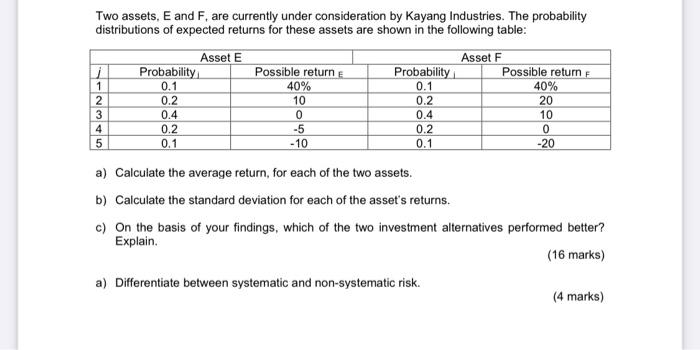

Question: Two assets, E and F, are currently under consideration by Kayang Industries. The probability distributions of expected returns for these assets are shown in the

Two assets, E and F, are currently under consideration by Kayang Industries. The probability distributions of expected returns for these assets are shown in the following table: 1 2 3 4 5 Asset E Probability 0.1 0.2 0.4 0.2 0.1 Possible return 40% 10 0 -5 -10 Probability 0.1 0.2 0.4 0.2 0.1 Asset F Possible return 40% 20 10 0 -20 a) Calculate the average return, for each of the two assets. b) Calculate the standard deviation for each of the asset's returns. c) On the basis of your findings, which of the two investment alternatives performed better? Explain. (16 marks) a) Differentiate between systematic and non-systematic risk. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts