Question: please explain this to me, how do I know when its overvalued or undervalued (Q: Compare the required rate of return to the estimated rate

please explain this to me, how do I know when its overvalued or undervalued

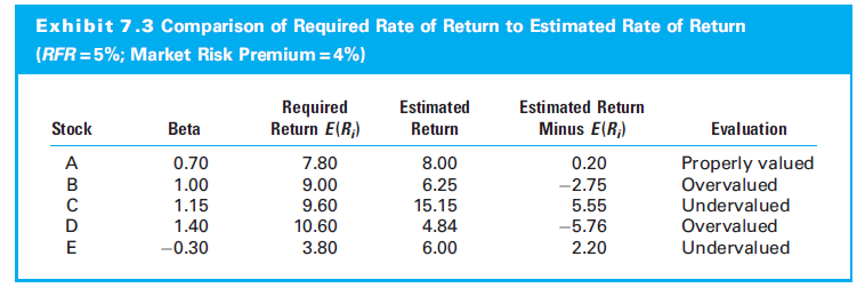

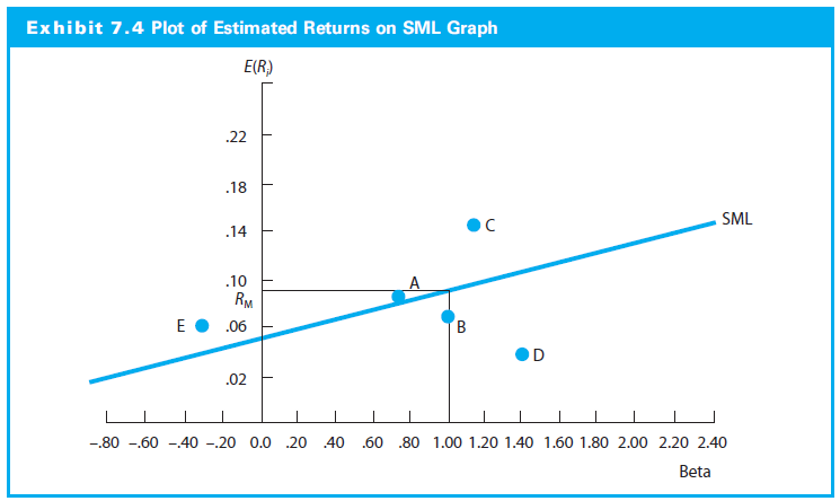

(Q: Compare the required rate of return to the estimated rate of return for a specific risky asset using the SML over a specific investment horizon to determine if it is an appropriate investment)

Answer:

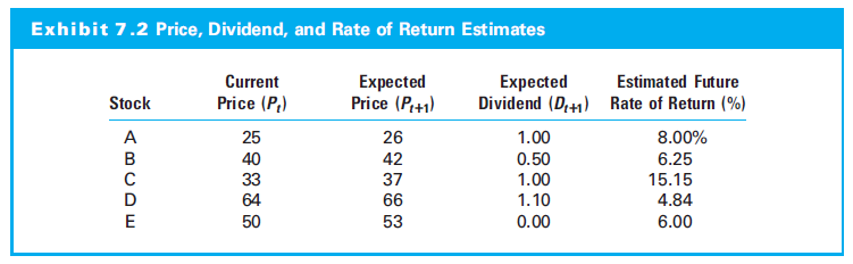

Exhil Exhibit 7.3 Comparison of Required Rate of Return to Estimated Rate of Return (RFR =5\%; Market Risk Premium = 4\%) \begin{tabular}{cccccl} Stock & Beta & RequiredReturnE(Ri) & EstimatedReturn & EstimatedReturnMinusE(Ri) & \multicolumn{1}{c}{ Evaluation } \\ \hline A & 0.70 & 7.80 & 8.00 & 0.20 & Properly valued \\ B & 1.00 & 9.00 & 6.25 & -2.75 & Overvalued \\ C & 1.15 & 9.60 & 15.15 & 5.55 & Undervalued \\ D & 1.40 & 10.60 & 4.84 & -5.76 & Overvalued \\ E & -0.30 & 3.80 & 6.00 & 2.20 & Undervalued \\ \hline \end{tabular} Exhibit 7.4 Plot of Estimated Returns on SML Graph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts