Question: PLEASE FIND EXPECTED RETURN AND STANDARD DEVIATION FOR A,B,C 2. Based on your examination of the historical record, you calculate that the expected return on

PLEASE FIND EXPECTED RETURN AND STANDARD DEVIATION FOR A,B,C

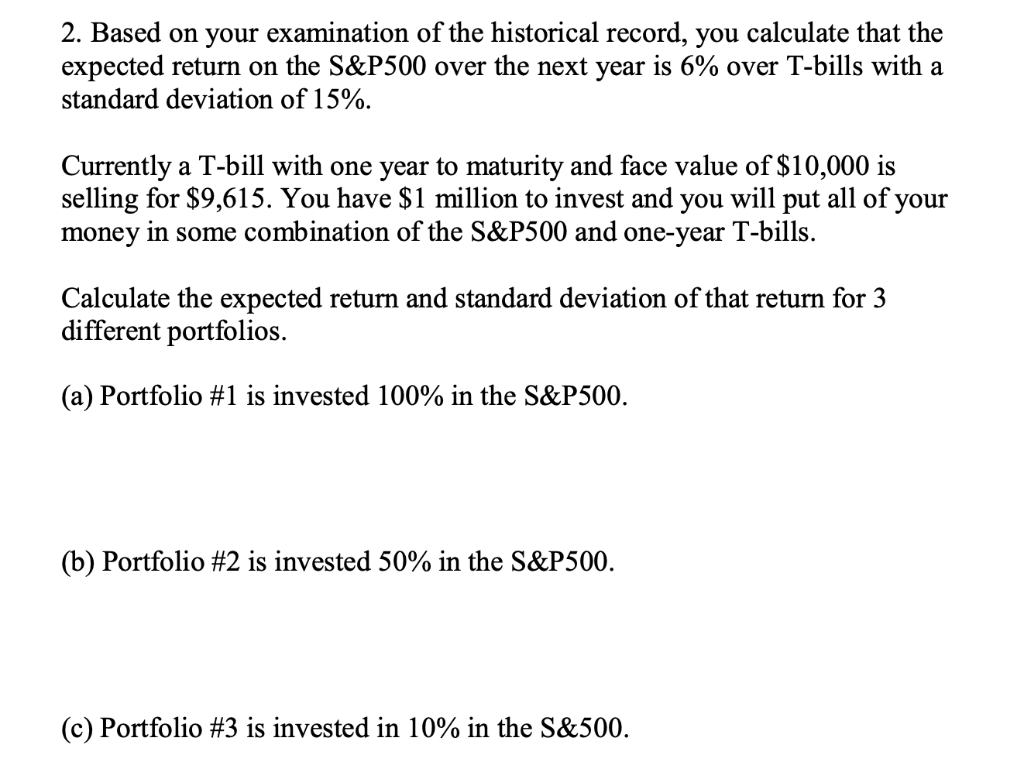

2. Based on your examination of the historical record, you calculate that the expected return on the S&P500 over the next year is 6% over T-bills with a standard deviation of 15% Currently a T-bill with one year to maturity and face value of $10,000 is selling for $9,615. You have $1 million to invest and you will put all of your money in some combination of the S&P500 and one-year T-bills. Calculate the expected return and standard deviation of that return for 53 different portfolios. (a) Portfolio #1 is invested 100% in the S&P500 (b) Portfolio #2 is invested 50% in the S&P500 (c) Portfolio #3 is invested in 10% in the S&500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts