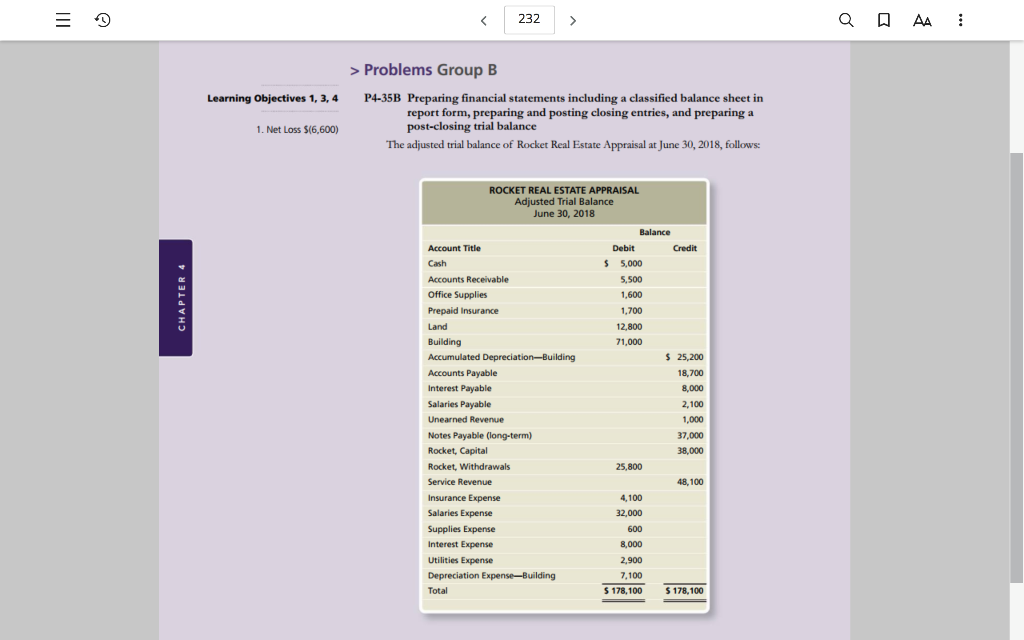

Question: Q AA 232 Problems Group B Learning Objectives 1, 3, 4 P4-35B Preparing financial statements includinga classified balance sheet in report form, preparing and posting

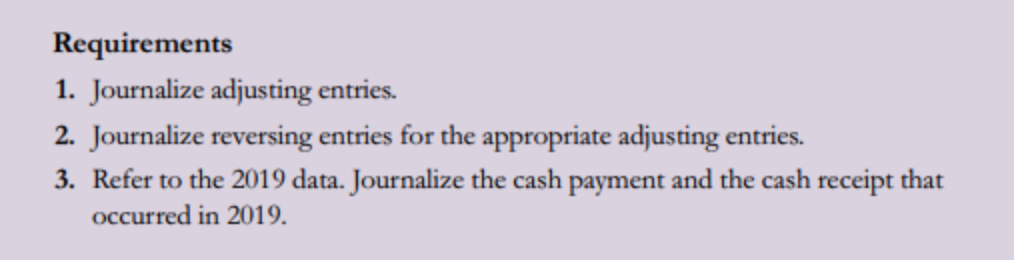

Q AA 232 Problems Group B Learning Objectives 1, 3, 4 P4-35B Preparing financial statements includinga classified balance sheet in report form, preparing and posting closing entries, and preparing a post-closing trial balance 1. Net Loss S(6,600) The adjusted trial balance of Rocket Real Estate Appraisal at June 30, 2018, follows ROCKET REAL ESTATE APPRAISAL Adjusted Trial Balance June 30, 2018 Balance Account Title Debit Credit S 5,000 Cash Accounts Receivable Office Supplies 5,500 1,600 1,700 Prepaid Insurance Land 12,800 Building 71,000 S25,200 Accumulated Depreciation-Building Accounts Payable 18,700 Interest Payable 8,000 Salaries Payable 2,100 Unearned Revenue 1,000 37,000 Notes Payable (long-term) Rocket, Capital 38,000 Rocket, Withdrawals 25,800 Service Revenue 48,100 Insurance Expense 4,100 Salaries Expense 32,000 Supplies Expense 600 Interest Expense 8,000 Utilities Expense 2,900 Depreciation Expense-Building 7,100 Total 178,100 $178,100 CHAPTER 4 Requirements 1. Journalize adjusting entries. 2. Journalize reversing entries for the appropriate adjusting entries. 3. Refer to the 2019 data. Journalize the cash payment and the cash receipt that occurred in 2019 Q AA 232 Problems Group B Learning Objectives 1, 3, 4 P4-35B Preparing financial statements includinga classified balance sheet in report form, preparing and posting closing entries, and preparing a post-closing trial balance 1. Net Loss S(6,600) The adjusted trial balance of Rocket Real Estate Appraisal at June 30, 2018, follows ROCKET REAL ESTATE APPRAISAL Adjusted Trial Balance June 30, 2018 Balance Account Title Debit Credit S 5,000 Cash Accounts Receivable Office Supplies 5,500 1,600 1,700 Prepaid Insurance Land 12,800 Building 71,000 S25,200 Accumulated Depreciation-Building Accounts Payable 18,700 Interest Payable 8,000 Salaries Payable 2,100 Unearned Revenue 1,000 37,000 Notes Payable (long-term) Rocket, Capital 38,000 Rocket, Withdrawals 25,800 Service Revenue 48,100 Insurance Expense 4,100 Salaries Expense 32,000 Supplies Expense 600 Interest Expense 8,000 Utilities Expense 2,900 Depreciation Expense-Building 7,100 Total 178,100 $178,100 CHAPTER 4 Requirements 1. Journalize adjusting entries. 2. Journalize reversing entries for the appropriate adjusting entries. 3. Refer to the 2019 data. Journalize the cash payment and the cash receipt that occurred in 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts