Question: Please fill in blank with the RIGHT answer after you double check the work. Thanks Problem 2: Your firm recently purchased an industrial machine costing

Please fill in blank with the RIGHT answer after you double check the work. Thanks

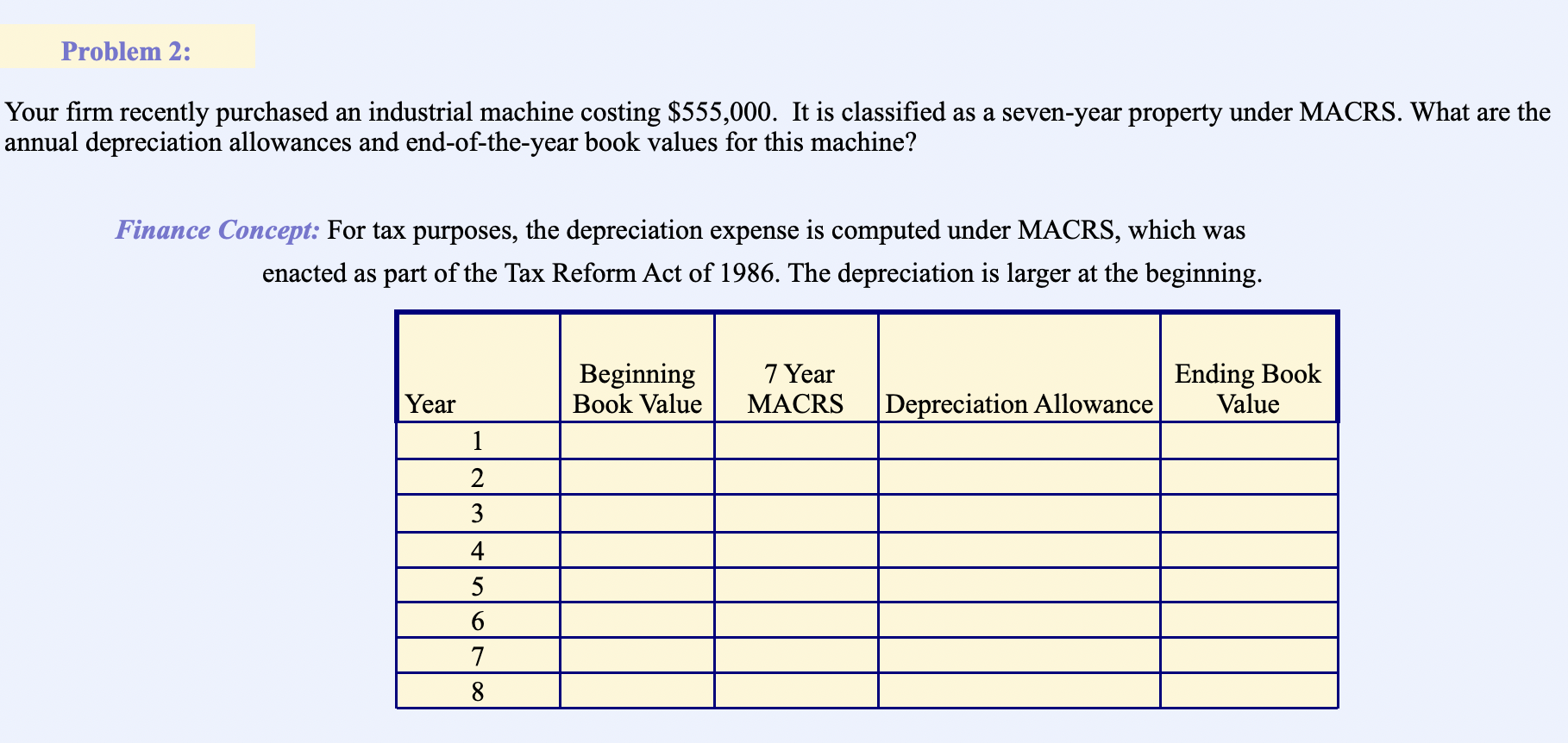

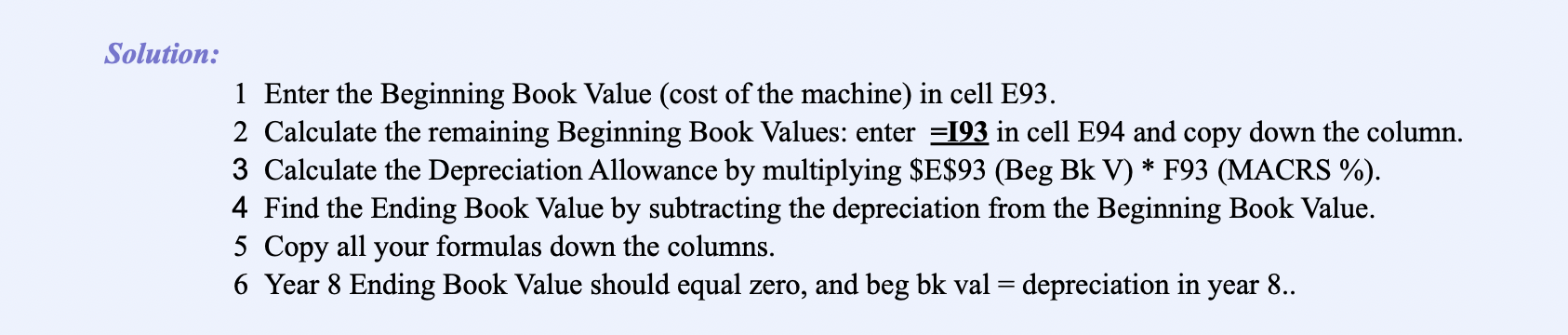

Problem 2: Your firm recently purchased an industrial machine costing $555,000. It is classified as a seven-year property under MACRS. What are the annual depreciation allowances and end-of-the-year book values for this machine? Finance Concept: For tax purposes, the depreciation expense is computed under MACRS, which was enacted as part of the Tax Reform Act of 1986. The depreciation is larger at the beginning. Beginning Book Value 7 Year MACRS Ending Book Value Year Depreciation Allowance 1 2 3 4 5 6 7 8 Solution: 1 Enter the Beginning Book Value (cost of the machine) in cell E93. 2 Calculate the remaining Beginning Book Values: enter =193 in cell E94 and copy down the column. 3 Calculate the Depreciation Allowance by multiplying $E$93 (Beg Bk V) * F93 (MACRS %). 4 Find the Ending Book Value by subtracting the depreciation from the Beginning Book Value. 5 Copy all your formulas down the columns. 6 Year 8 Ending Book Value should equal zero, and beg bk val = depreciation in year 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts