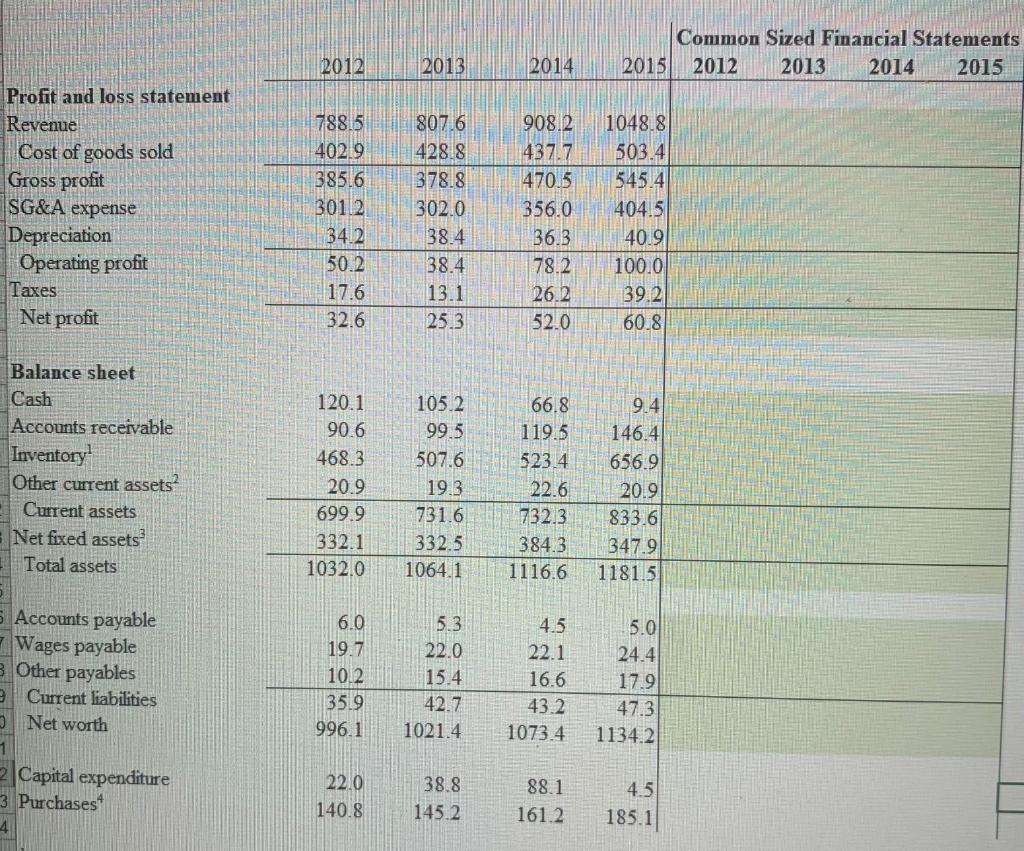

Question: please fill colored blanks and show work Common Sized Financial Statements 2015 2012 2013 2014 2015 2012 2013 2014 Profit and loss statement Revenue Cost

please fill colored blanks and show work

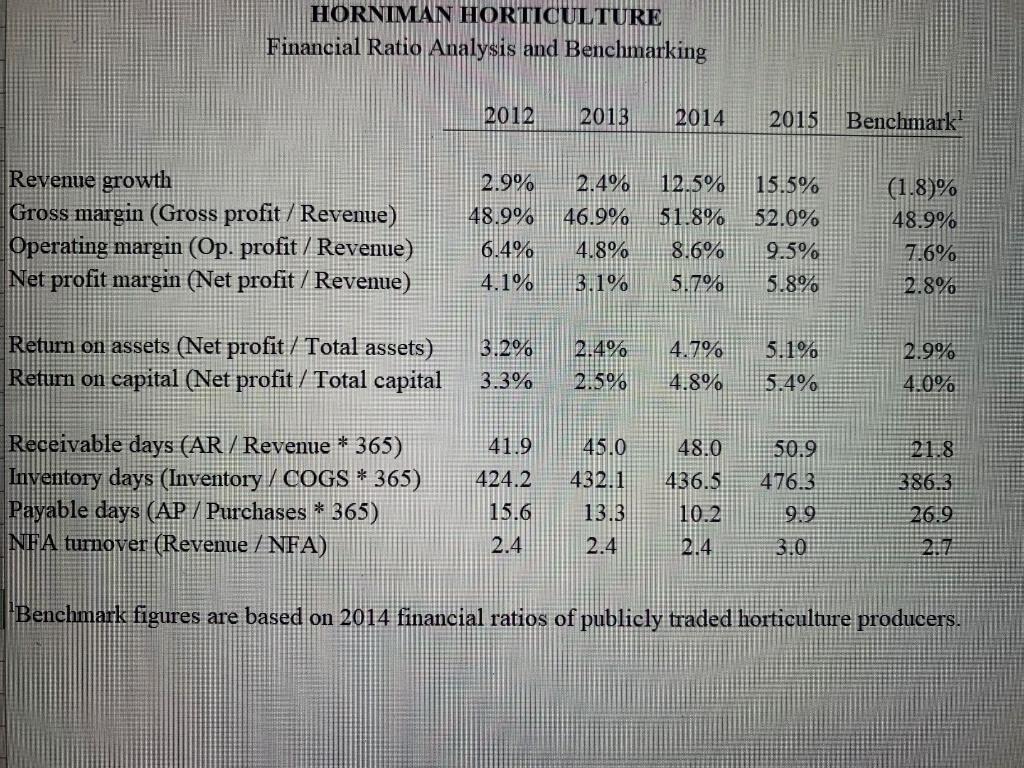

Common Sized Financial Statements 2015 2012 2013 2014 2015 2012 2013 2014 Profit and loss statement Revenue Cost of goods sold Gross profit SG&A expense Depreciation Operating profit Taxes Net profit 78815 40219 385.6 30112 34.2 50.2 17.6 807.6 428.8 378.8 302.0 38.4 38.4 13.1 25.3 908.2 437.7 470.5 356.0 36.3 78.2 26.2 52.0 1048.8 503.4 545.4 404.5 40.9 100.0 39.2 60.8 32.6 Balance sheet Cash Accounts receivable Inventory Other current assets? Current assets Net fixed assets Total assets 120.1 90.6 468.3 20.9 699.9 332.1 1032.0 105.2 99.5 507.6 19.3 731.6 332.5 1064.1 66.8 119.5 523.4 22.6 732.3 384.3 1116.6 9.4 146.4 656.9 20.9 833.6 347.9 1181.5 5 Accounts payable Wages payable Other payables Current liabilities 3 Net worth 6.0 19.7 10.2 35.9 996.1 5.3 22.0 15.4 42.7 1021.4. 4.5 22.1 16.6 43.2 1073.4 5.0 24.4 17.9 47.3 1134.2 2 Capital expenditure 3 Purchases 4 22.0 140.8 38.8 145.2 88.1 161.2 4.5 185.1 HORNIMAN HORTICULTURE Financial Ratio Analysis and Benchmarking 2012 2013 2014 2015 Benchmark Revenue growth Gross margin (Gross profit / Revenue) Operating margin (Op. profit / Revenue) Net profit margin (Net profit / Revenue) 2.9% 48.9% 6.4% 4.1% 2.4% 46.9% 4.8% 3.1% 12.5% 51.8% 8.6% 5.7% 15.5% 52.0% 9.5% 5.8% (1.8)% 48.9% 7.6% 2.8% 3.2% Return on assets (Net profit / Total assets) Return on capital (Net profit / Total capital 2.4% 2.5% 4.7% 4.8% 5.1% 5.4% 2.9% 4.0% 3.3% Receivable days (AR / Revenue * 365) Inventory days (Inventory / COGS * 365) Payable days (AP / Purchases * 365) NFA turnover (Revenue / NFA) 41.9 424.2 15.6 2.4 45.0 432.1 13.3 2.4 48.0 436.5 10.2 2.4 50.9 476.3 9.9 3.0 21.8 386.3 26.9 2.7 Benchmark figures are based on 2014 financial ratios of publicly traded horticulture producers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts