Question: please explain this without financial calculator Suppose you are thinking of purchasing the stock of Moore Oil, Inc. You expect it to pay a $2

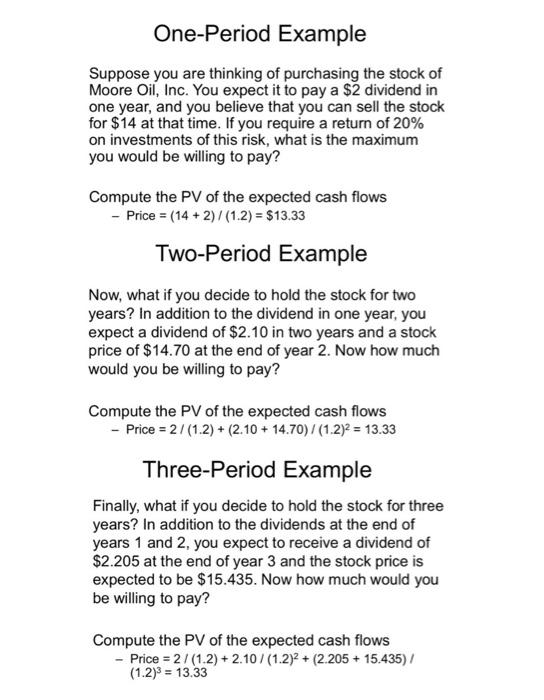

Suppose you are thinking of purchasing the stock of Moore Oil, Inc. You expect it to pay a $2 dividend in one year, and you believe that you can sell the stock for $14 at that time. If you require a return of 20% on investments of this risk, what is the maximum you would be willing to pay? Compute the PV of the expected cash flows Price =(14+2)/(1.2)=$13.33 Two-Period Example Now, what if you decide to hold the stock for two years? In addition to the dividend in one year, you expect a dividend of $2.10 in two years and a stock price of $14.70 at the end of year 2 . Now how much would you be willing to pay? Compute the PV of the expected cash flows - Price =2/(1.2)+(2.10+14.70)/(1.2)2=13.33 Three-Period Example Finally, what if you decide to hold the stock for three years? In addition to the dividends at the end of years 1 and 2 , you expect to receive a dividend of $2.205 at the end of year 3 and the stock price is expected to be $15.435. Now how much would you be willing to pay? Compute the PV of the expected cash flows Price(1.2)3=13.33=2/(1.2)+2.10/(1.2)2+(2.205+15.435)/ (1.2)3=13.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts