Question: please explain why the answer is negative for the NVP of Carol, George, and Thomas Problem 3 Net Present Value. A company has four project

please explain why the answer is negative for the NVP of Carol, George, and Thomas

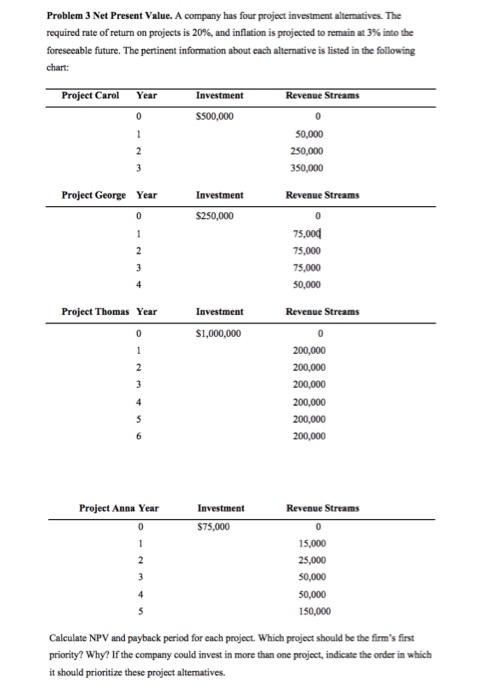

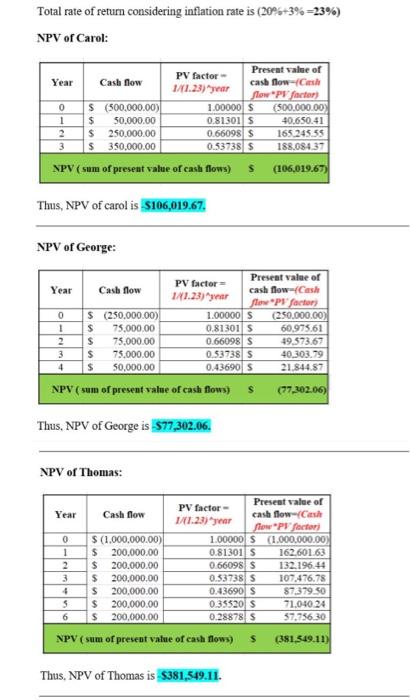

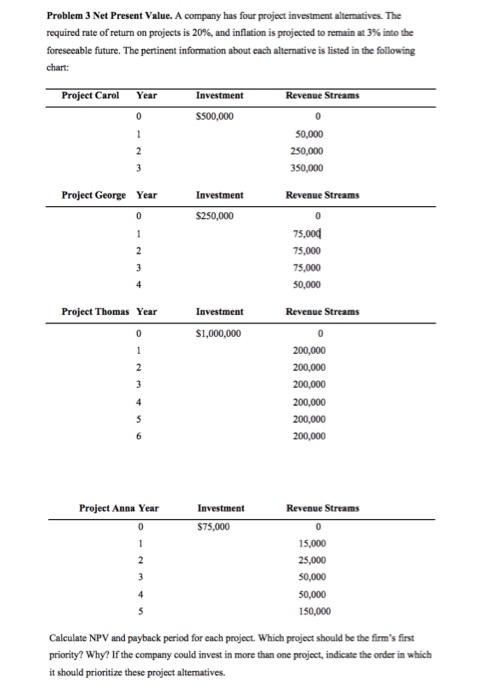

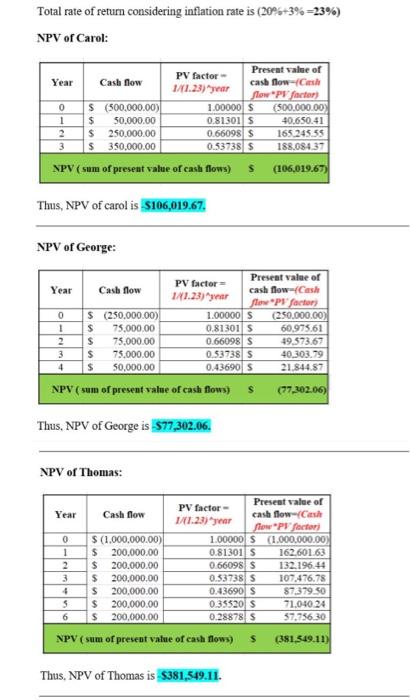

Problem 3 Net Present Value. A company has four project investment alternatives. The required rate of return on projects is 20%, and inflation is projected to remain at 3% into the foreseeable future. The pertinent information about each alternative is listed in the following chart: Project Carol Year Investment Revenue Streams 0 $500,000 1 50,000 2 250,000 3 350,000 Project George Year Investment Revenue Streams 0 $250,000 0 1 75,000 2 75,000 3 75,000 4 50,000 Project Thomas Year Investment Revenue Streams 0 $1,000,000 0 1 200,000 2 200,000 3 200,000 4 200,000 5 200,000 200,000 Project Anna Year Investment Revenue Streams 0 $75,000 0 1 15,000 25,000 3 50,000 50,000 150,000 Calculate NPV and payback period for each project. Which project should be the firm's first priority? Why? If the company could invest in more than one project, indicate the order in which it should prioritize these project alternatives. Total rate of return considering inflation rate is (20% +3% -23%) NPV of Carol: Present value of cash flow-(Cash Year PV factor- 1/(1.23) year Cash flow flow PV factor) 0 $ (500,000.00) 1.00000 $ 1 $ 50,000.00 0.81301 S 2 $ 250,000.00 0.66098 $ 3 $ 350,000.00 0.53738 S NPV (sum of present value of cash flows) S Thus, NPV of carol is $106,019.67. NPV of George: Year Cash flow 0 $ (250,000.00) 1.00000 $ (250,000.00) 1 $ 75,000.00 0.81301 S 60,975.61 2 $ 75,000.00 0.66098 $ 49,573.67 3 $ 75.000.00 0.53738 S 40,303.79 4 $ 50,000.00 0.43690 S 21,844.87 NPV (sum of present value of cash flows) S (77,302.06) Thus, NPV of George is $77,302.06. NPV of Thomas: Year Cash flow Present value of cash flow-(Cash flow"PV factor) 1.00000 $ (1.000.000.00) 0 $ (1,000,000.00) 1 $ 200,000.00 0.81301 $ 162.601.63 0.66098 $ 132,196.44 2 $ 200,000.00 3 $ 200,000.00 0.53738 S 107,476.78 4 $ 200,000.00 0.43690 S 87,379.50 5 $ 200,000.00 0.35520 S 71.040.24 6 $ 200,000.00 0.28878 S 57.756.30 NPV (sum of present value of cash flows) $ (381,549.11) Thus, NPV of Thomas is $381,549.11. PV factor- 1/1.23) year PV factor- 1/(1.23)"year (500,000.00) 40,650.41 165.245.55 188.084.37 (106,019.67) Present value of cash flow-(Cash flow "PV factor)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock