Question: Please fill in boxes with missing ratios. Also include cell formula used from financial statements. File Home Insert Draw Page Layout Formulas Data Review View

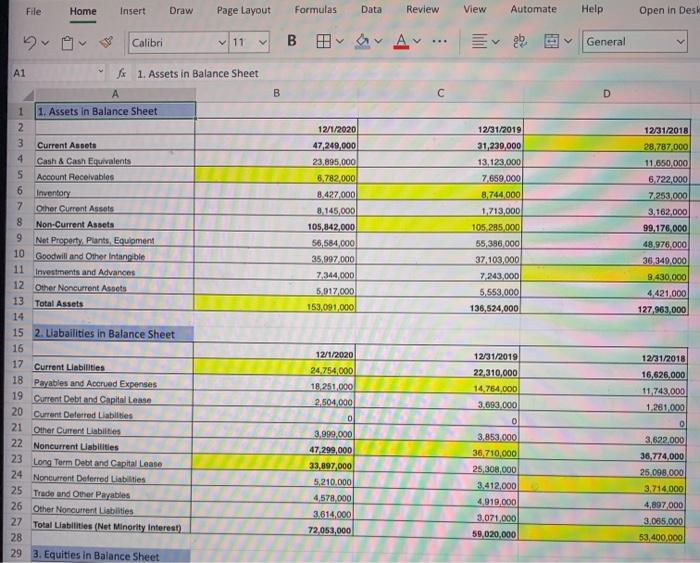

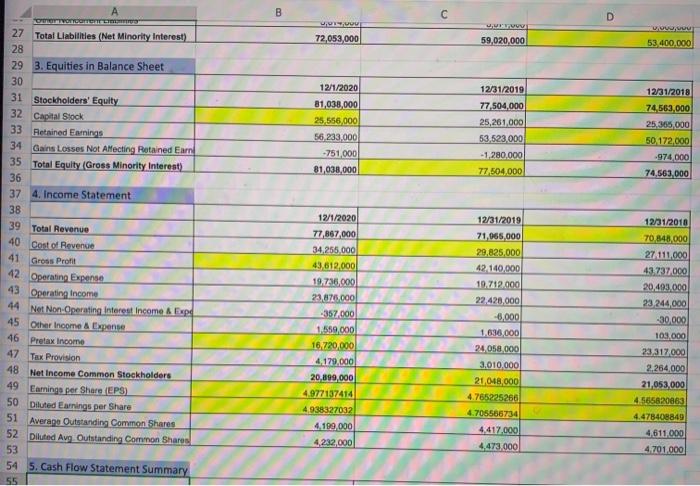

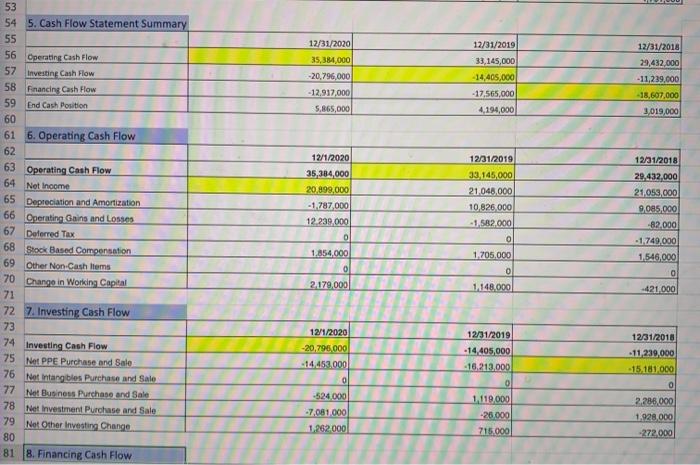

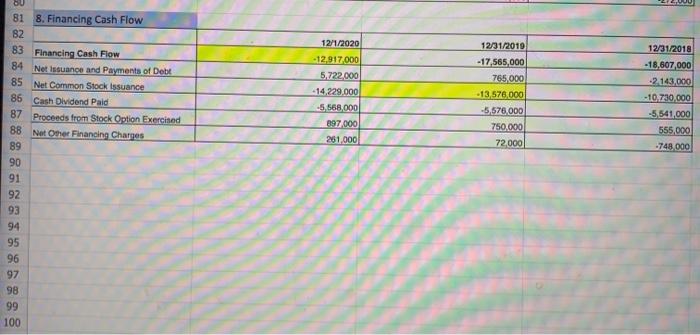

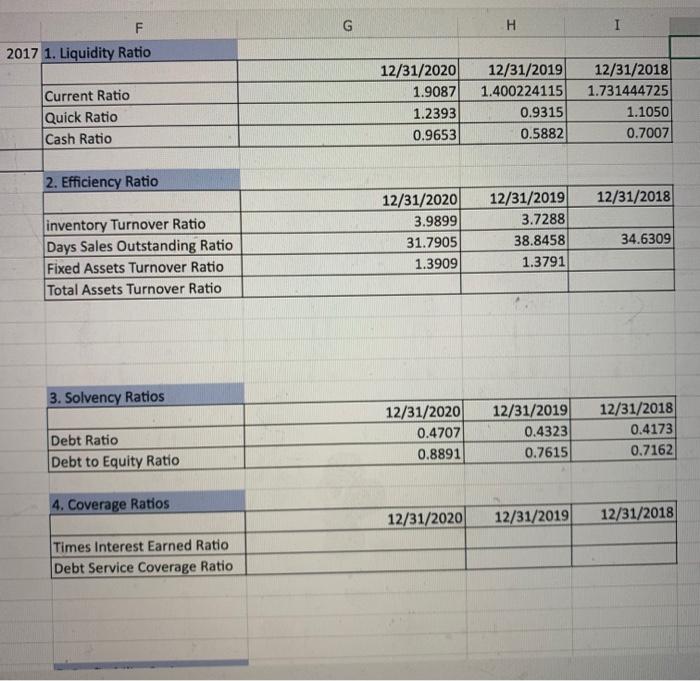

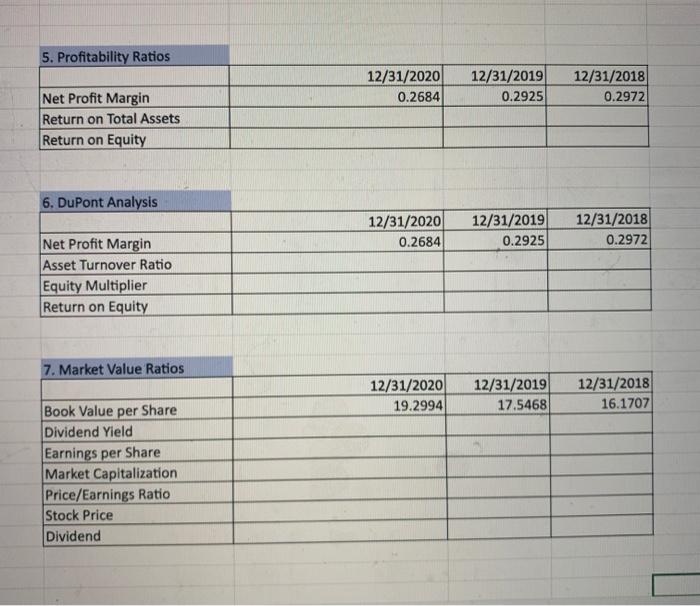

File Home Insert Draw Page Layout Formulas Data Review View Automate Help Open in Desh Calibri v 11 v ... B BOYA V 2 BGeneral A1 fx 1. Assets in Balance Sheet A B c D 12/31/2019 12/31/2018 28.787.000 11.650.000 6722,000 12/1/2020 47,249,000 23,895,000 6.782.000 8.427 000 8.145,000 105,842,000 56,584,000 35,997 000 7.344.000 5.917.000 153,091,000 31,230,000 13,123,000 7659,000 8.744 000 1,713,000 105,285,000 55,386,000 7253.000 3.162.000 99.176.000 48,976,000 36 340,000 9.430,000 4.421,000 127 963.000 37 103.000 7243,000 5.553,000 136,524,000 1 1. Assets in Balance Sheet 2 3 Current Assets 4 Cash & Cash Equivalents S Account Receivables 6 Inventory 7 Other. Current Assets 8 Non-Current Assets 9 Net Property Plants, Equioment 10 Goodwill and Other Intangible 11 Investments and Advances 12 Other Noncurrent Assets 13 Total Assets 14 15 2. Labailities in Balance Sheet 16 17 Current Liabilities 18 Payables and Accrued Expenses 19 Current Debt and Capital Lease 20 Current Deferred Liabilities 21 Other Current Liabilties 22 Noncurrent Liabilities 23 Long Term Debt and Capital Lease 24 Noncurrent Deferred Liabilities 25 Trade and Other Payables 26 Other Noncurrent Liabilities 27 Total Liabilities (Net Minority Interest) 28 29 3. Equities in Balance Sheet 12/31/2019 22,310,000 14.764,000 3.693.000 12/31/2018 16,626.000 11,743,000 1.281.000 0 12/1/2020 24.754,000 18.251.000 2,504,000 0 3.999,000 47,299,000 33,897,000 5,210,000 4,578,000 3.614,000 72,053,000 3.853.000 36 710,000 25,308,000 3.412,000 4,919,000 3.071.000 59,020,000 3,699.000 36,774,000 25.098.000 3.714.000 4,897000 3,085,000 53,400,000 OVOCALISTS B Wou UTOV 72,053,000 59,020,000 UUUU 53 400,000 12/31/2018 12/1/2020 81,038,000 25,556,000 56,233,000 -751 000 81,038,000 12/31/2019 77,504,000 25,261,000 53,523,000 -1,280.000 77 504.000 74,563,000 25.365.000 50 172.000 .974 000 74,563,000 27 Total Liabilities (Net Minority Interest) 28 29 3. Equities in Balance Sheet 30 31 Stockholders' Equity 32 Capital Stock 33 Retained Earnings 34 Gains Losses Not AMecting Retained Earn 35 Total Equity Gross Minority Interest) 36 37 4. Income Statement 38 39 Total Revenue 40 Cost of Reverse 41 Gross Profit 42 Operating Expense 43 Operating Income 44 Net Non-Operating Interest Income A Expg 45 Other Income A Expense 46 Pretax income 47 Tax Provision 48 Net Income Common Stockholders 49 Earnings per Share (EPS) 50 Diluted Earnings per Share 51 Average Outstanding Common Shares 52 Diluted Aug Outstanding Common Shares 53 54 5. Cash Flow Statement Summary 55 12/31/2010 70848,000 27.111.000 43.737.000 20.400.000 23,244,000 12/1/2020 77,867,000 34,255,000 43 612.000 19.726,000 23.875.000 -357.000 1.559.000 16.720,000 4179.000 20,899,000 4.977137414 4938327032 4.199.000 4,232,000 12/31/2019 71,065,000 29.825,000 42 140,000 19.712.000 22,420,000 -65,000 1.635,000 24.058.000 3,010,000 21.048.000 4765225266 4.705566734 4.417.000 -30,000 103,000 23317.000 2.264,000 21,053,000 4.565820863 4.478408849 4611 000 4.701.000 4,473,000 12/31/2020 12/31/2018 29,432,000 35,384,000 -20,796,000 -12.917.000 5,865,000 12/31/2019 33,145,000 -14,405,000 -17,565,000 4,194,000 - 11.239.000 18.607.000 3,019,000 12/1/2020 12/31/2019 33,145,000 53 54 5. Cash Flow Statement Summary 55 56 Operating Cash Flow 57 Investing Cash Flow 58 Financing Cash Flow 59 End Cash Position 60 61 6. Operating Cash Flow 62 63 Operating Cash Flow 64 Net Income 65 Depreciation and Amortization 66 Operating Gains and Losses 67 Deferred Tax 68 Stock Based Compensation 69 Other Non-Cash Items 70 Change in Working Capital 71 72 7. Investing Cash Flow 73 74 Investing Cash Flow 75 Net PPE Purchase and Sale 76 Net Intangibles Purchase and Sale 77 Net Business Purchase and Sale 78 Net investment Purchase and Sale 79 Net Other Investing Change 80 81 8. Financing Cash Flow 21.048.000 10,826,000 -1.582.000 35,384,000 20,899,000 - 1,787,000 12 239,000 0 1.854,000 12/01/2018 29,432,000 21,053,000 9.085.000 82.000 -1.749.000 1,546,000 0 1.705,000 0 0 0 2.179.000 1.148.000 421.000 12/1/2020 -20,796 000 -14.453.000 12/31/2019 -14,405,000 -18.213.000 12/31/2018 -11 239,000 15.181.000 0 o -524.000 -7081000 0 1 119000 -26.000 715.000 2.286.000 1.928,000 -272.000 1,202 000 DU 12/1/2020 12.917.000 5.722.000 -14.229.000 -5.568.000 897000 261.000 12/31/2019 -17,565,000 765,000 13,576,000 -5,578,000 750.000 72,000 12/31/2018 -18.607.000 -2143,000 -10.730.000 -5541,000 555,000 -748.000 81 8. Financing Cash Flow 82 83 Financing Cash Flow 84 Net Issuance and Payments of Debt 85 Net Common Stock issuance 86 Cash Dividend Paid 87 Proceeds from Stock Option Exercised 88 Net Other Financing Charges 89 90 91 92 93 94 95 96 97 98 99 100 F G H I 2017 1. Liquidity Ratio Current Ratio Quick Ratio Cash Ratio 12/31/2020 1.9087 1.2393 0.9653 12/31/2019 1.400224115 0.9315 0.5882 12/31/2018 1.731444725 1.1050 0.7007 2. Efficiency Ratio 12/31/2018 12/31/2020 3.9899 31.7905 1.3909 inventory Turnover Ratio Days Sales Outstanding Ratio Fixed Assets Turnover Ratio Total Assets Turnover Ratio 12/31/2019 3.7288 38.8458 1.3791 34.6309 3. Solvency Ratios 12/31/2020 0.4707 0.8891 12/31/2019 0.4323 0.7615 12/31/2018 0.4173 0.7162 Debt Ratio Debt to Equity Ratio 4. Coverage Ratios 12/31/2020 12/31/2019 12/31/2018 Times Interest Earned Ratio Debt Service Coverage Ratio 5. Profitability Ratios 12/31/2020 0.2684 12/31/2019 0.2925 12/31/2018 0.2972 Net Profit Margin Return on Total Assets Return on Equity 6. DuPont Analysis 12/31/2020 0.2684 12/31/2019 0.2925 12/31/2018 0.2972 Net Profit Margin Asset Turnover Ratio Equity Multiplier Return on Equity 7. Market Value Ratios 12/31/2020 19.2994 12/31/2019 17.5468 12/31/2018 16.1707 Book Value per Share Dividend Yield Earnings per Share Market Capitalization Price/Earnings Ratio Stock Price Dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts