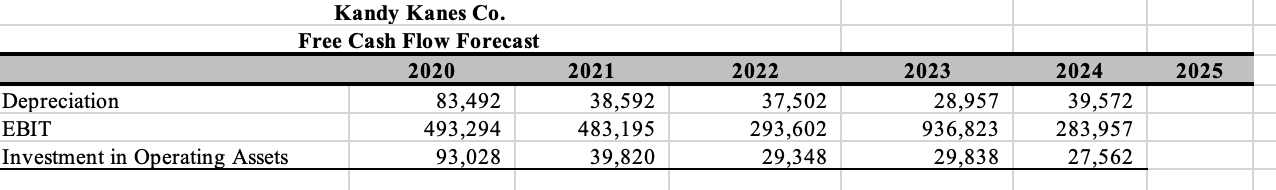

Question: Please find attached an Excel spreadsheet with forecasts for Kandy Kanes, Co . Five years of earnings, depreciation, and capital expenditures have been estimated by

Please find attached an Excel spreadsheet with forecasts for Kandy Kanes, Co Five years of earnings, depreciation, and capital expenditures have been estimated by your equity analyst, and you believe that after the fifth year, free cash flow will grow by per year. The market value of debt is $ and the firm has $ in marketable securities There are shares outstanding, the tax rate is and the discount rate WACC is Please do the following:

Calculate free cash flow for the next five years

Calculate free cash flow for the sixth year assuming a growth rate

Estimate the value of a share of Kandy Kanes' stock.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock