Question: please explain without using excel a. A corporate treasurer decides to purchase a 20-year Treasury bonds with a 4 percent coupon rate. The current market

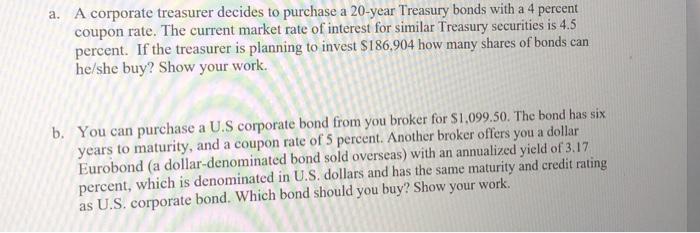

a. A corporate treasurer decides to purchase a 20-year Treasury bonds with a 4 percent coupon rate. The current market rate of interest for similar Treasury securities is 4.5 percent. If the treasurer is planning to invest $186,904 how many shares of bonds can he/she buy? Show your work. b. You can purchase a U.S corporate bond from you broker for $1.099,50. The bond has six years to maturity, and a coupon rate of 5 percent. Another broker offers you a dollar Eurobond (a dollar-denominated bond sold overseas) with an annualized yield of 3.17 percent, which is denominated in U.S. dollars and has the same maturity and credit rating as U.S. corporate bond. Which bond should you buy? Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts