Question: please fill in all and show work and please fast 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

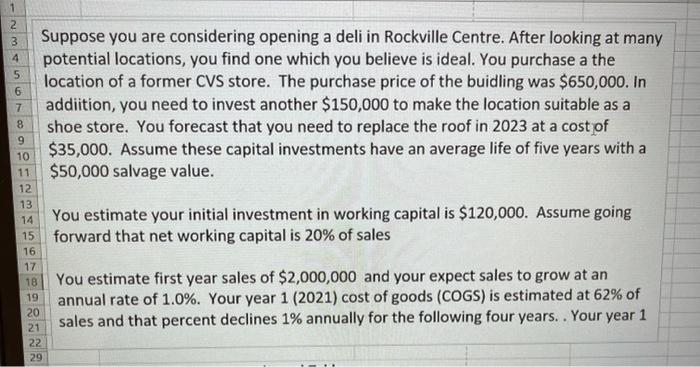

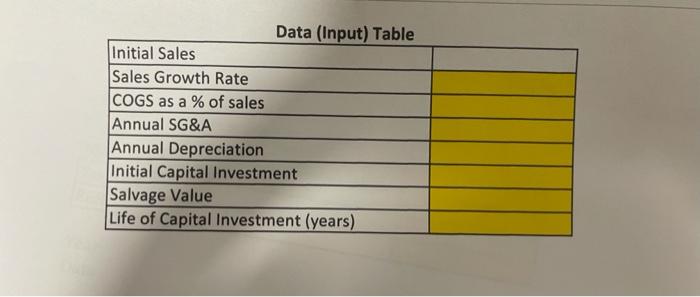

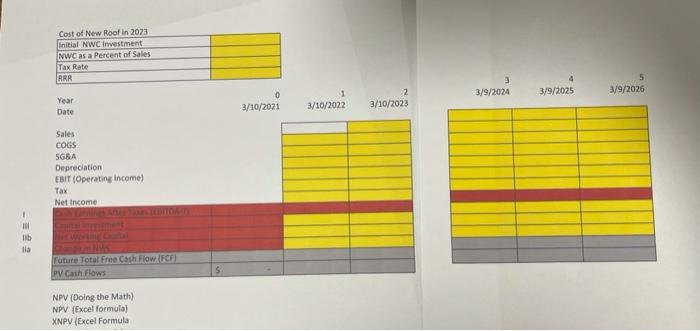

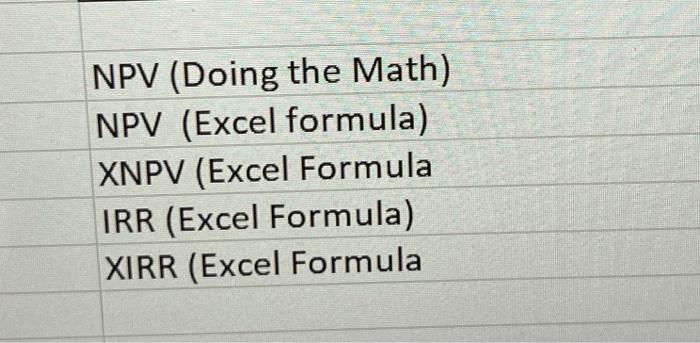

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 29 Suppose you are considering opening a deli in Rockville Centre. After looking at many potential locations, you find one which you believe is ideal. You purchase a the location of a former CVS store. The purchase price of the buidling was $650,000. In addition, you need to invest another $150,000 to make the location suitable as a shoe store. You forecast that you need to replace the roof in 2023 at a cost of $35,000. Assume these capital investments have an average life of five years with a $50,000 salvage value. You estimate your initial investment in working capital is $120,000. Assume going forward that net working capital is 20% of sales You estimate first year sales of $2,000,000 and your expect sales to grow at an annual rate of 1.0%. Your year 1 (2021) cost of goods (COGS) is estimated at 62% of sales and that percent declines 1% annually for the following four years.. Your year 1 Data (Input) Table Initial Sales Sales Growth Rate COGS as a % of sales Annual SG&A Annual Depreciation Initial Capital Investment Salvage Value Life of Capital Investment (years) Cost of New Roof in 2023 Initial NWC Investment NWC as a Percent of Sales Tax Rate RRR 5 3/9/2026 3/9/2024 3/9/2025 Year Date 0 3/10/2021 1 3/10/2022 2 3/10/2023 Sales COGS SGSA Depreciation EBIT (Operating income) Tax Net Income lib lia Future Total Free Cash Flow (FCF Ipv Cash Flows 5 NPV (Doing the Math) NPV (Excel formula) XNPV (Excel Formula NPV (Doing the Math) NPV (Excel formula) XNPV (Excel Formula IRR (Excel Formula) XIRR (Excel Formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts