Question: Please fill in empty spaces and include formulas used in excel (including Initial Margin %, Cost of Loan, Return %, and Margin Call Price). Suppose

Please fill in empty spaces and include formulas used in excel (including Initial Margin %, Cost of Loan, Return %, and Margin Call Price).

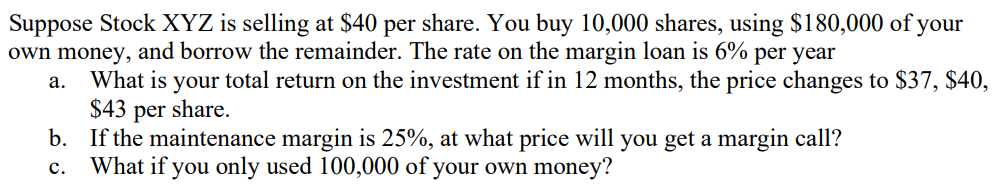

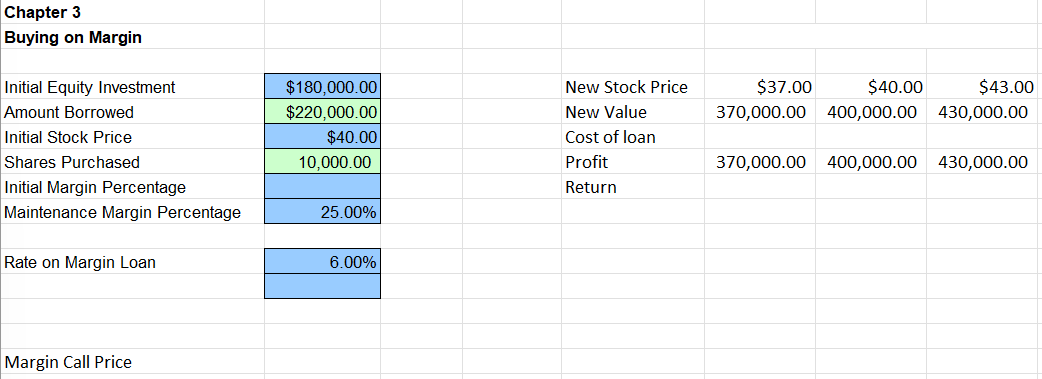

Suppose Stock XYZ is selling at $40 per share. You buy 10,000 shares, using $180,000 of your own money, and borrow the remainder. The rate on the margin loan is 6% per year a. What is your total return on the investment if in 12 months, the price changes to $37,$40, $43 per share. b. If the maintenance margin is 25%, at what price will you get a margin call? c. What if you only used 100,000 of your own money? Chapter 3 Buying on Margin Initial Equity Investment Amount Borrowed Initial Stock Price Shares Purchased Initial Margin Percentage \begin{tabular}{|r|} \hline$180,000.00 \\ \hline$220,000.00 \\ \hline$40.00 \\ \hline 10,000.00 \\ \hline 25.00% \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline New Stock Price & $37.00 & $40.00 & $43.00 \\ \hline New Value & 370,000.00 & 400,000.00 & 430,000.00 \\ \hline Cost of loan & & & \\ \hline Profit & 370,000.00 & 400,000.00 & 430,000.00 \\ \hline Return & & & \\ \hline \end{tabular} Rate on Margin Loan \begin{tabular}{|r|} \hline 6.00% \\ \hline \end{tabular} Margin Call Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts