Question: Please explain your answer. Thank you. > Problems Group A Learning Objectives 1, 3, 4 P4-29A Preparing financial statements including a classified balance sheet in

Please explain your answer. Thank you.

Please explain your answer. Thank you.

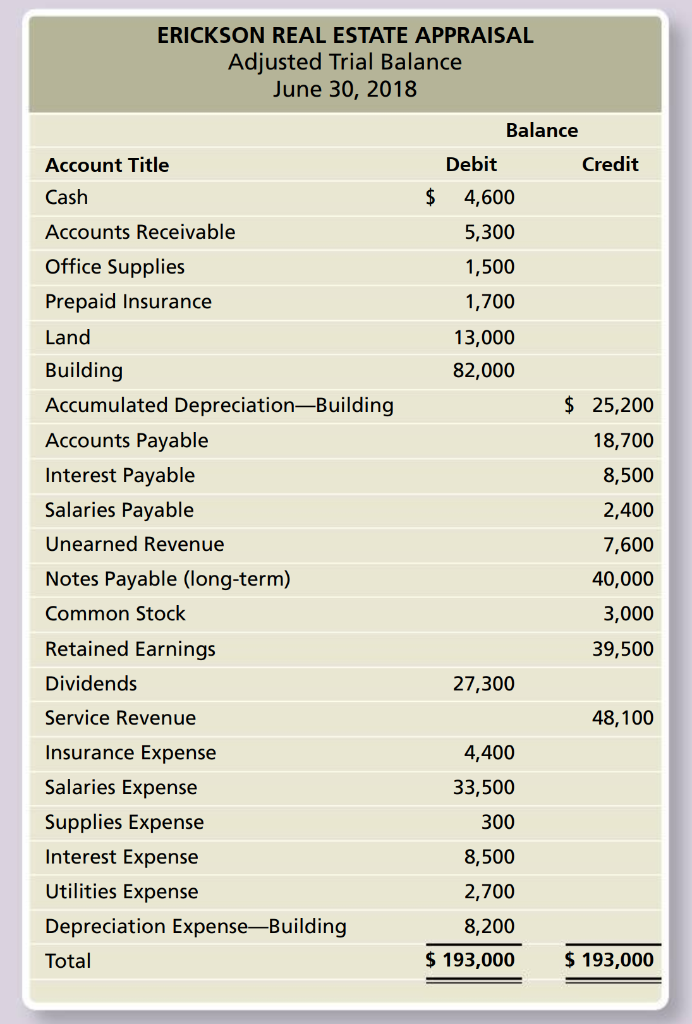

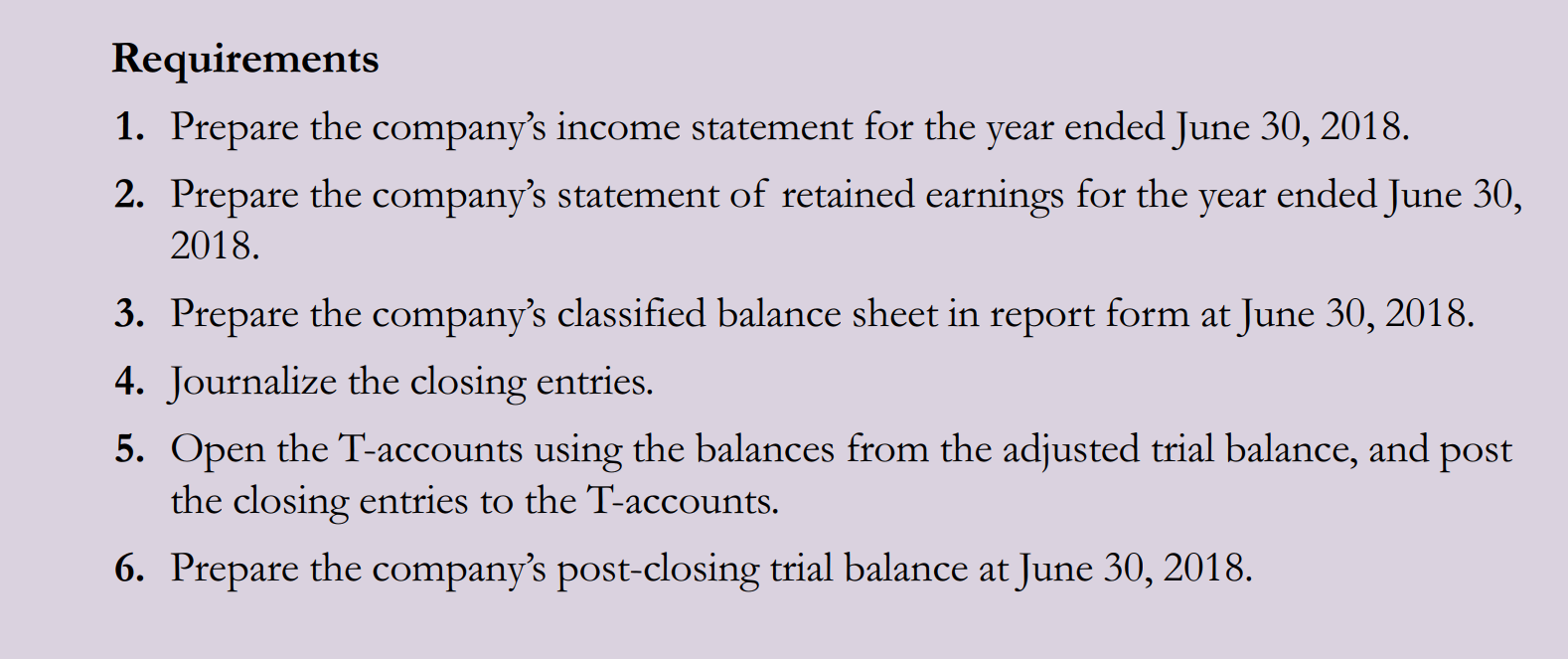

> Problems Group A Learning Objectives 1, 3, 4 P4-29A Preparing financial statements including a classified balance sheet in report form, preparing and posting closing entries, and preparing a post-closing trial balance The adjusted trial balance of Erickson Real Estate Appraisal at June 30, 2018, follows: 1. Net Loss $(9,500) ERICKSON REAL ESTATE APPRAISAL Adjusted Trial Balance June 30, 2018 $ Balance Debit Credit 4,600 5,300 1,500 1,700 13,000 82,000 $ 25,200 18,700 Account Title Cash Accounts Receivable Office Supplies Prepaid Insurance Land Building Accumulated Depreciation-Building Accounts Payable Interest Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Common Stock Retained Earnings Dividends Service Revenue Insurance Expense Salaries Expense Supplies Expense Interest Expense Utilities Expense Depreciation Expense-Building Total 8,500 2,400 7,600 40,000 3,000 39,500 27,300 48,100 4,400 33,500 300 8,500 2,700 8,200 $ 193,000 $ 193,000 Requirements 1. Prepare the company's income statement for the year ended June 30, 2018. 2. Prepare the company's statement of retained earnings for the year ended June 30, 2018. 3. Prepare the company's classified balance sheet in report form at June 30, 2018. 4. Journalize the closing entries. 5. Open the T-accounts using the balances from the adjusted trial balance, and post the closing entries to the T-accounts. 6. Prepare the company's post-closing trial balance at June 30, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts