Question: Please fill in blank with the RIGHT answer after you double check the work. Thanks Problem 2: Finding the NPV with Incremental Cash Flows. LLL

Please fill in blank with the RIGHT answer after you double check the work. Thanks

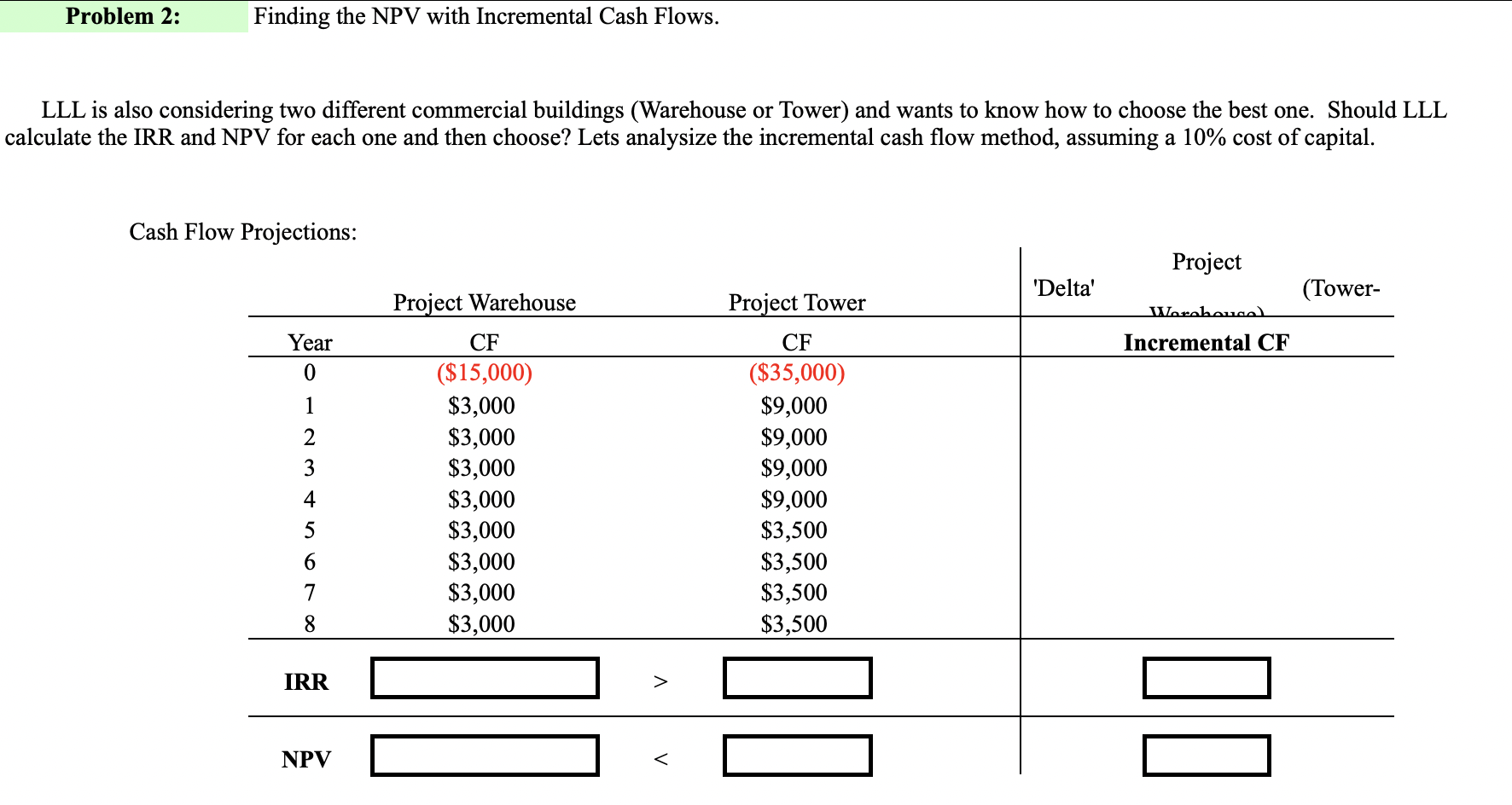

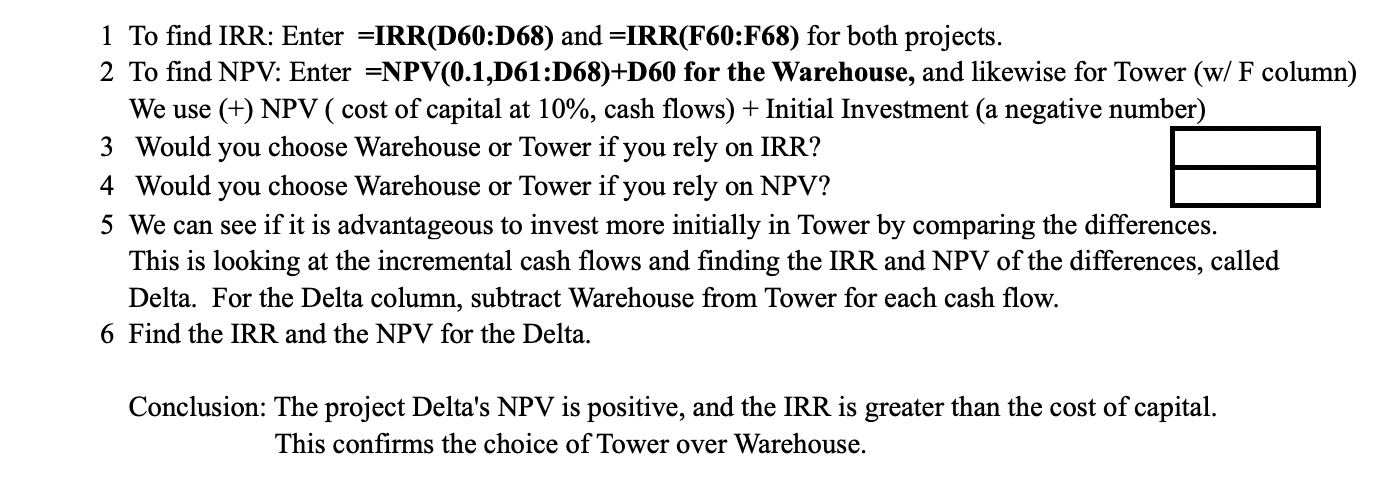

Problem 2: Finding the NPV with Incremental Cash Flows. LLL is also considering two different commercial buildings (Warehouse or Tower) and wants to know how to choose the best one. Should LLL calculate the IRR and NPV for each one and then choose? Lets analysize the incremental cash flow method, assuming a 10% cost of capital. Cash Flow Projections: Project 'Delta' (Tower- Warehouse Incremental CF Year 0 1 2 3 4 Project Warehouse CF ($15,000) $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Project Tower CF ($35,000) $9,000 $9,000 $9,000 $9,000 $3,500 $3,500 $3,500 $3,500 5 6 7 8 IRR 00 TD 00 NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts