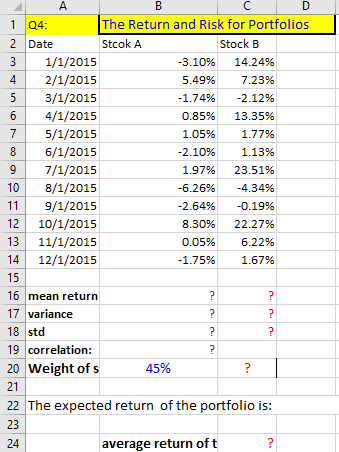

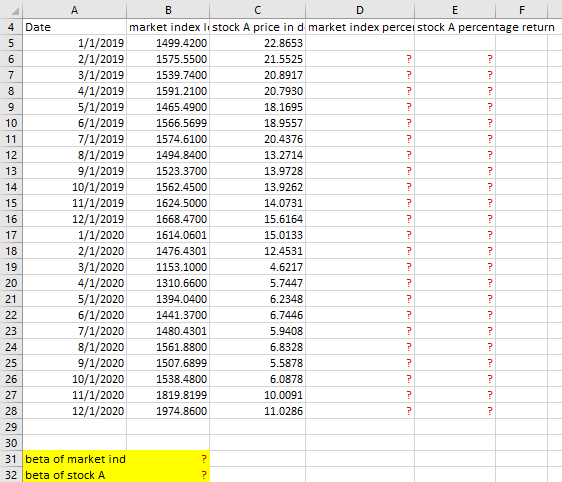

Question: Please fill in red qeustion marks with excel formulas. Please leave cell number/letters as is. Thank You! WN 4 5 B C D 1 04:

Please fill in red qeustion marks with excel formulas. Please leave cell number/letters as is. Thank You!

WN 4 5 B C D 1 04: The Return and Risk for Portfolios 2 Date Stcok A Stock B 3 1/1/2015 -3.10% 14.24% 4 2/1/2015 5.49% 7.23% 3/1/2015 -1.74% -2.12% 6 4/1/2015 0.85% 13.35% 7 5/1/2015 1.05% 1.77% 8 6/1/2015 -2.10% 1.13% 9 7/1/2015 1.97% 23.51% 10 8/1/2015 -6.26% -4.34% 11 9/1/2015 -2.64% -0.19% 12 10/1/2015 8.30% 22.27% 13 11/1/2015 0.05% 6.22% 14 12/1/2015 -1.75% 1.67% 15 16 mean return ? ? 17 variance ? ? 18 std ? ? 19 correlation: ? 20 Weight of s 45% ? 21 22 The expected return of the portfolio is: 23 24 average return oft ? ? 700 B D E F 4 Date market index li stock A price in d market index percei stock A percentage return 1/1/2019 1499.4200 22.8653 2/1/2019 1575.5500 21.5525 ? ? 3/1/2019 1539.7400 20.8917 ? ? 4/1/2019 1591.2100 20.7930 ? ? 5/1/2019 1465.4900 18.1695 ? ? 10 6/1/2019 1566.5699 18.9557 ? ? 11 7/1/2019 1574.6100 20.4376 ? ? 12 8/1/2019 1494.8400 13.2714 ? ? 13 9/1/2019 1523.3700 13.9728 ? ? 14 10/1/2019 1562.4500 13.9262 ? ? 15 11/1/2019 1624.5000 14.0731 ? ? 16 12/1/2019 1668.4700 15.6164 ? ? 17 1/1/2020 1614.0601 15.0133 ? ? 18 2/1/2020 1476.4301 12.4531 ? ? 19 3/1/2020 1153.1000 4.6217 ? ? 20 4/1/2020 1310.6600 5.7447 ? ? 21 5/1/2020 1394.0400 6.2348 ? ? 22 6/1/2020 1441.3700 6.7446 ? ? 23 7/1/2020 1480.4301 5.9408 ? ? 24 8/1/2020 1561.8800 6.8328 ? ? 25 9/1/2020 1507.5899 5.5878 ? ? 26 10/1/2020 1538.4800 6.0878 ? ? 27 11/1/2020 1819.8199 10.0091 ? ? 28 12/1/2020 1974.8600 11.0286 ? ? 29 30 31 beta of market ind ? 32 beta of stock A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts