Question: Please fill in the blanks in the table using the attached statements. Show all excel formulas. # of Times Interests Earned 1600 420 3.81 Income

Please fill in the blanks in the table using the attached statements. Show all excel formulas.

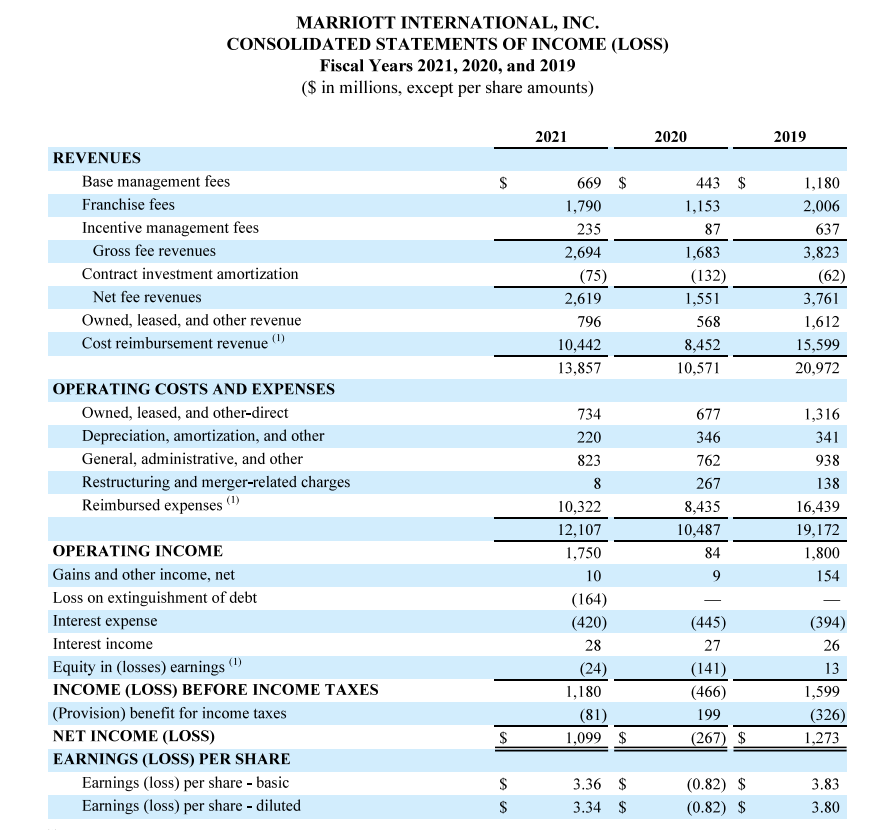

| # of Times Interests Earned | 1600 | 420 | 3.81 |

| Income before income tax | 1180 | ||

| Interest expense | 420 | ||

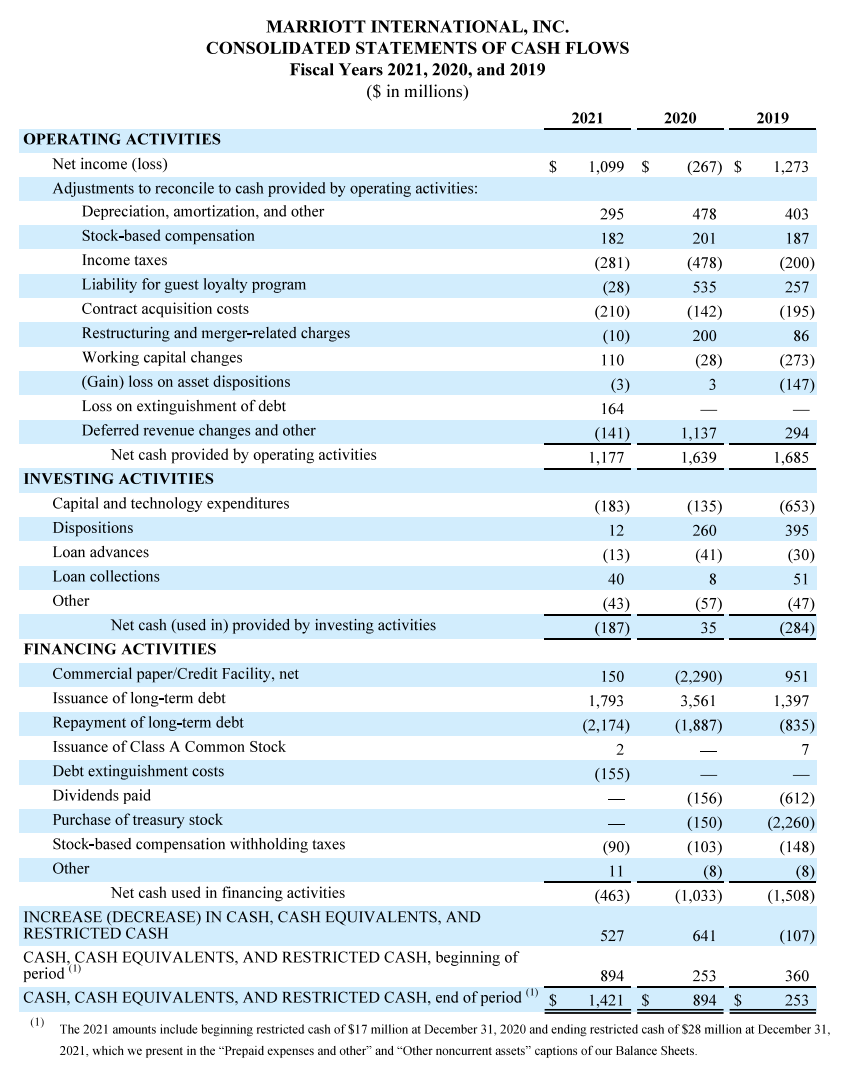

| OCF to Interest | 1597 | 420 | 3.80 |

| Operating cash flows | 1177 | ||

| Interest expense | 420 | ||

| Profitability Ratios | |||

| Profit Margin | given | given | calculated |

| Operating Efficiency Ratio | given | given | calculated |

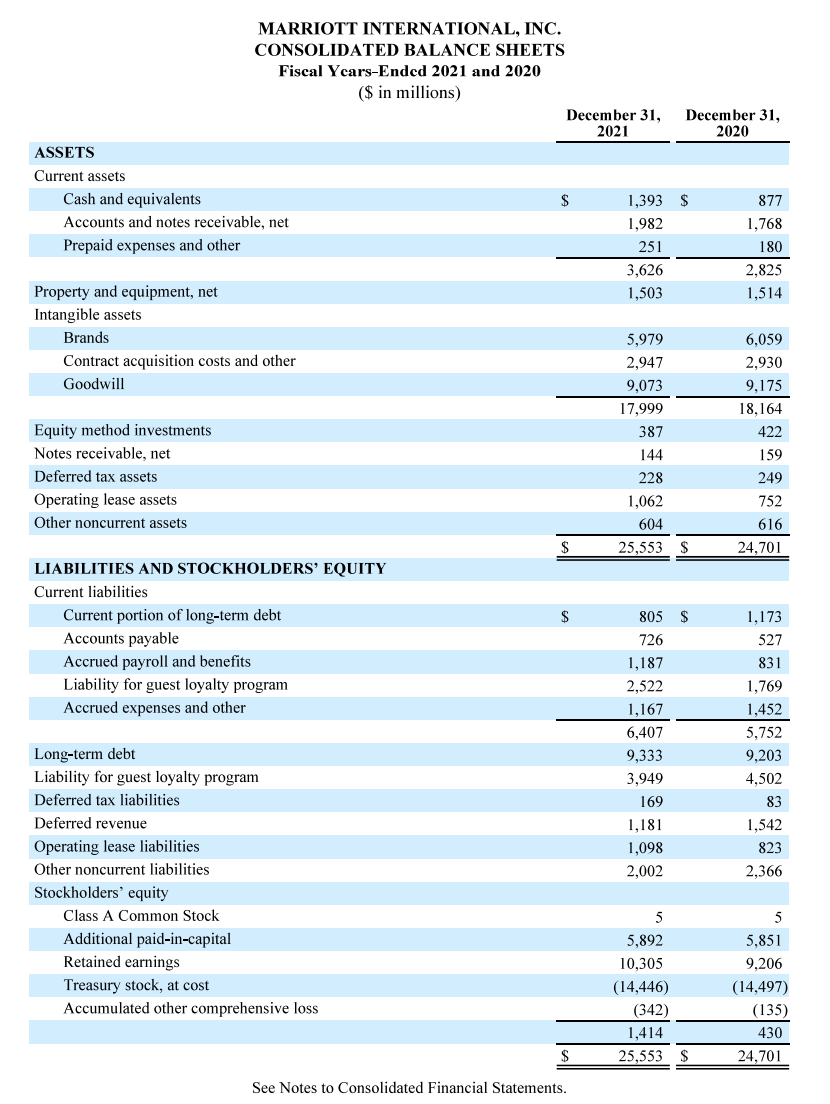

| Gross ROA | given | calculated | calculated |

| 2020 assets | 24701 | ||

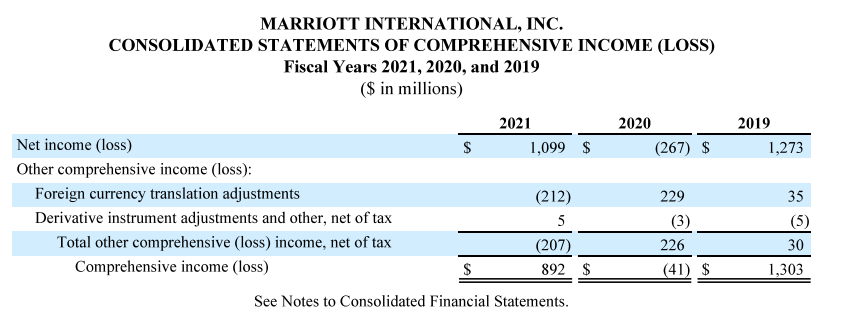

| Net ROA | 1099 | calculated | calculated |

| ROE | 1099 | calculated | |

| 2021 equity | 1414 | ||

| 2020 equity | 430 | ||

| EPS | given | calculated | calculated |

| P/E Ratio | $26.21 (09/27/22) | calculated | calculated |

| Turnover Ratios | |||

| Working Capital Turnover | given | calculated | calculated |

| Fixed Asset Turnover | given | calculated | calculated |

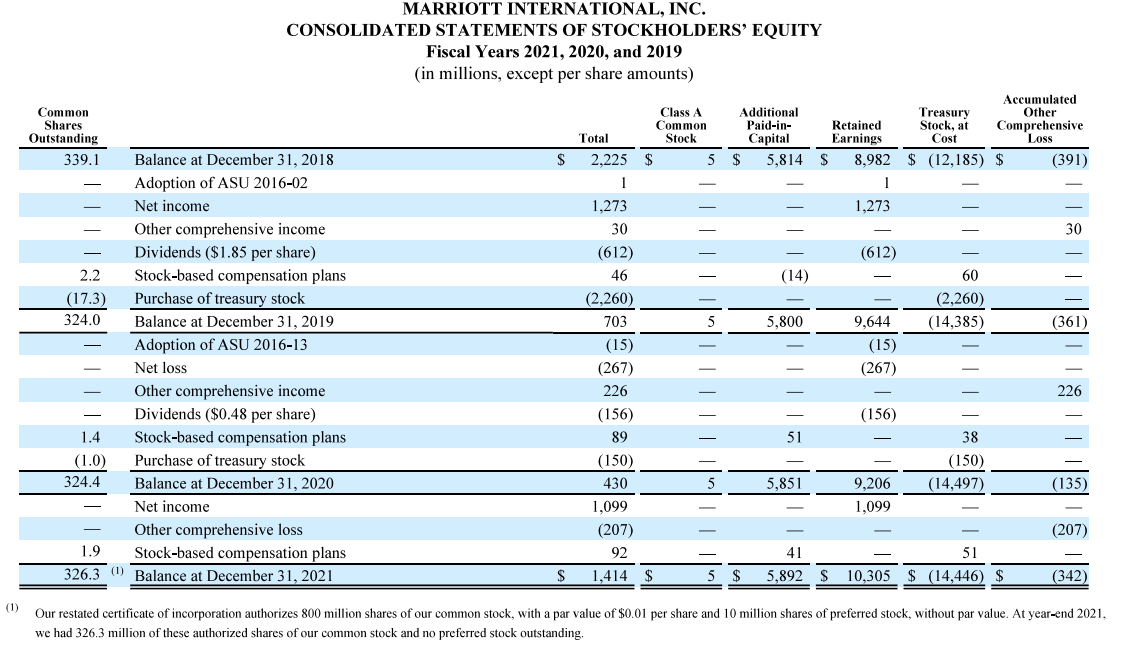

MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF INCOME (LOSS) Fiscal Years 2021, 2020, and 2019 ( $ in millions, except per share amounts) MARRIOTT INTERNATIONAL, INC. CONSOLIDATED BALANCE SHEETS Fiscal Ycars-Ended 2021 and 2020 (\$ in millinns) MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Fiscal Years 2021, 2020, and 2019 ( $ in millions) 2021, which we present in the "Prepaid expenses and other" and "Other noncurrent assets" captions of our Balance Sheets. MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) Fiscal Years 2021, 2020, and 2019 (\$ in millions) See Notes to Consolidated Financial Statements. MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Fiscal Years 2021, 2020, and 2019 (in millions, except per share amounts) we had 326.3 million of these authorized shares of our common stock and no preferred stock outstanding. MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF INCOME (LOSS) Fiscal Years 2021, 2020, and 2019 ( $ in millions, except per share amounts) MARRIOTT INTERNATIONAL, INC. CONSOLIDATED BALANCE SHEETS Fiscal Ycars-Ended 2021 and 2020 (\$ in millinns) MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Fiscal Years 2021, 2020, and 2019 ( $ in millions) 2021, which we present in the "Prepaid expenses and other" and "Other noncurrent assets" captions of our Balance Sheets. MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) Fiscal Years 2021, 2020, and 2019 (\$ in millions) See Notes to Consolidated Financial Statements. MARRIOTT INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Fiscal Years 2021, 2020, and 2019 (in millions, except per share amounts) we had 326.3 million of these authorized shares of our common stock and no preferred stock outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts