Question: Please explain where do those numbers that I heighted come from And show the calculation if it is necessary E3.4 Consolidation journal entries for fair

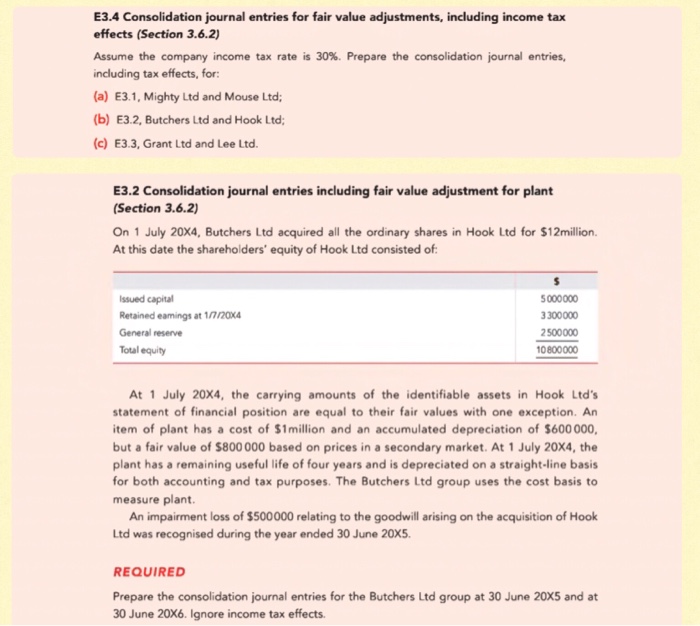

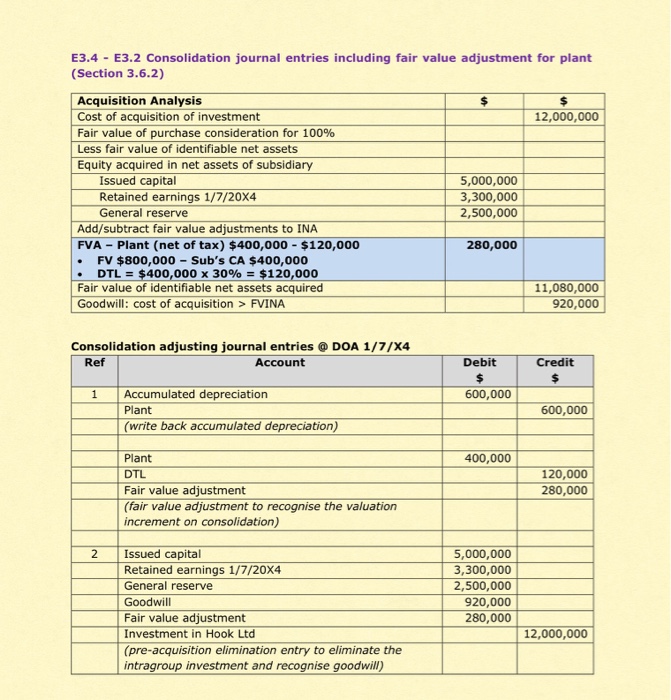

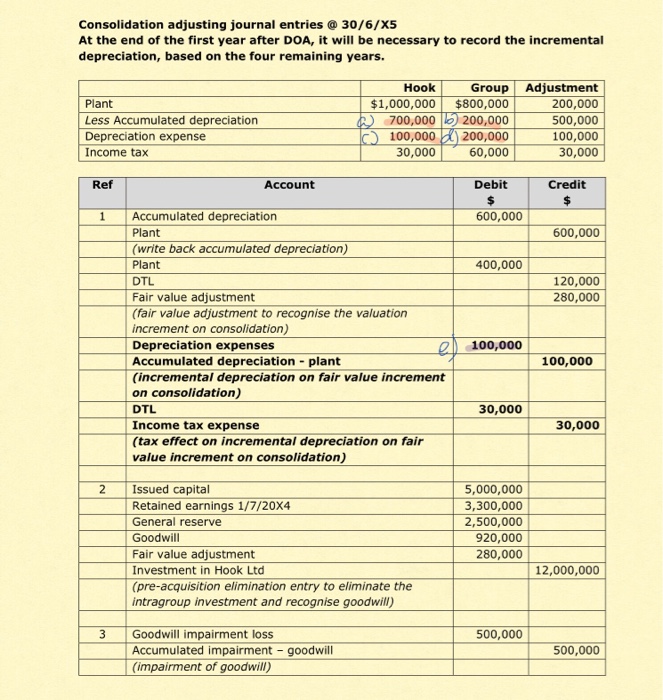

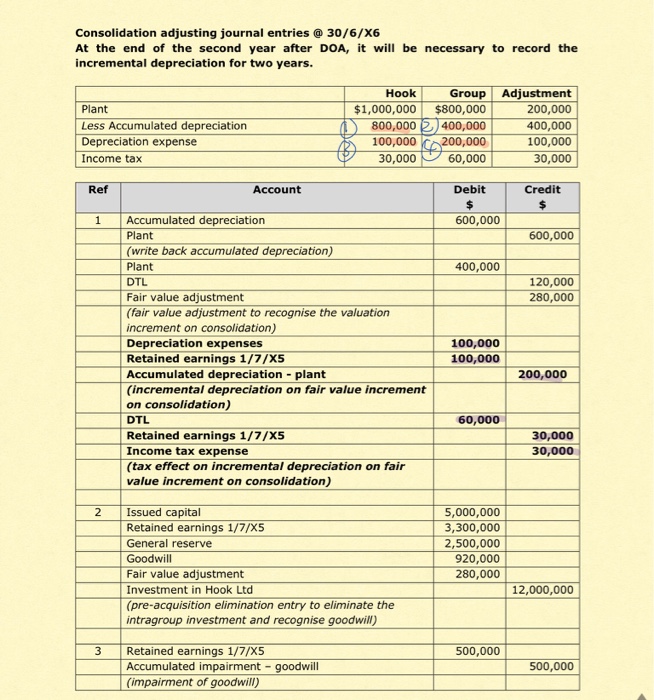

E3.4 Consolidation journal entries for fair value adjustments, including income tax effects (Section 3.6.2 Assume the company income tax rate is 30% Prepare the consolidation journal entries. including tax effects, for (a) E3.1, Mighty Ltd and Mouse Ltd; (b) E3.2, Butchers Ltd and Hook Ltd (c) E3.3, Grant Ltd and Lee Ltd. E3.2 Consolidation journal entries including fair value adjustment for plant (Section 3.6.2) On 1 July 20X4, Butchers Ltd acquired all the ordinary shares in Hook Ltd for $12million. At this date the shareholders' equity of Hook Ltd consisted of Issued capitl Retained eamings at 1nnox4 General reserve Total equity 3 300000 2500000 10800000 At 1 July 20X4, the carrying amounts of the identifiable assets in Hook Ltd's statement of financial position are equal to their fair values with one exception. An item of plant has a cost of $1million and an accumulated depreciation of $600 000 but a fair value of $800 000 based on prices in a secondary market. At 1 July 20X4, the plant has a remaining useful life of four years and is depreciated on a straight-line basis for both accounting and tax purposes. The Butchers Ltd group uses the cost basis to measure plant An impairment loss of $500000 relating to the goodwill arising on the acquisition of Hook Ltd was recognised during the year ended 30 June 20xS REQUIRED Prepare the consolidation journal entries for the Butchers Ltd group at 30 June 20X5 and at 30 June 20x6. Ignore income tax effects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts