Question: Please fill in every blank! Not looking for a copy and paste of an answer that is already out there. Thank you. Sharon Slotten purchased

Please fill in every blank!

Not looking for a copy and paste of an answer that is already out there.

Thank you.

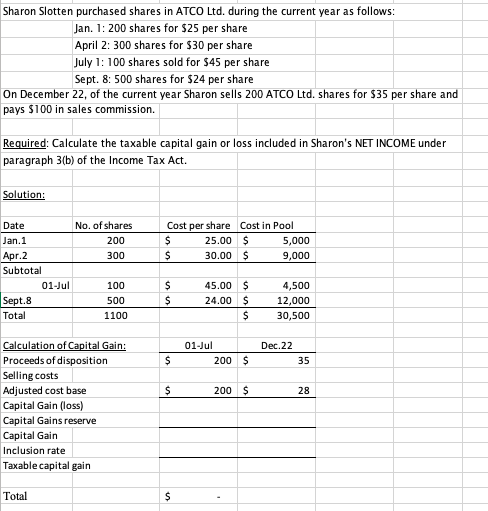

Sharon Slotten purchased shares in ATCO Ltd. during the current year as follows: Jan. 1: 200 shares for $25 per share April 2: 300 shares for $30 per share July 1: 100 shares sold for $45 per share Sept. 8: 500 shares for $24 per share On December 22, of the current year Sharon sells 200 ATCO Ltd. shares for $35 per share and pays $100 in sales commission Required: Calculate the taxable capital gain or loss included in Sharon's NET INCOME under paragraph 3(b) of the Income Tax Act. Solution: No. of shares 200 300 Cost per share Costin Pool $ 25.00 $ 5,000 $ 30.00 $ 9,000 Date Jan. 1 Apr.2 Subtotal 01-Jul Sept.8 Total 100 500 1100 $ $ 45.00 $ 24.00 $ $ 4,500 12,000 30,500 Dec.22 01-Jul 200 $ $ 35 $ 200 $ 28 Calculation of Capital Gain: Proceeds of disposition Selling costs Adjusted cost base Capital Gain (loss) Capital Gains reserve Capital Gain Inclusion rate Taxable capital gain Total $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts