Question: Please fill in the blanks in the table using the attached statements. Show all excel formulas. To solve a formula please zoom into the blue

Please fill in the blanks in the table using the attached statements. Show all excel formulas. To solve a formula please zoom into the blue statements below and find the "given" elements. Then make the necessary steps to calculate the rest of the operation. Ex) Debt to Equity Ratio = total debt/total equity. Total equity is given so look for it in the statements, then fill in the rest of the blanks in the equation using previously calculated in past questions.

| Marriott 2021 Ratio Analysis | |||

| Numerator | Denominator | Results | |

| Liquidity Ratios | |||

| Current Ratio | 3626 | 6407 | 0.57 |

| Quick Ratio | 3375 | 6407 | 0.53 |

| 1393 | |||

| 1982 | |||

| OCF to Current Liabilities | 1177 | 6079.5 | 0.19 |

| 6407 | |||

| 5752 | |||

| AR % | calculated | given | calculated |

| Net sales | |||

| Average accounts recievables | |||

| AR Turnover | given | calculated | calculated |

| Average Collection Period | 365 | calculated | calculated |

| Average acounts recievables | |||

| net sales | |||

| Solvency Ratios | |||

| Solvency Ratio | given | calculated | calculated |

| Total Liabilities to Total Assets | calculated | given | calculated |

| Debt Equity Ratio | calculated | given | calculated |

| OCF to Total Liabilities | 1177 | 24205 | 0.05 |

| 2021 total liabilities | 24139 | ||

| 2020 total liabilities | 24271 | ||

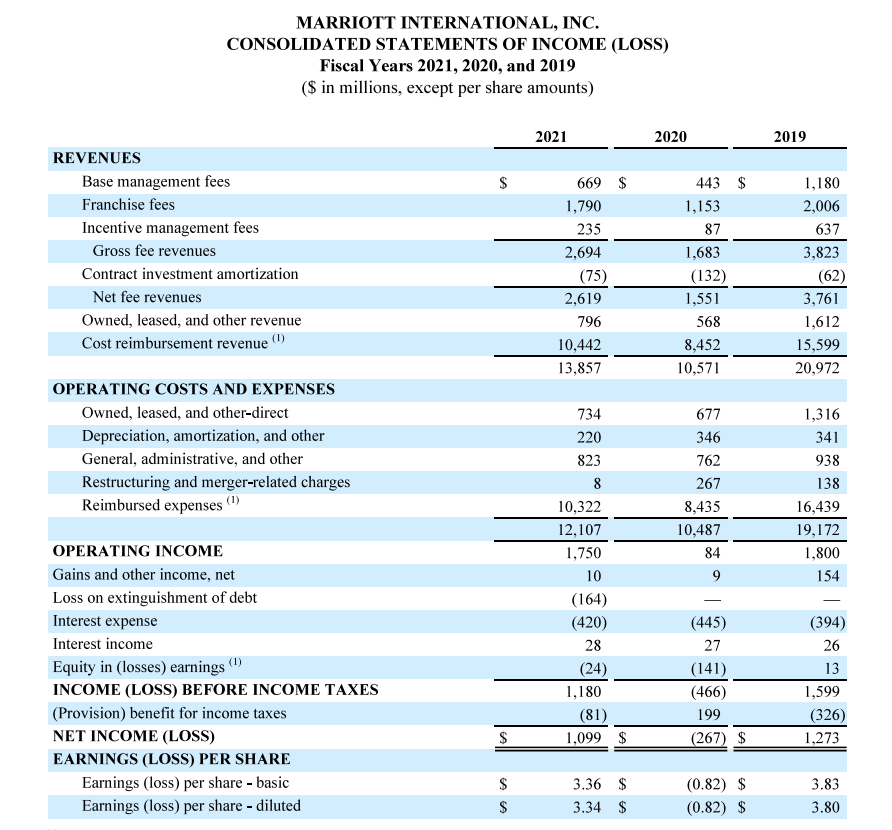

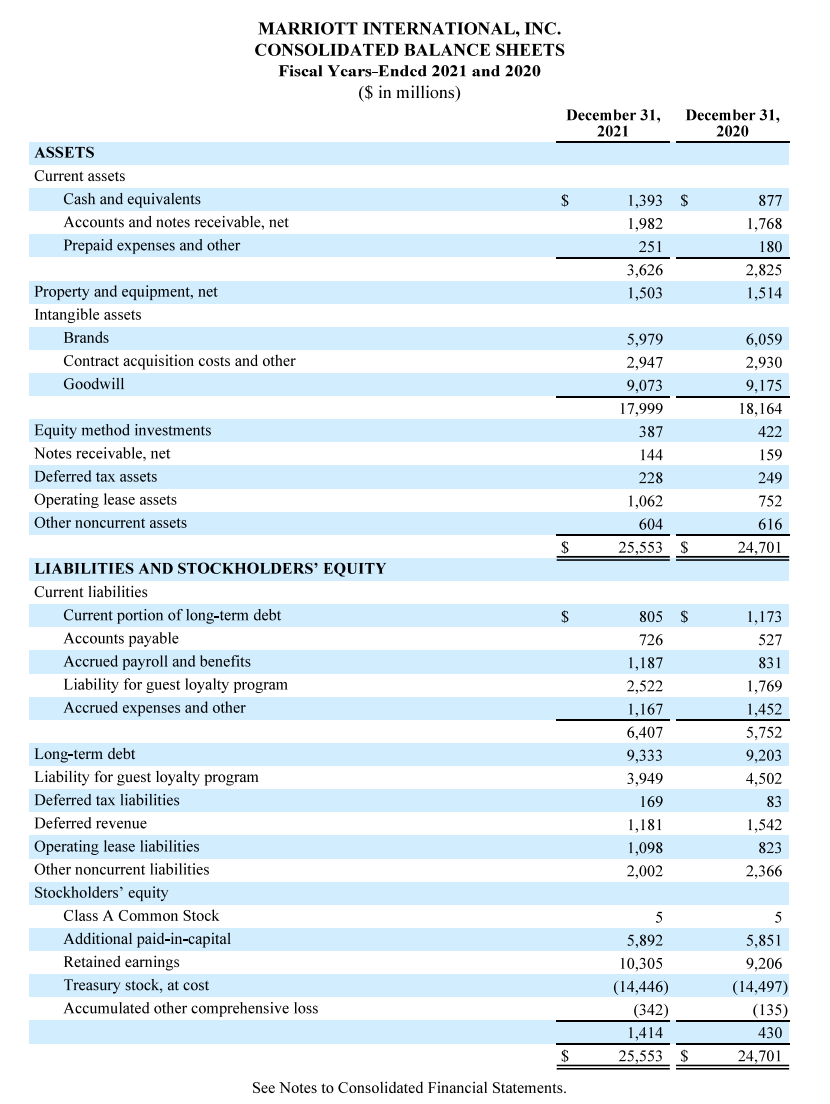

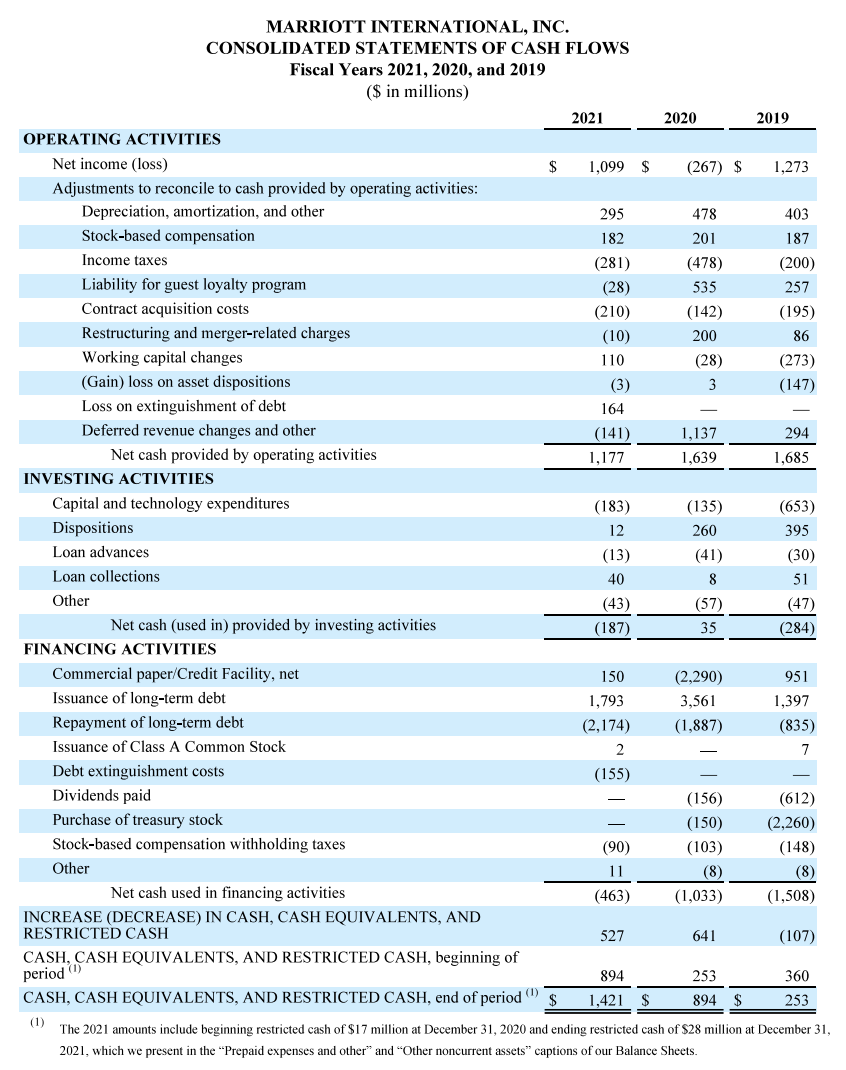

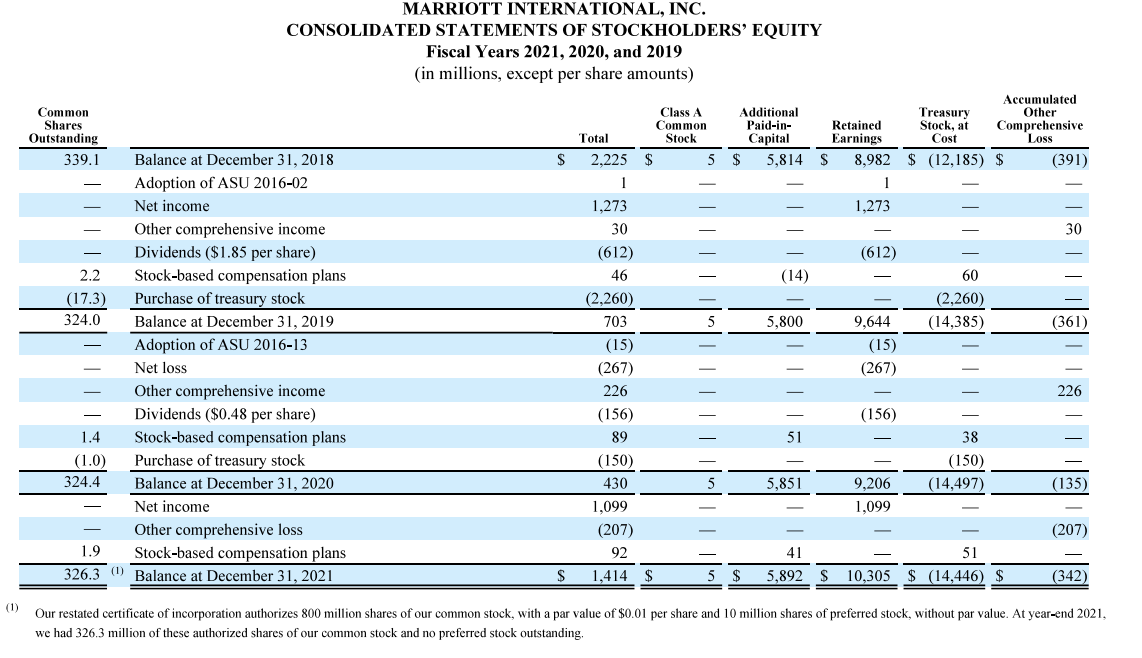

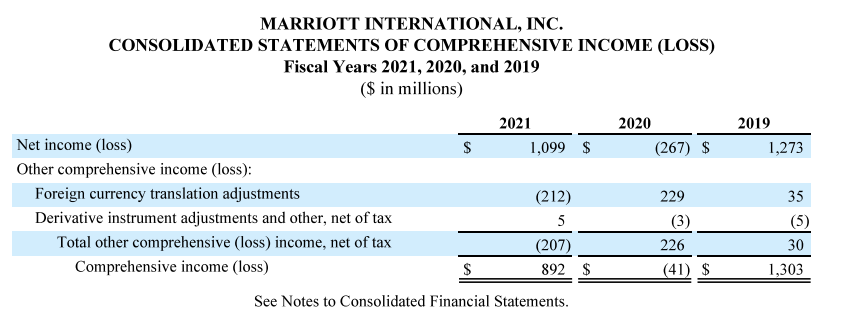

MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF INCOME (LOSS) Fiscal Years 2021, 2020, and 2019 ( $ in millions, except per share amounts) MARRIOTT INTERNATIONAL, INC. CONSOLIDATED BALANCE SHEETS Fiscal Ycars-Ended 2021 and 2020 (\$ in millinns) MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Fiscal Years 2021, 2020, and 2019 ( $ in millions) 2021, which we present in the "Prepaid expenses and other" and "Other noncurrent assets" captions of our Balance Sheets. MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Fiscal Years 2021, 2020, and 2019 (in millions, except per share amounts) we had 326.3 million of these authorized shares of our common stock and no preferred stock outstanding. MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) Fiscal Years 2021, 2020, and 2019 (\$ in millions) See Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts