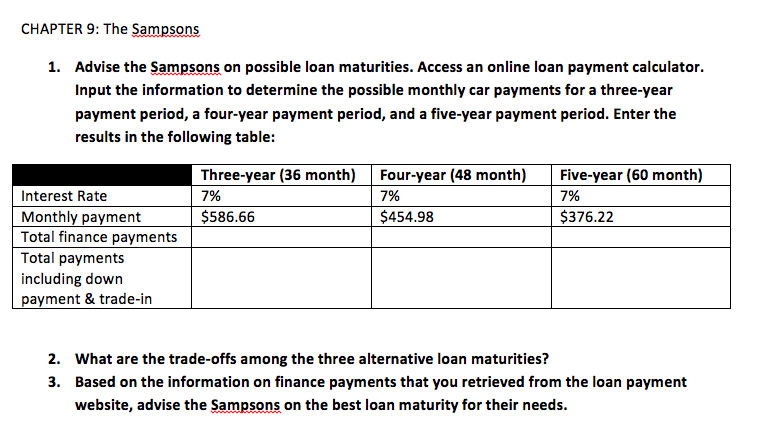

Question: PLEASE fill out the chart and answer the two additional questions attached to the scenario (2 and 3). I cant get the answer using the

PLEASE fill out the chart and answer the two additional questions attached to the scenario (2 and 3). I cant get the answer using the online calculators like the problem suggests. Thank you very much in advance! I have attached what I was able to fill out.

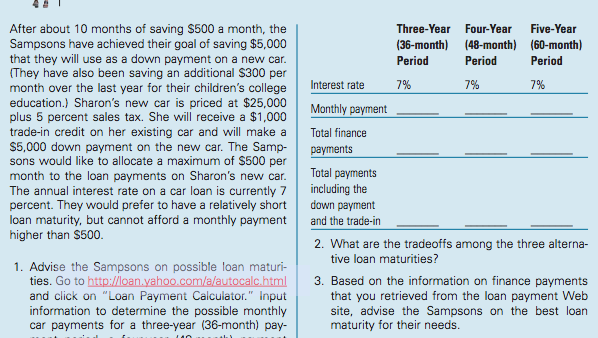

Three-Year Four-Year Five-Year (36-month) (48-month) (60-month) Period After about 10 months of saving $500 a month, the Sampsons have achieved their goal of saving $5,000 that they will use as a down payment on a new car. They have also been saving an additional $300 per month over the last year for their children's college education.) Sharon's new car plus 5 percent sales tax. She will receive a $1,000 trade-in credit on her existing car and will make a Total finance $5,000 down payment on the new car. The Samp- payments sons would like to allocate a maximum of $500 per month to the loan payments on Sharon's new car. Total payments The annual interest rate on a car loan is currently 7 including the percent. They would prefer to have a relatively short down payment loan maturity, but cannot afford a monthly payment and the trade-in higher than $500 Period Period Interest rate Monthly payment 7% 7% 7% is priced at $25,000 2. What are the tradeoffs among the three alterna- tive loan maturities? 1. Advise the Sampsons on possible loan maturi- ties. Go to and click on "Loan Payment Calculator." Input information to determine the possible monthly car payments for a three-year (36-month) pay- 3. Based on the information on finance payments that you retrieved from the loan payment Web site, advise the Sampsons on the best loan maturity for their needs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts