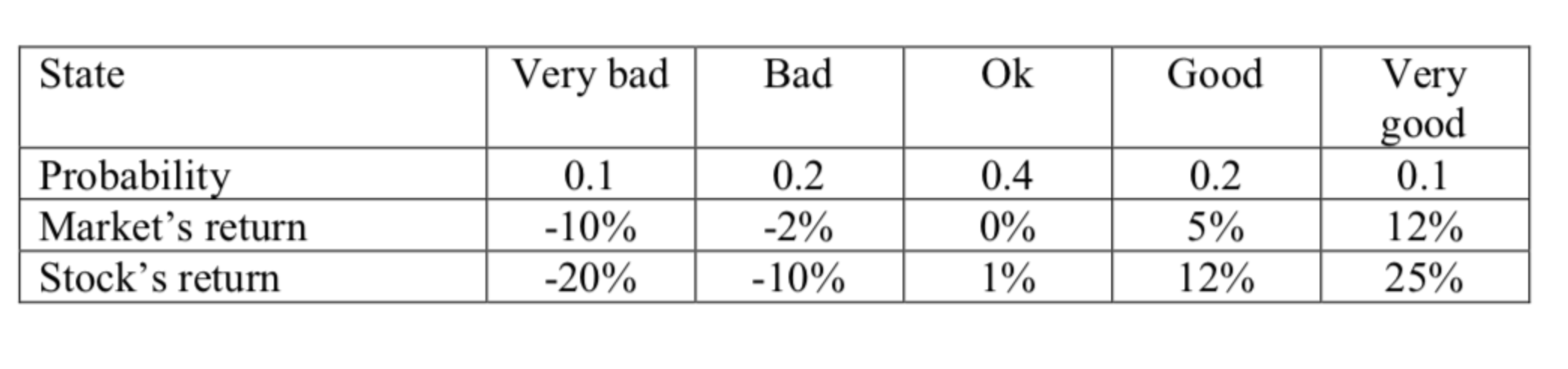

2. Risk and return of portfolios of securities The expected annual returns from investing in four different national stock markets, and the variance/covariance matrix between them, are given below: Expected Return National Market Variance/Covariance Matrix UK US Japan Germany 0.16 UK 0.10 0.04 0.02 0.03 0.15 US 0.04 0.06 0.03 0.02 0.13 Japan 0.02 0.03 0.04 0.01 0.14 Germany 0.03 0.02 0.0] 0.05 Calculate the expected return and risk for a portfolio invested as follows: UK 20%, US 30%, Japan 30%, Germany 20% 3. Capital Asset Pricing Model A portfolio is constructed from 4 shares as follows: Weight Share 8 Specic Risk 0.40 A 1 .40 25% 0.30 B 1.20 30% 0.20 C 0.95 20% 0. 10 D 1 .05 15% The risk-free interest rate is 5% pa, the market offers an expected return 3% pa. above the risk free rate, and the standard deviation of the market return is 20%. (a) Calculate the B of the portfolio; (b) Calculate the expected return on the portfolio using the CAPM; (c) What percentage of the portfolio variance is due to the specic risk? *4. Stock beta The table below gives the returns of the market and a stock under possible states of the market. Calculate the stock's beta, which is the covariance between the stock and the market returns, divided by the variance of market returns. State Very bad Bad Ok Good Very good Probability 0.1 0.2 0.4 0.2 0.1 Market's return -10% -2% 0% 5% 12% Stock's return -20% -10% 1% 12% 25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts