Question: please fill out the same 1065 FORM and one K1 FORM for emily and another K1 FORM for james, and post the picture. thank you

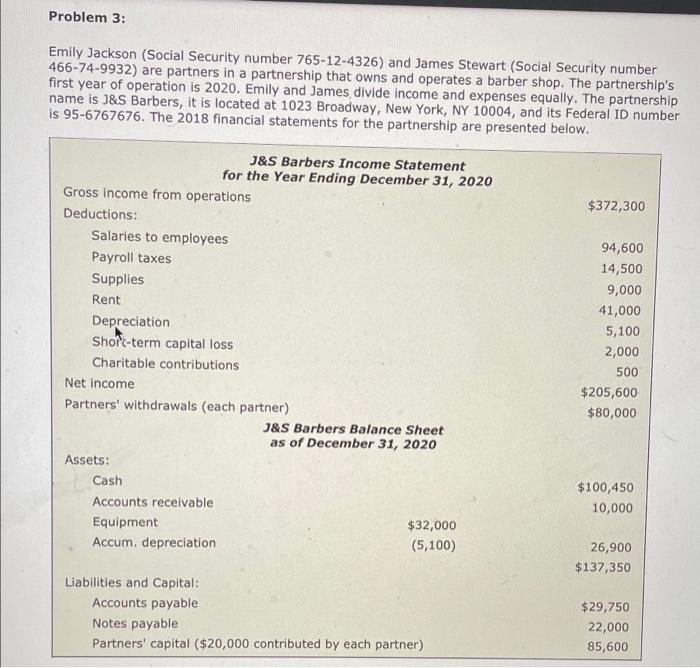

Problem 3: Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a barber shop. The partnership's first year of operation is 2020. Emily and James divide income and expenses equally. The partnership name is J&S Barbers, it is located at 1023 Broadway, New York, NY 10004, and its Federal ID number is 95-6767676. The 2018 financial statements for the partnership are presented below. $372,300 J&S Barbers Income Statement for the Year Ending December 31, 2020 Gross income from operations Deductions: Salaries to employees Payroll taxes Supplies Rent Depreciation Short-term capital loss Charitable contributions Net income Partners' withdrawals (each partner) J&S Barbers Balance Sheet as of December 31, 2020 Assets: Cash Accounts receivable Equipment $32,000 Accum. depreciation (5,100) 94,600 14,500 9,000 41,000 5,100 2,000 500 $205,600 $80,000 $100,450 10,000 26,900 $137,350 Liabilities and Capital: Accounts payable Notes payable Partners' capital ($20,000 contributed by each partner) $29,750 22,000 85,600 Notes payable Partners' capital ($20,000 contributed by each partner) 22,000 85,600 $137,350 Emily livestat 456 E. 70th Street, New York, NY 10006, and James lives at 436 E. 63rd Street, New York, NY 10012 Required: Complete the Form 1065 and the accompanying K-1 (K-1for Emily and another K-1 for James) forms Only. Do not complete Schedule D for the capital loss, Form 4562 for depreciation, or Schedule B-1 related to ownership of the partnership. Make realistic assumptions about any missing data. If an amount box does not require an entry or the answer is zero, enter "0". If required, round your answers to nearest dollar. Enter amounts as positive numbers, except for a "loss". If required, enter a "loss" as a negative number on the tax form. Assume all debt is recourse debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts