Question: Please fill in each open box worth 2 points 1-Fill in the percent and ratios to show the financial performance for Urban Outfitters for 2017

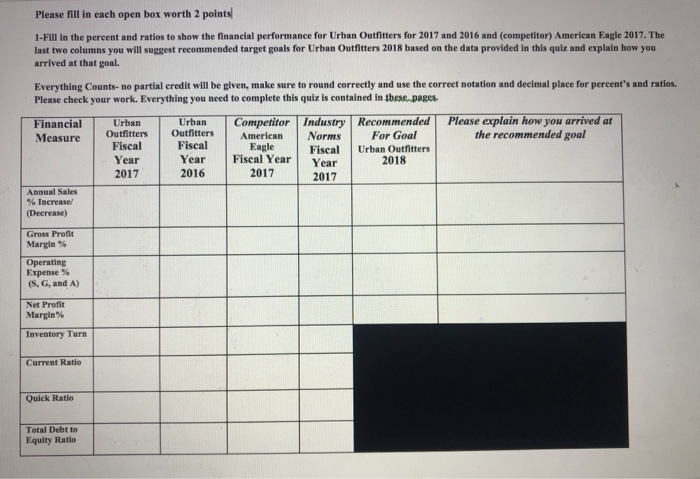

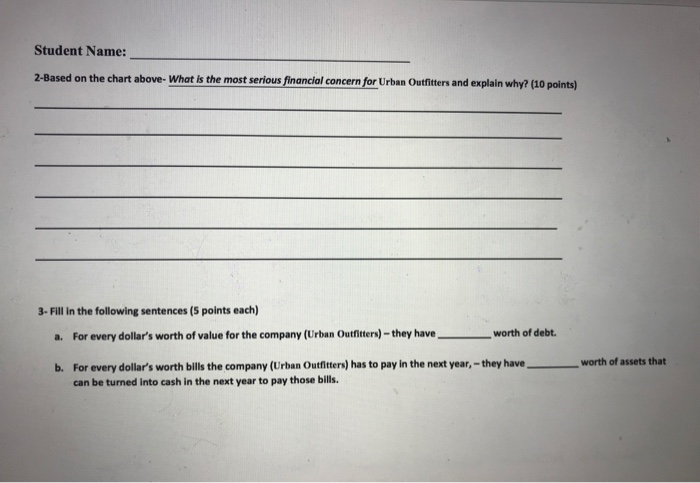

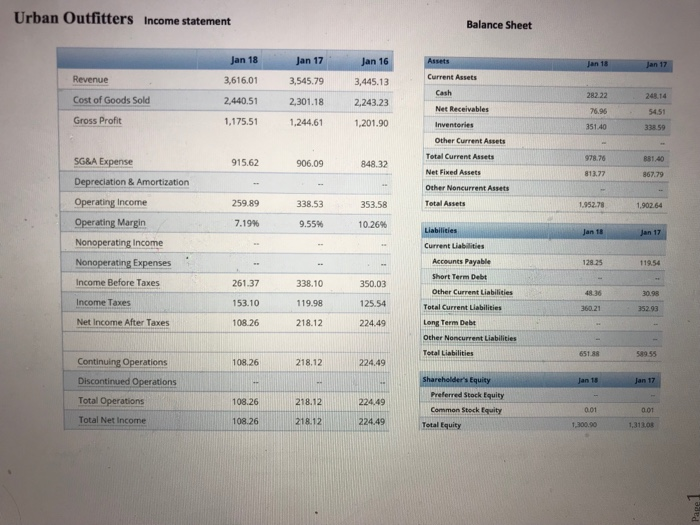

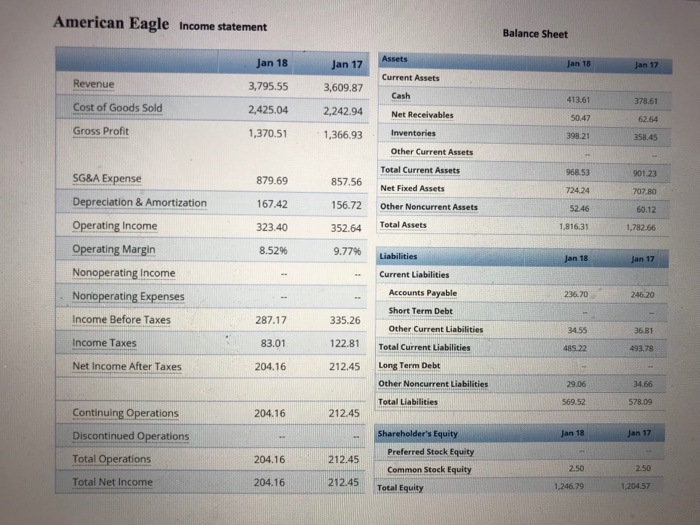

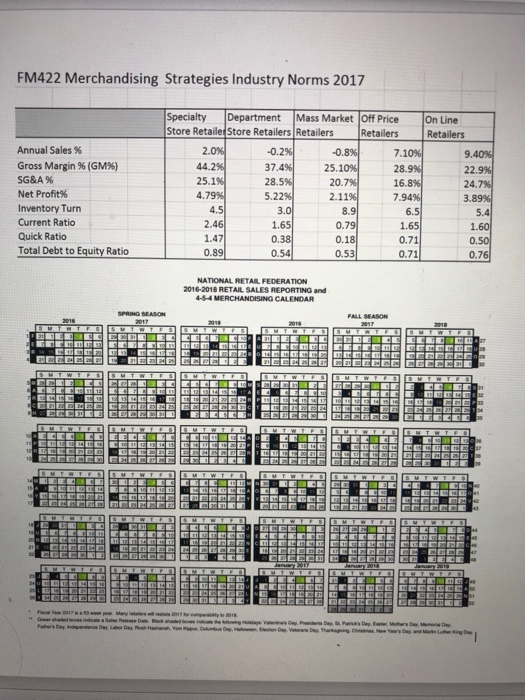

Please fill in each open box worth 2 points 1-Fill in the percent and ratios to show the financial performance for Urban Outfitters for 2017 and 2016 and (competitor) American Eagle 2017. The last two columns you will suggest recommended target goals for Urban Outfitters 2018 based on the data provided in this quiz and explain how you arrived at that goal. Everything Counts- no partial credit will be given, make sure to round correctly and use the correct notation and decimal place for percent's and ratios. Please check your work. Everything you need to complete this quiz is contained in tbess.pages Financial Urban Urban-T Competitor Industry Recommended Please explain how you arrived at Measure OutfittersOutfitters American Norms For Goal the recommended goal Fiscal Fiscal Year 2017 Eagle Year Fiscal Year Year 2017 Fiscal Urban Outfitters 2018 2016 2017 Annual Sales % Increase/ Decrease) Gross Profit Margin % Expense % (S, G, and A) Net Profit Margin % Inventory Turn Current Ratio Quick Ratio Total Debt to Equity Ratio Student Name: 2-Based on the chart above- What is the most serious financial concern for Urban Outfiters and explain why? (10 points) 3- Fill in the following sentences (5 points each) worth of debt. a. For every dollar's worth of value for the company (Urban Outfitters)-they have b. For every dollar's worth bills the company (Urban Outiters) has to pay in the next year,-they haveworth of assets that can be turned into cash in the next year to pay those bills. Urban Outfitters Income statement Balance Sheet Jan 18Jan 17Jan 16 3,445.13 2,440.51 230.18 2,243.23 1,201.90 Jan 18Jan 17 Current Assets Revenue Cost of Goods Sold Gross Profit 3,616.01 3,545.79 248 14 Net Receivables 76.96 54.51 1,175.511,244.61 Inventories 351.40 Other Current Assets Total Current Assets Net Fixed Assets Other Noncurrent Assets Total Assets 978.76 881.40 SG&A Expense Depreciation & Amortization Operating Income Operating Margin Nonoperating income Nonoperating Expenses Income Before Taxes Income Taxes Net Income After Taxes 915.62 906.09 848.32 813.77 867.79 259.89 338.53 53.58 1952.78 1,90264 7.19% 9.55% 1 0.26% Current Liabilities Accounts Payable 128.25 119.54 Short Term Debt 261.37 53.10 108.26 338.10 19.98 218.12 350.03 125.54 224.49 Other Current Liabilities Total Current Liabilitiets Long Term Debt Other Noncurrent Liabilities Total Liabilities 30.98 360.21 352.93 651.88 58955 Continuing Operations Discontinued Operations Total Operations Total Net Income 108.26 218.12 224.49 s Equity 108.26218.122244 108.26 Preferred Stock Equity Common Steck Equity 001 0.01 21812 224.49 Total Equity 1,300.90 1,31 1308 American Eagle Income statement Balance Sheet an 18 3,795.55 2,425.04 2,242.94 Net Receivables 1,370.51 Jan 17 Jan 18 Current Assets Revenue Cost of Goods Sold Gross Profit 3,609.87 413.61 50.47 398.21 378.61 1,366.93Inventories 358.45 Other Current Assets Total Current Assets 968.53 901.23 07.80 60.12 1,782.66 SG&A Expense Depreciation & Amortization Operating Income Operating Margin Nonoperating Income Nonoperating Expenses Income Before Taxes Income Taxes Net Income After Taxes 879.69 167.42 323.40 85296 857.56 Net Fixed Assets 156.72 Other Noncurrent Assets 352.64 Total Assets 9.77% Liabilities 724.24 1,816.31 Current Liabilities Accounts Payable 236.70 246.20 Short Term Debt 287.17 83.01 204.16 335.26 other Current Liabilities 122.81 Total Current Liabilities 212.45 Long Term Debt 36.81 485.22 493.78 Other Noncurrent Liabilities 34.66 Total Liabilities 569.52 578.09 Continuing Operations Discontinued Operations Total Operations Total Net Income 204.16 212.45 .. Shareholder's Equity an 17 Preferred Stock Equity Common Stock Equity 204.16 212.45 2.50 2.50 204.16 212.45 Total Equity 1,246.79 FM422 Merchandising Strategies Industry Norms 2017 Specialty Department Mass Market Off Price On Line Store Retailer Store Retailers Retailers Gross Margin % (GM96) 1.65 Total Debt to Equity Ratio NATIONAL RETAFEDERATION

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts