Question: Please explain your answer as much as possible for better understanding Initial equipment cost = $ 100,000 Market value at the end of 6 years

Please explain your answer as much as possible for better understanding

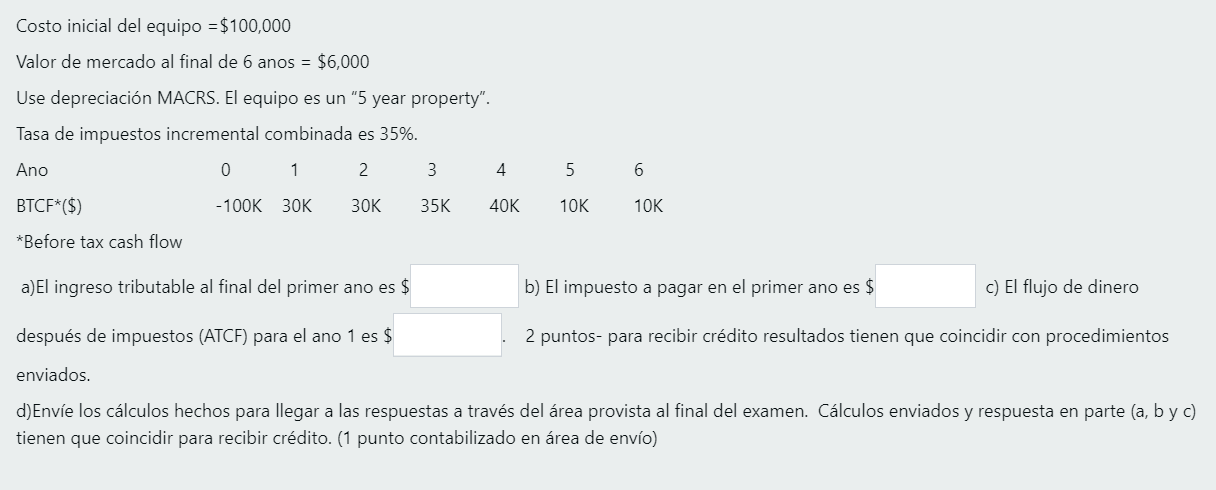

Initial equipment cost = $ 100,000 Market value at the end of 6 years = $ 6,000 Use MACRS depreciation. The team is a 5 year property. Combined Incremental Tax Rate is 35%. Year 0 1 2 3 4 5 6 BTCF * ($) -100K 30K 30K 35K 40K 10K 10K * Before tax cash flow a) Taxable income at the end of the first year is $ Answer b) The tax to pay in the first year is $ Answer c) The after tax cash flow (ATCF) for year 1 is $ Answer

Costo inicial del equipo = $100,000 Valor de mercado al final de 6 anos = $6,000 Use depreciacin MACRS. El equipo es un "5 year property". Tasa de impuestos incremental combinada es 35%. Ano 0 1 2 3 4. 5 6 -100K 30K 30K 35K 40K 10K 10K BTCF*($) *Before tax cash flow a)El ingreso tributable al final del primer ano es $ b) El impuesto a pagar en el primer ano es $ c) El flujo de dinero despus de impuestos (ATCF) para el ano 1 es $ 2 puntos- para recibir crdito resultados tienen que coincidir con procedimientos enviados. d) Enve los clculos hechos para llegar a las respuestas a travs del rea provista al final del examen. Clculos enviados y respuesta en parte (a, by c) tienen que coincidir para recibir crdito. (1 punto contabilizado en rea de envo)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts