Question: Problem #4 Notes Receivable (20%) REQUIRED: In a TWO COLUMN JOURNAL, record the following independent transactions: 1) On 10/01/18, Sold merchandise to Fraser Co. $

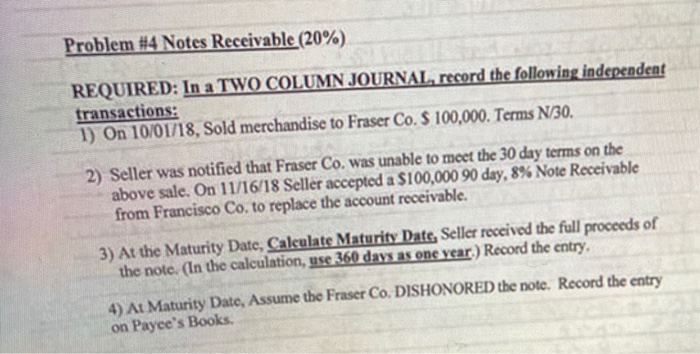

Problem #4 Notes Receivable (20%) REQUIRED: In a TWO COLUMN JOURNAL, record the following independent transactions: 1) On 10/01/18, Sold merchandise to Fraser Co. $ 100,000. Terms N/30. 2) Seller was notified that Fraser Co. was unable to meet the 30 day terms on the above sale. On 11/16/18 Seller accepted a $100,000 90 day, 8% Note Receivable from Francisco Co. to replace the account receivable 3) At the Maturity Date, Calculate Maturity Date, Seller received the full proceeds of the note. (In the calculation, use 360 days as one year.) Record the entry 4) At Maturity Date, Assume the Fraser Co. DISHONORED the note. Record the entry on Payee's Books

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts