Question: please fill in spreadsheet thanks!!! Table 2 Projected Cash Flow Statements (In Millions) Depreciation/amortization expense is included in the cost of goods sold, yet it

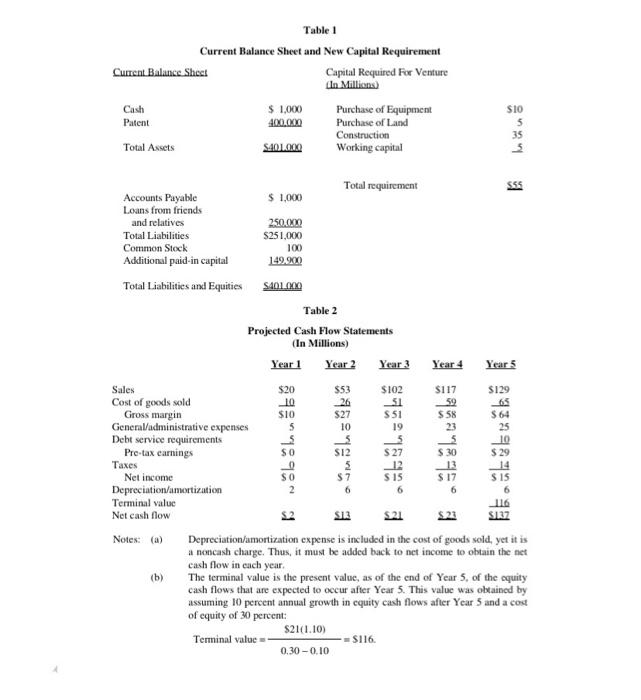

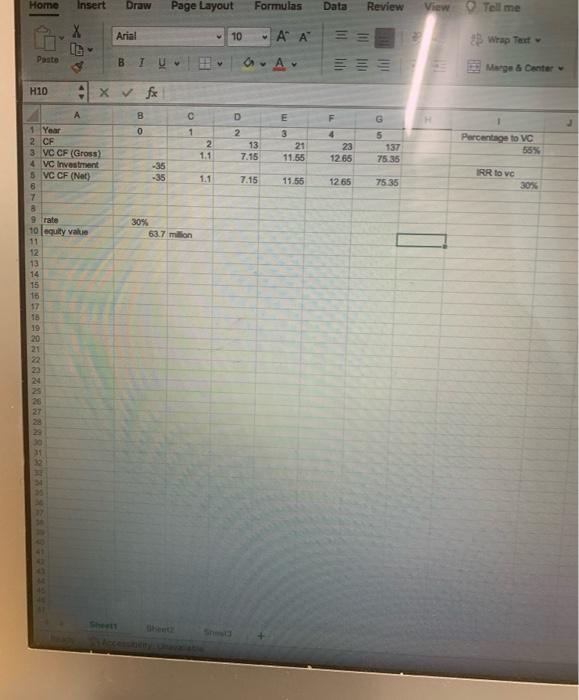

Table 2 Projected Cash Flow Statements (In Millions) Depreciation/amortization expense is included in the cost of goods sold, yet it is a noncash charge. Thus, it must be added back to net income to obtain the net cash flow in each year. The terminal value is the present value, as of the end of Year 5, of the equity cash flows that are expected to oecur after Year 5 . This value was oblained by assuming 10 percent annual growth in equity cash flows after Year 5 and a cost of equity of 30 percent: Terminalvalue=0.300.10$21(1.10)=$116. Table 2 Projected Cash Flow Statements (In Millions) Depreciation/amortization expense is included in the cost of goods sold, yet it is a noncash charge. Thus, it must be added back to net income to obtain the net cash flow in each year. The terminal value is the present value, as of the end of Year 5, of the equity cash flows that are expected to oecur after Year 5 . This value was oblained by assuming 10 percent annual growth in equity cash flows after Year 5 and a cost of equity of 30 percent: Terminalvalue=0.300.10$21(1.10)=$116

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts