Question: please explain well how you derive to answer . A. B. $100,000 19. Red Company is a calendar-year firm with operations in several countries. At

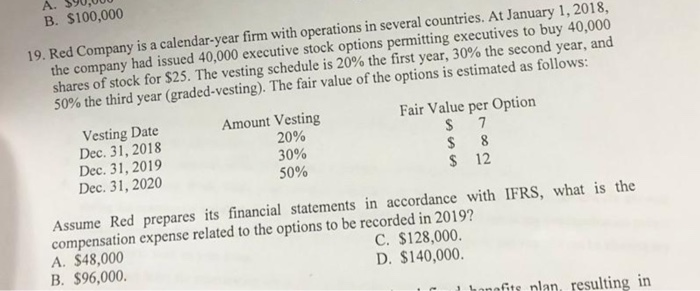

A. B. $100,000 19. Red Company is a calendar-year firm with operations in several countries. At January 1, 2018, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting). The fair value of the options is estimated as follows: Fair Value per Option Amount Vesting 20% 30% 50% Vesting Date Dec. 31, 2018 Dec. 31, 2019 Dec. 31, 2020 $ 12 Assume Red prepares its financial statements in accordance with IFRS, what is the compensation expense related to the options to be recorded in 2019? A. $48,000 B. $96,000. C. $128,000. D. $140,000. 1 hanafits plan, resulting in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts