Question: Please fill out the green section in excel 3. You are considering buying the Widget Company incuding assuming all of its $9 million outstanding debt.

Please fill out the green section in excel

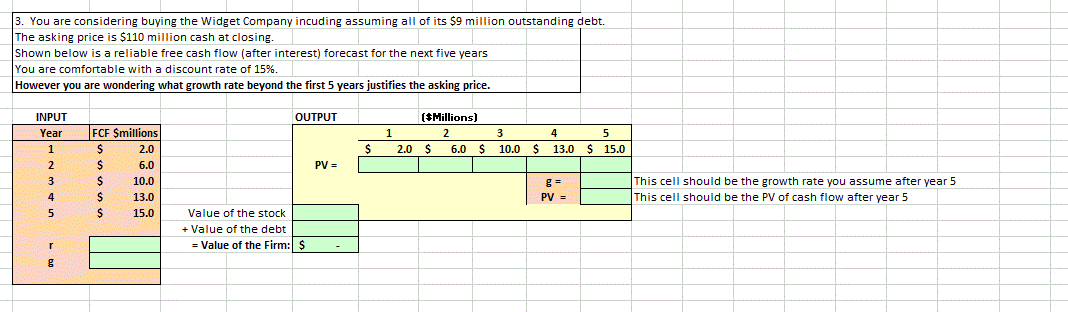

3. You are considering buying the Widget Company incuding assuming all of its $9 million outstanding debt. The asking price is $110 million cash at closing. Shown below is a reliable free cash flow (after interest) forecast for the next five years You are comfortable with a discount rate of 15%. However you are wondering what growth rate beyond the first 5 years justifies the asking price. OUTPUT INPUT Year 1 ($Millions) 2 S 6.0 $ 3 10.0 4 13.0 5 $ 15.0 $ 2.0 S . PV = FCF Smillions S 2.0 $ 6.0 $ 10.0 $ 13.0 15.0 This cell should be the growth rate you assume after year 5 This cell should be the PV of cash flow after year 5 4 PV = 5 $ Value of the stock + Value of the debt = Value of the Firm: S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts